Article written by Brielle Regdos for CDP

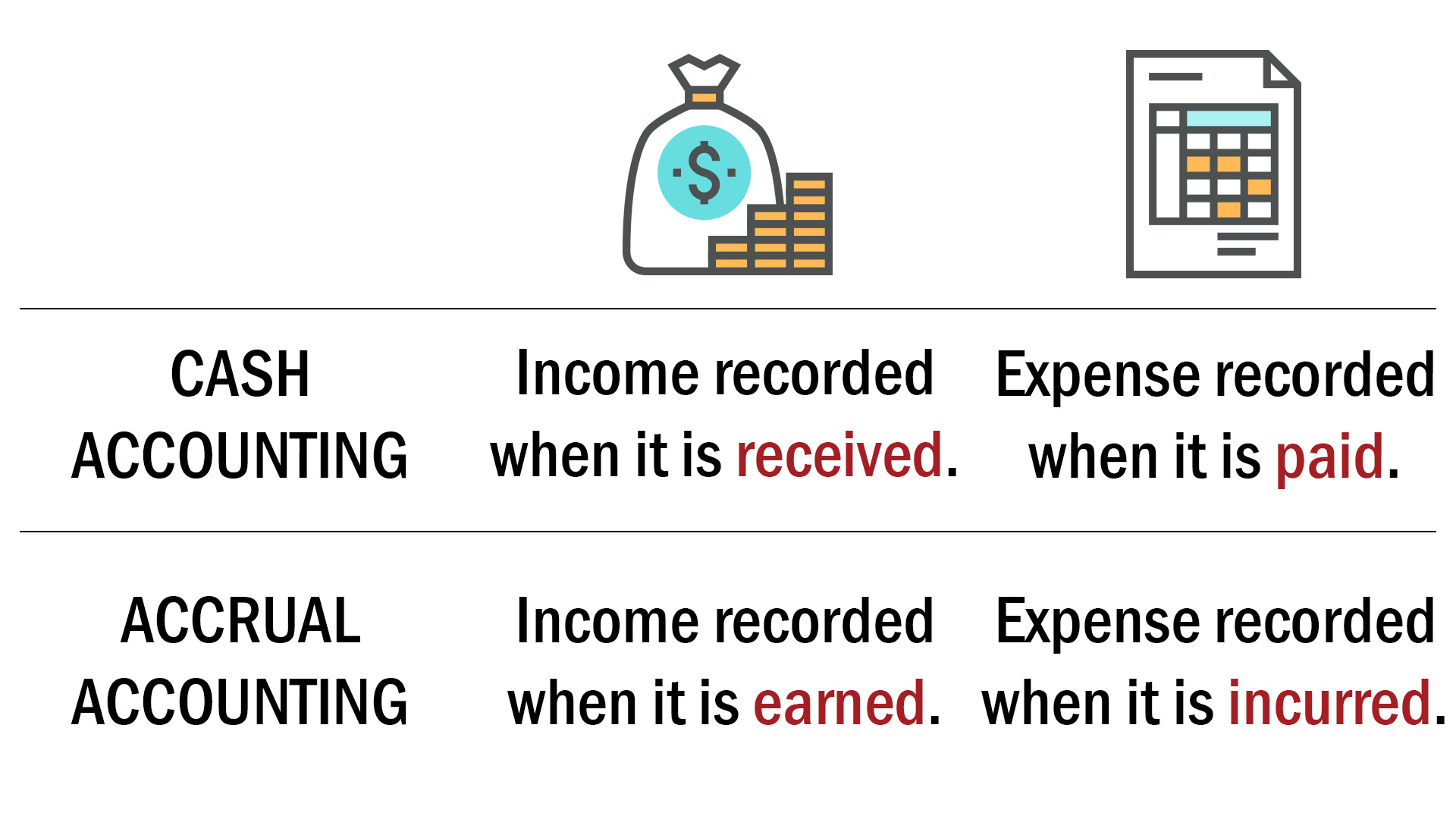

Accrual-based and cash-based accounting are two fundamental methods used to record and report financial transactions, and they primarily differ in the timing of when revenues and expenses are recognized. In accrual-based accounting, revenues are documented when they are earned– when a product/service has been delivered– regardless of when the actual payment is received. Expenses are recorded when they are incurred, not necessarily when the payment is made. This approach clings to the matching principle, which seeks to align income with the related expenses in the same accounting period to present a more accurate depiction of a business’s financial performance.

Under the accrual method, if a company provides a consulting service in June but receives payment in July, the revenue is still recorded in June. It’s done this way because that’s when the economic activity occurred. While this method offers a more complete and realistic picture of financial health, it is also more complex to manage, requiring ongoing monitoring of accounts receivable, accounts payable, and other non-cash transactions. It is the preferred and often mandatory method for larger businesses and entities that must comply with generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS).

Cash-based accounting operates on a simpler, more immediate system. It recognizes revenues only when cash is actually received and records expenses only when cash is paid out. Returning to the earlier example, if a service is performed in June but payment is received in July, the income would be recorded in July under the cash method. This system is straightforward and easy to use, making it particularly appealing to sole proprietors, freelancers, and small businesses with limited financial complexity. However, it can lead to a misleading financial picture because it does not account for outstanding invoices or upcoming liabilities. It may not reflect a business’s true profitability or financial obligations at any given time. This type of accounting is not permitted for larger corporations or companies required to adhere to GAAP or IFRS guidelines.

While both accrual and cash-based accounting systems serve the purpose of financial recordkeeping, they differ significantly in complexity, accuracy, and suitability based on the size and structure of the business. Accrual accounting delivers a more complete and consistent financial overview, especially important for investors, regulatory bodies, and decision-making processes in larger organizations. However, cash-based accounting offers simplicity and ease of implementation, making it better suited for smaller operations that prioritize straightforward bookkeeping over long-term financial planning. Choosing between the two methods ultimately depends on the nature of the business, the regulatory requirements it must follow, and its broader financial objectives.

Contact CDP to learn more about cash and accrual methods, and how the right construction accounting platform can help transform your business.