Key Takeaways

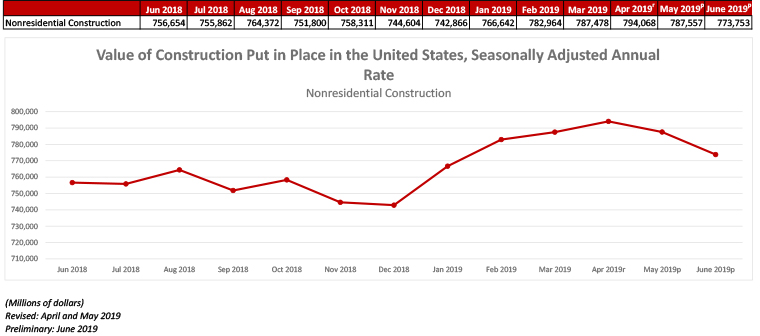

- Nonresidential construction spending, which totaled $773.8 billion on a seasonally adjusted annual basis for June, declined 1.8% from May but is a 2.3% increase over the same time last year.

- Public nonresidential spending fell 3.7% in June, but is up 6.4% year over year, while private nonresidential spending fell 0.3% on a monthly basis and is down 0.4% from June 2018.

- “Like the balance of the U.S. economy, nonresidential construction spending appears to be softening, albeit gradually.”

Press Release from Associated Builders and Contractors, Inc.

WASHINGTON, Aug. 1—National nonresidential construction spending declined 1.8% in June, totaling $773.8 billion on a seasonally adjusted annualized basis—a 2.3% increase compared to the same time a year ago, according to an Associated Builders and Contractors analysis of U.S. Census Bureau data published today. Public nonresidential spending fell 3.7% in June, but is up 6.4% year over year, while private nonresidential spending fell 0.3% on a monthly basis and is down 0.4% from June 2018.

Among the 16 nonresidential construction spending categories tracked by the Census Bureau, seven experienced increases in monthly spending, although only the conservation and development (+3.8%) and commercial (+1.3%) categories increased by more than 1%. While spending in several categories fell for the month, significant decreases in the publicly driven educational (-6.5%) and highway and street (-6.3%) categories accounted for nearly all of the monthly decline.

“Like the balance of the U.S. economy, nonresidential construction spending appears to be softening, albeit gradually,” said ABC Chief Economist Anirban Basu. “Private nonresidential construction spending has been trending lower for several months, and segments like office and lodging are no longer the drivers of construction spending growth that they had been, likely due to growing concerns about market saturation.

“The dip in public construction may have been merely temporary, which is likely the case given the ongoing strength of state and local government finances.” said Basu. “And with the economy still adding substantial numbers of jobs, wages growing at or near a decade-high pace, consumers continuing to spend and property values remaining stable, local and state governments should continue to experience solid income, retail and real estate tax collections. All things being equal, that should help fuel infrastructure outlays, especially given still very low borrowing costs.

“While many observers continue to focus on issues such as trade disputes, high levels of corporate debt and asset prices that are susceptible to sharp declines, the U.S. construction industry’s most significant source of uncertainty may be the pending insolvency of the Highway Trust Fund,” said Basu. “That insolvency is now a mere two years away, and if policymakers fail to act expeditiously, state and local policymakers may choose to postpone certain projects given the rising uncertainty of federal funding. The highway/street and transportation categories are especially vulnerable to such dynamics.”

Press Release from Associated General Contractors of America

Construction Spending Deteriorates in June but Multifamily and Nonresidential Categories Increase in First Half of 2019, Offsetting Single-Family Weakness

Infrastructure Segments Post Double-Digit Gains Compared to First Six Months of 2018 and Apartment Spending Sets New Record Highs, While Private Nonresidential Construction Shows Mixed Trends and Homebuilding Slides Further

Construction spending declined in June from May 2019 and June 2018 levels, but most categories other than single-family homebuilding ended the first half of the year ahead of the year-to-date totals for 2018, according to an analysis today by the Associated General Contractors of America of new federal spending data. Association officials said that the monthly declines in construction spending may reflect the fact contractors are having a difficult time finding enough workers to keep pace with demand.

“Although the initial estimates for spending in June show decreases from May in all major categories, the first half of 2019 as a whole has been positive, aside from single-family construction,” said Ken Simonson, the association’s chief economist. “The initial monthly estimates have mostly been revised upward, making the six-month year-to-date totals a more reliable indicator of underlying trends.”

Construction spending totaled $1.287 trillion at a seasonally adjusted annual rate in June, a drop of 1.3 percent from the May rate and 2.1 percent from the June 2018 rate, according to estimates the U.S. Census Bureau released today. For the first six months of 2019 combined, spending dipped by 0.5 percent from the same period in 2018.

Public construction spending slipped 3.7 percent for the month but jumped 10.1 percent year-to-date. Spending in the first half of 2019 was up sharply for most public infrastructure, with year-to-date increases of 14.5 percent for highway and street construction spending, 7.1 percent for transportation (airports, transit, rail and port) spending, 16.2 percent for sewage and waste disposal, 15.1 percent for water supply and 12.2 percent for conservation and development.

Private nonresidential spending declined 0.3 by percent from May to June but the six-month total was 1.7 percent higher than in January-June 2018. Major private nonresidential categories experienced mixed first-half results. The largest, power construction (comprising electric power generation, transmission and distribution, plus oil and gas fields and pipelines), inched up by 0.3 percent year-to-date. Commercial (retail, warehouse and farm) construction decreased by 9.9 percent. Manufacturing construction posted an 11.6 percent gain. Private office construction spending rose 8.6 percent.

Private residential construction spending declined 0.5 percent for the month and 7.8 percent year-to-date. Single-family homebuilding decreased 7.0 percent in the first six months of the year, while spending on multifamily projects increased 11.5 percent. Spending on residential improvements plunged 13.8 percent year-to-date.

Association officials said that one reason construction spending declined between May and June is because contractors cannot find enough qualified workers to keep pace with demand. They noted that seventy-eight percent of construction firms reported earlier this year having a hard time finding enough qualified workers to hire. As a result, the drop in construction spending in some categories in June likely reflects the fact firms are turning down or delaying projects until they have enough people on hand to do the work.

“The reason construction workforce shortages are a problem is their potential to undermine broader economic growth,” said Stephen E. Sandherr, the association’s chief executive officer. “That is why Congress and the administration should boost funding for career and technical education and make Pell Grants eligible for students studying construction at career and technical colleges.”