Key Takeaways

- Construction spending, which totaled $749 billion on a seasonally adjusted annual rate for May, is up 3 percent from the same time last year.

- Public nonresidential spending increased 0.6% for the month and 4.9% for the year, while the private sector contracted 0.3% for the month but increased 1.8% year-over-year.

- "While private construction spending should remain sturdy during the months ahead given healthy backlog and current economic momentum, the outlook for construction spending may be rather different in a few quarters.”

- Continued labor shortages and rising materials costs threaten future growth in demand.

Press Release from Associated Builders and Contractors, Inc.

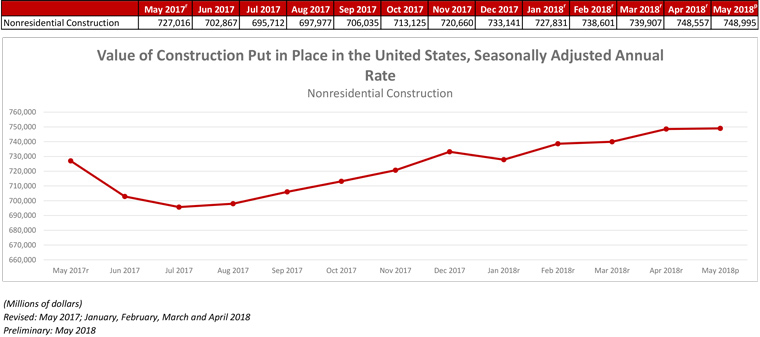

WASHINGTON, July 2—Nonresidential construction spending inched 0.1 percent higher on a monthly basis in May, according to an Associated Builders and Contractors analysis of U.S. Census Bureau data released today. Spending, which totaled $749 billion on a seasonally adjusted annual rate for the month, is up 3 percent from the same time last year.

Public nonresidential spending increased 0.6 percent for the month and 4.9 percent for the year, while the private sector contracted 0.3 percent for the month but increased 1.8 percent year-over-year. The dip in private sector is spending is largely attributable to a 2.3 percent decrease in manufacturing-related spending.

“The prediction has been that publicly financed construction spending would rise in America,” said ABC’s Chief Economist Anirban Basu. “The logic of this is rooted in two basic factors. The first is that the ongoing economic expansion, now in its 10th year, has steadily improved fiscal conditions in state and local government. With more money to spend, more communities are empowered to deal with deferred maintenance and even to expand the capacity of certain key infrastructure, whether roads, mass transit, wastewater treatment plants or water systems.

“The other factor relates to a political cycle,” said Basu. “Increasingly, policymakers have been making the case—and much of the electorate seems convinced—that stepped-up infrastructure investment is needed. Accordingly, in recent years, 31 states have expanded their transportation funding, including 24 of them by raising state gas taxes. Not surprisingly, public construction spending is higher on month-over-month and year-over-year basis.

“What has been less clear is whether privately financed construction would continue to rise,” said Basu. “While the economy remains strong, a number of headwinds have formed, particularly concerns regarding tariffs and trade wars. Construction material prices have already begun to surge, in part because of trade disputes involving materials such as softwood lumber, steel and aluminum. This increases project costs without offering developers and their financiers any offsetting commercial benefit.

“Moreover, fears of a full-blown trade war between the United States and NAFTA partners, the European Union and/or China have likely resulted in some businesses and investors adopting a wait-and-see attitude,” said Basu. “This helps explain the recent dip in construction spending related to manufacturing. With key interest rates, like the prime rate, also on the rise, the motivation to move forward with projects may be waning. Rising borrowing costs make it less likely that a project will satisfy a given investor’s hurdle rate. Rising labor costs contribute further to this calculus.

“The upshot is that contractors would likely be primary beneficiaries of a less precarious policymaking environment,” said Basu. “Businesses, markets, developers and financiers each prefer certainty. They also prefer input costs that aren’t surging. This strongly suggests that, while private construction spending should remain sturdy during the months ahead given healthy backlog and current economic momentum, the outlook for construction spending may be rather different in a few quarters.”

Press Release from Associated General Contractors of America

Construction Spending Reaches Record High with 0.4% Pickup in May as Residential and Public Investment Offset Dip in Nonresidential Outlays.

