Nonresidential Construction Employment Added 27,900 Jobs in January

According to data released yesterday by the US Bureau of Labor Statistics:

Status of Construction Data

The government shutdown this fall continues to disrupt the release of construction spending and employment data. Previously, construction spending data was released on the first of each month (reflecting figures from two months prior), and construction employment data was released on the first Friday (reflecting the prior month).

As of today (February 6),

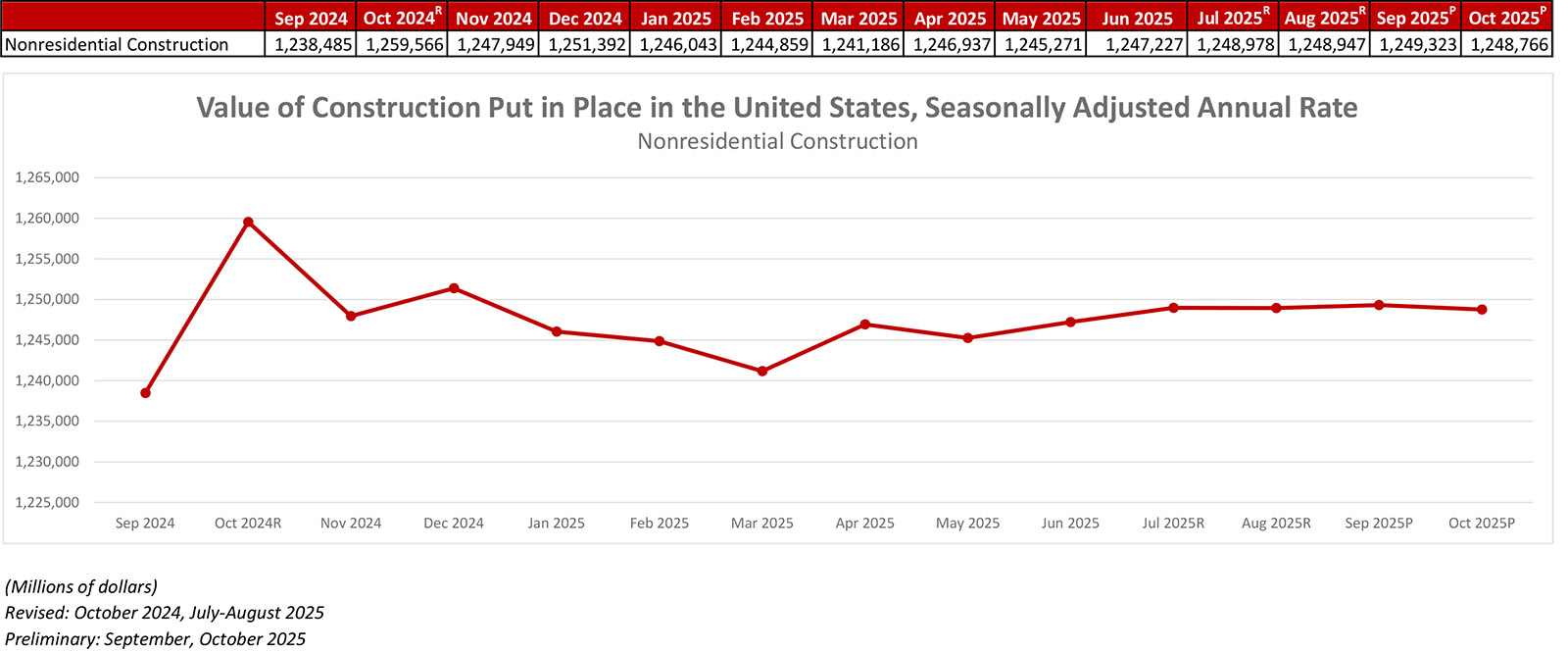

Nonresidential Construction Virtually Unchanged in October

Key Takeaways

- National nonresidential construction spending was virtually unchanged in October.

- On a seasonally adjusted annualized basis, nonresidential spending totaled $1.25 trillion for the month.

