Key Takeaways

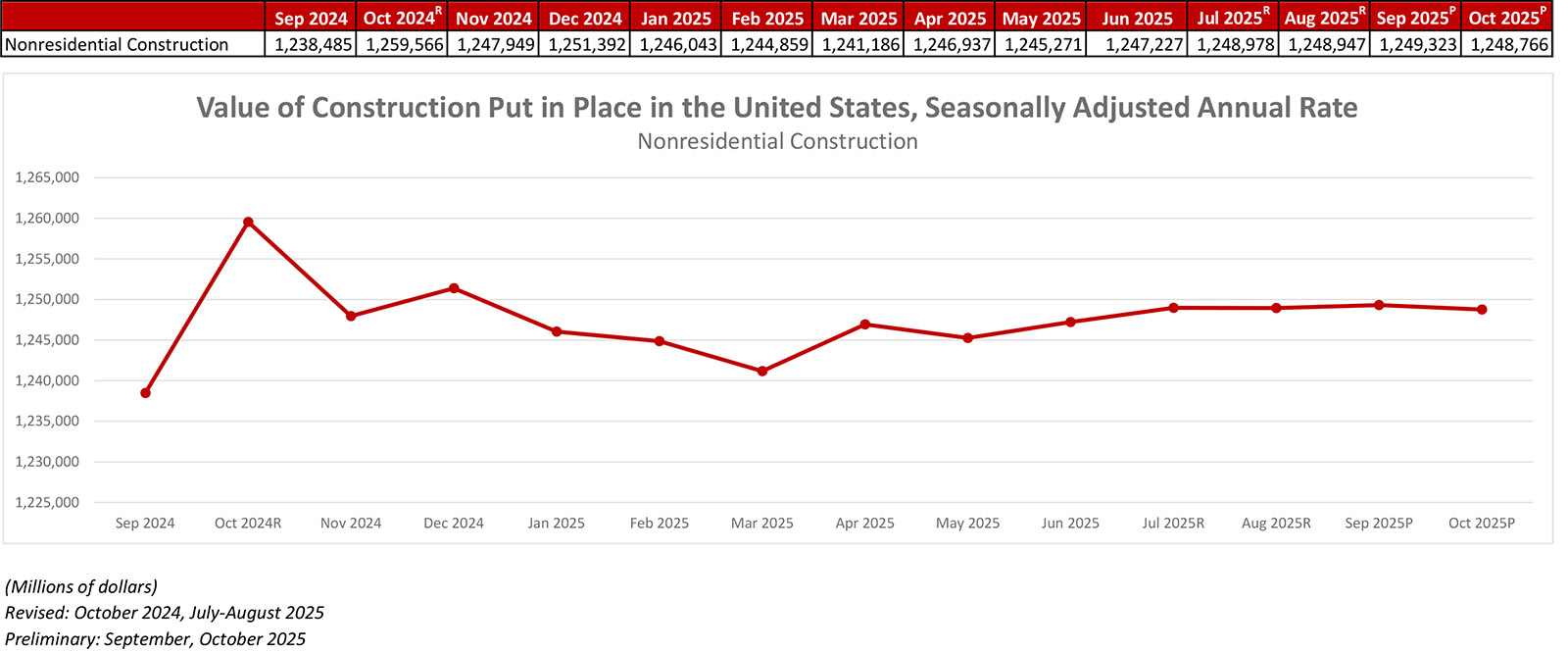

- National nonresidential construction spending was virtually unchanged in October.

- On a seasonally adjusted annualized basis, nonresidential spending totaled $1.25 trillion for the month.

- "There are steps federal officials can take to encourage more construction activity while making the economy more productive. Cutting red tape, making go or no-go decisions more quickly and continuing to invest vital infrastructure will boost employment, stimulate new economic activity and make the American economy even more competitive."

Press Release from Associated Builders and Contractors (ABC)

ABC: Nonresidential Construction Spending Remains Stagnant in October

WASHINGTON, Jan. 21—National nonresidential construction spending remained virtually unchanged on a monthly basis in October and was down 0.9% year over year, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.25 trillion.

Spending was up on a monthly basis in 9 of the 16 nonresidential subcategories. Private nonresidential spending was down 0.2%, while public nonresidential construction spending was up 0.1% in October.

“Nonresidential construction failed to gather momentum at the start of 2025’s third quarter,” said ABC Chief Economist Anirban Basu. “While there are few sources of private nonresidential growth outside of the still surging data center category, much of the recent decline in construction spending is due to a precipitous drop in manufacturing investment. With CHIPS Act-enabled megaprojects winding down and the stiff headwind of trade policy, manufacturing construction spending has fallen by nearly 10% over the past 12 months, accounting for more than the entire decline in private nonresidential spending. Despite consistently downbeat construction industry data during the latter months of 2025, contractors remain upbeat about the first half of 2026, according to ABC’s Construction Confidence Index.”

Press Release from Associated General Contractors of America (AGC)

Association Survey Finds Subdued Outlook for Spending Growth, Apart from Data Centers and Power Projects; Officials Urge Administration to Streamline Decision-Making, Boost Workforce Development

Spending on projects underway in October climbed by 0.5 percent from September, led by a huge increase in residential improvements and a small pickup in public works, according to an analysis of new government data that the Associated General Contractors of America released today. Association officials noted the results are consistent with their recent survey that found contractors much less optimistic about growth prospects than a year ago.

“Our survey of contractors found widespread expectations of growing demand for data centers and power projects, but expectations are subdued for all other types of projects compared to the 2025 Outlook Survey,” said Ken Simonson, the association’s chief economist. “On balance, more contractors expect a decline rather than an increase in spending on five project types, compared to just two negative readings a year ago.”

Expectations on net were negative for elementary and secondary schools, higher education, and lodging construction, categories that contractors had expected would increase in 2025. In addition, expectations are even more negative than a year ago for private office and retail construction.

Spending totaled $2.18 trillion at a seasonally adjusted annual rate in October, an increase of 0.5 percent from the September rate but down 1.0 percent from October 2024. A 4.5 percent jump in residential improvements—additions and renovations to owner-occupied houses—accounted for most of the increase, along with a gain of 0.1 percent in public construction spending.

The overall increase in spending total was tempered by declines of 1.3 percent in single-family homebuilding, 0.2 percent in private multifamily construction, and 0.2 percent in private nonresidential spending. There were mixed patterns among the four largest private nonresidential categories. Manufacturing construction slumped by 0.9 percent. Private power spending edged up 0.1 percent. Commercial construction rose 0.2 percent and private office construction declined by 0.4 percent. Within the office segment, data center spending increased 1.2 percent, while traditional private office construction fell 1.8 percent. Public construction segments also showed divergent trends. The largest, highway and street construction, rose 0.1 percent. Educational construction rose 0.7 percent. But transportation construction fell 0.1 percent.

Association officials said the spending data reinforces the results of its recently released 2026 Construction Hiring and Business Outlook survey, which found “dampened” expectations for most construction market segments this year. They urged public officials to accelerate efforts to streamline the federal permitting process, continue finding ways to streamline regulations and focus on passing needed infrastructure measures, like the next surface transportation bill, before current legislation expires later this year.

“There are steps federal officials can take to encourage more construction activity while making the economy more productive,” said Jeffrey D. Shoaf, the association’s chief executive officer. “Cutting red tape, making go or no-go decisions more quickly and continuing to invest vital infrastructure will boost employment, stimulate new economic activity and make the American economy even more competitive.”