Continued Labor Shortages, Rising Materials Costs Related to New Tariffs Could Stall All Types of Projects; Construction Officials Urge Feds to Enact New Workforce Measures, Avoid Damaging Trade War

Construction spending reached a record level of $1.309 trillion in May as monthly increases in residential and public investment outweighed a decline in private nonresidential outlays, according to an analysis of new government data by the Associated General Contractors of America. Association officials warned, however, that continued labor shortages and rising materials costs threaten future growth in demand.

“Public construction spending has increased strongly for the past nine months and is now at the highest level since 2010, led by a rebound in infrastructure investment,” said Ken Simonson, the association’s chief economist. “Single-family homebuilding is continuing to expand, while multifamily construction has pulled out of a recent slump, but growth in private nonresidential spending remains modest and inconsistent. However, rising materials costs and shortages of qualified workers may stall all types of projects.”

Construction spending in May increased 0.4 percent from the rate in April and 4.5 percent from the May 2017 rate to $1.309 trillion at a seasonally adjusted annual rate. For the month, public construction spending rose 0.7 percent, private residential spending increased 0.8 percent, and private nonresidential construction spending slipped 0.3 percent. On a year-over-year basis, public construction spending climbed 4.7 percent, private residential spending grew 6.6 percent, and private nonresidential construction spending edged up 1.8 percent.

Among public infrastructure spending categories, highway and street construction increased 5.8 percent from May 2017 to May 2018; transportation construction (airports, transit, public rail and ports) rose 9.1 percent; sewage and waste disposal construction climbed 5.6 percent; water supply, 9.4 percent; and conservation and development, 8.5 percent. The largest public building construction type—educational construction—inched up 0.4 percent over the year.

Spending on single-family homebuilding increased 8.2 percent from May 2017 to May 2018, while multifamily construction spending climbed 4.2 percent over that period, Simonson noted. He added that private nonresidential spending showed a mixed pattern. The largest category—power construction spending (including oil and gas field and pipeline structures)—dipped 0.7 percent over 12 months, but the next largest segment—commercial construction (comprising retail, warehouse and farm buildings) had a gain of 2.0 percent. Manufacturing construction spending fell by 11.0 percent year-over-year, while private office construction spending jumped by 9.7 percent.

Association officials noted that rapidly rising materials costs, due in part to new and anticipated tariffs, are likely to make some projects unaffordable. In addition, acute shortages of qualified labor may result in project delays, Stephen E. Sandherr, the association’s chief executive officer, cautioned. He urged Congress to pass a new Perkins Act that increases funding for career and technical education and for the Trump Administration to avoid a damaging trade war.

“Contractors are struggling to be successful in an environment where there aren’t enough workers available to install increasingly expensive construction materials.” Sandherr said. “Establishing more construction training programs and finding a more effective way to boost domestic steel and aluminum production will help this industry and the economy to continue expanding.”

Reporting from ABC News:

US construction spending rose 0.4 percent in May

Spending on U.S. construction projects edged up 0.4 percent in May, while April's figure was revised down significantly — signs that new building is still uneven despite a growing economy.

The uptick in May brought total construction spending to a seasonally adjusted all-time high of $1.31 trillion, 4.5 percent higher than a year ago, the Commerce Departments said Monday. April's figure was revised down to 0.9 percent from what was originally reported as 1.8 percent gain, which would have been the largest increase in 24 years. That came on the heels of 0.9 percent drop in March, the first monthly drop since July of 2017.

Total private construction rose 0.3 percent, with residential projects up 0.8 percent in May. New single-family home construction rose 0.6 percent and the volatile apartment building sector jumped 1.6 percent. Private, non-residential building fell 0.3 percent.

Economists are forecasting that construction spending will contribute to overall growth this year even though interest rates are rising. A lack of inventory has stymied homebuyers and pushed home prices higher as demand for existing and new homes has surged.

Last month the Commerce Department reported that housing starts rose to a seasonally adjusted annual rate of 1.35 million, the strongest pace since July 2007, thanks to a surge of building in the Midwest.

Even as government budgets have tightened, construction of public projects in May rose 0.7 percent to $304.1 billion, the highest since October 2010. That gain was fueled by a 0.6 percent rise in state and local construction, which accounts for more than 90 percent of total government activity. State and local government construction spending was $282.1 billion, the most since September of 2009.

Spending on the power grid increased nearly 11 percent on a monthly basis, and is up more than 25 percent over a year ago.