- "There are steps federal officials can take to encourage more construction activity while

Nonresidential Construction Employment Lost 11,300 Jobs in December, Added Just 14,000 Jobs in 2025

According to data released last week by the US Bureau of Labor Statistics:

Nonresidential Construction Employment Increased by 16,300 Jobs in September

According to data released today by the US Bureau of Labor Statistics:

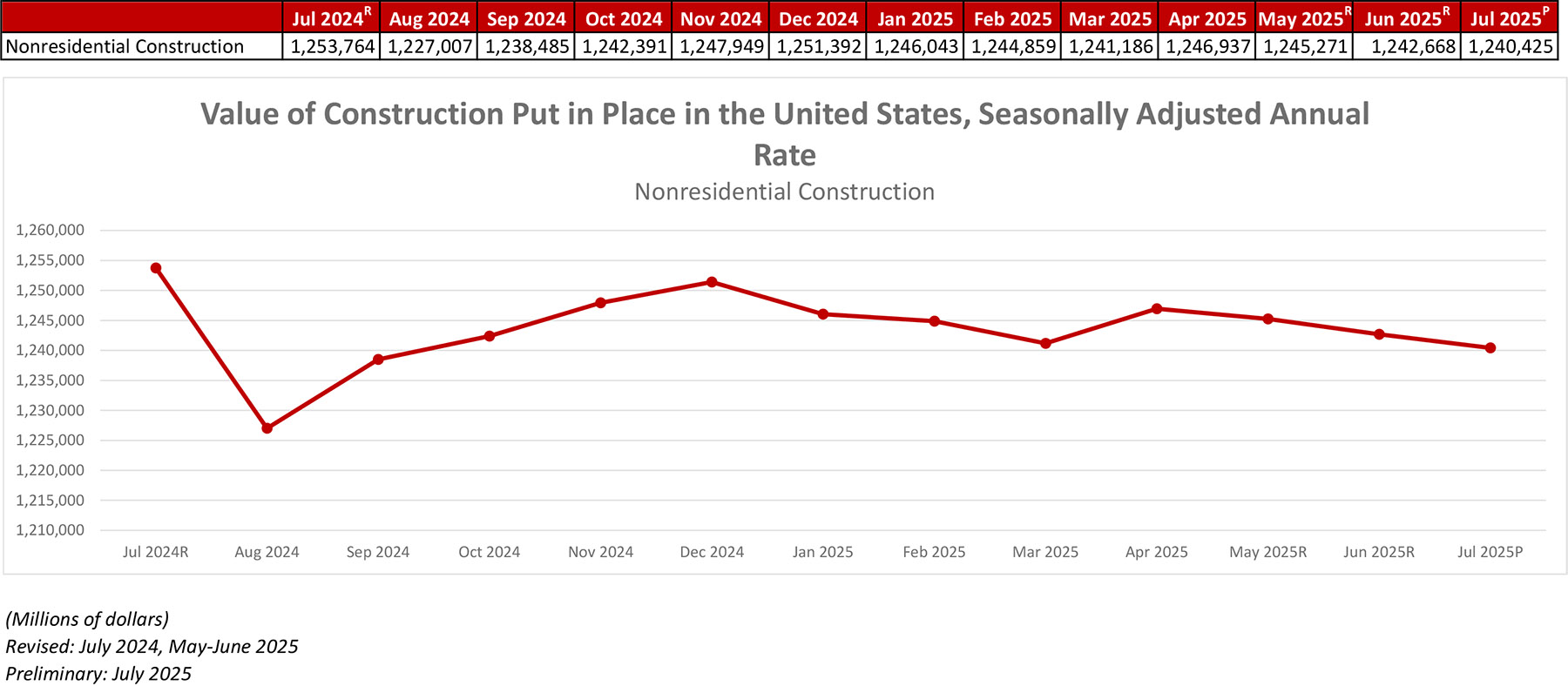

Nonresidential Construction Spending Decreased 0.2% in August

Key Takeaways

- National nonresidential construction spending decreased 0.2% in August.

- On a seasonally adjusted annualized basis, nonresidential spending totaled $1.24 trillion for the month.

- "...this data pertains to August and reflects neither the effects of the government shutdown nor

CE: State of 2025 Q3 Construction Economy

Anirban Basu, chief economist for Associated Builders and Contractors (ABC), presented “Construction Executive‘s 2025 Q3 Construction Economic Update and Forecast” yesterday. According to ABC, "Basu’s presentations are designed to inform commercial construction contractors on general economic conditions affecting the current construction

Nonresidential Construction Employment Decreased by 1,200 Jobs in August

According to data released today by the US Bureau of Labor Statistics:

Nonresidential Construction Spending Decreased 0.2% in July

Key Takeaways

- National nonresidential construction spending decreased 0.2% in July.

- On a seasonally adjusted annualized basis, nonresidential spending totaled $1.24 trillion for the month.

- "Providing greater certainty on tariff rates and taking steps to address severe construction labor

New Job Opportunities at BHL Federal

BHL Federal has been officially accepted by NC Rebuild as one of a select few Certified Single-family home builders through HUD and NC GROW to rebuild WNC after Hurricane Helene in September 2024.

They currently have 3 positions open: