Key Takeaways

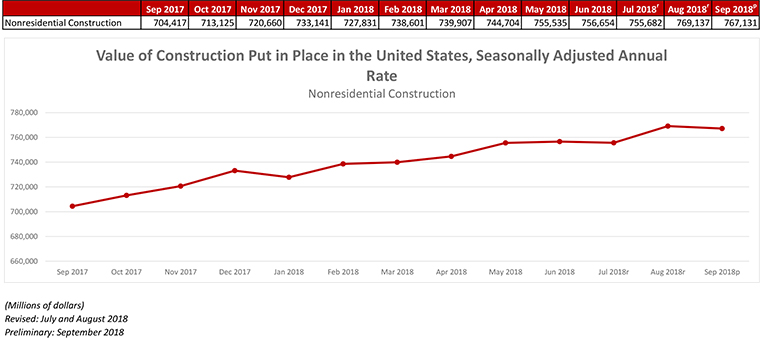

- Nonresidential construction spending, which totaled $767.1 billion on a seasonally adjusted annual rate for September, fell 0.3% but remains historically elevated and increased 8.9% on a year-ago basis

- August’s estimate was revised almost a full percent higher from $762.7 billion to $769.1 billion, the highest level in the history of the series.

- “Unlike previous instances of rapid construction growth, this one is led by a neatly balanced combination of private and public spending growth.”

Press Release from Associated Builders and Contractors, Inc.

WASHINGTON, Nov. 1— National nonresidential construction spending fell 0.3 percent in September but remains historically elevated, according to an Associated Builders and Contractors analysis of U.S. Census Bureau data released today. Total nonresidential spending stood at $767.1 billion on a seasonally adjusted, annualized rate in September, an increase of 8.9 percent on a year-ago basis.

Note that August’s estimate was revised almost a full percent higher from $762.7 billion to $769.1 billion, the highest level in the history of the series. Private nonresidential spending increased 0.1 percent in September while public nonresidential spending decreased 0.8 percent for the month.

Virtually no weight should be placed upon the monthly decline in nonresidential construction spending that occurred in September,” said ABC Chief Economist Anirban Basu. “Rather, we should focus on the massive upward revision to August’s spending data. That revision finally aligns construction spending data with statistics on backlog, employment and other indicators of robust nonresidential construction spending. On a year-over-year basis, nonresidential construction is up nearly 9 percent, an impressive performance by any standard."

“Unlike previous instances of rapid construction growth, this one is led by a neatly balanced combination of private and public spending growth,” said Basu. “Among the leading sources of spending growth over the past year are water supply, transportation, lodging and office construction. This is not only consistent with an economy that continues to perform splendidly along multiple dimensions, but also with significantly improved state and local government finances, which has helped to support greater levels of infrastructure spending."

“Given healthy backlog and indications that the economy will continue to manifest momentum into 2019, contractors can expect to remain busy,” said Basu. “The most substantial challenges will continue to be rising workforce and input costs. That said, there are indications of softening business investment, which could serve to weaken U.S. economic growth after what is setting up to be a strong first half of 2019.”

Press Release from Associated General Contractors of America

Construction spending increases to record high of $1.329 trillion, most public and private segments show healthy growth

Construction Spending Should Stay Robust through Early 2019, But Trade Disputes, Workforce Shortages and Rising Interest Rates Threaten to Undermine Long-Term Growth in Construction Demand, Officials Caution

Construction spending hit a seasonally adjusted annual rate of $1.329 trillion and grew 5.5 percent for nine months of 2018 combined, with continued year-to-date gains for major public and private categories, according to an analysis of new government data by the Associated General Contractors of America. Association officials said that while demand for construction should remain strong for the next several months, the construction sector could be impacted by new trade tariffs, continues workforce shortages and higher interest rates.

“Construction spending has increased among nearly every project type and geographic area this year,” said Ken Simonson, the association’s chief economist. “Despite month-to-month fluctuations, the outlook remains positive for modest to moderate increases in most spending categories at least through the first part of 2019. However, damaging trade policies, labor shortages and rising interest rates pose growing challenges to contractors and their clients.”

Spending year-to-date through the first nine months of 2018 was 7.0 percent higher than in January through September 2017 for public construction and 5.1 percent for private construction, the economist commented. Within private construction, spending for residential projects increased 6.4 percent and 3.5 percent for nonresidential projects.

Major segments continued year-to-date gains, Simonson observed. The largest public categories recorded year-to-date gains of 5.8 percent for highway construction, 2.0 percent for educational construction and 15.8 percent for transportation construction. Of the three private residential spending categories, single-family homebuilding rose 6.4 percent year-to-date, multifamily was virtually unchanged and improvements to existing buildings climbed 7.1 percent. Among private nonresidential spending segments, the largest—power construction (including oil and gas field and pipeline structures)—edged up 2.3 percent, commercial (retail, warehouse and farm) construction rose 4.8 percent, office construction increased 7.4 percent and manufacturing construction declined 3.4 percent.

Association officials said that overall economic conditions remain positive as the economy continues to benefit from recently enacted tax and regulatory reforms. But they warned that a growing trade dispute with China, shortages of qualified workers and rising interest rates could undermine future demand for construction services. They urged federal officials to resolve trade disputes and boost investments in career and technical education programs.

“Washington has taken a number of positive steps to deliver robust economic growth during the past two years,” said Stephen E. Sandherr, the association’s chief executive officer. “The best thing federal officials can do to maintain current rates of growth is to resolve potentially costly trade disputes and boost investments in workforce development.”

Reporting from CNBC:

Manufacturing activity slips for second month; construction spending unchanged in September

U.S. manufacturing activity fell short of expectations in October with a gauge of new orders easing to its lowest level since April 2017.

The Institute for Supply Management (ISM) said its index of national factory activity dropped 2.1 percentage points to 57.7 last month from 59.8 in September. A reading above 50 indicates growth in manufacturing, which accounts for about 12 percent of the U.S. economy.

Economists polled by Refinitiv expected the ISM manufacturing index to hit 59 in October. An index tracking new orders registered 57.4 percent, a decrease of 4.4 percentage points from the September reading of 61.8 percent.

“Demand remains moderately strong, with the New Orders Index easing to below 60 percent for the first time since April 2017, the Customers’ Inventories Index remaining low but improving, and the Backlog of Orders Index remaining steady,” Timothy Fiore, Chair of the ISM Manufacturing Business Survey Committee, said in a press release. “Consumption softened, with production and employment continuing to expand, but at lower levels compared to September.”

Despite the moderation in the manufacturing numbers, October marked the 114th consecutive month of overall economic growth, according to the Manufacturing ISM report.

The latest read on the health of the manufacturing sector comes amid an ongoing trade dispute between the United States and China as a part of President Donald Trump’s “America First” policy. The White House hopes that it can pressure Beijing into a more favorable trade deal through taxes on Chinese goods.

The president escalated the economic spat in September, imposing tariffs on an additional $200 billion worth of goods from China as of Sept. 24. The next wave of tariffs started at a 10 percent rate before climbing to 25 percent at the start of 2019 if the disagreement between the two nations is not resolved.

The rift has not yet had a major impact on U.S. economic activity, with the first read on third-quarter gross domestic product (GDP) showing growth of 3.5 percent on an annualized rate. The Commerce Department said last month that inflation has remained relatively tame and that consumer spending surged.

Construction spending

Spending on U.S. construction projects was essentially unchanged in September. It is the weakest showing since June, as an increase in home construction was offset by a slide in spending on government projects.

The Commerce Department says that the flat reading for September followed a 0.8 percent rise in August. Construction spending, meanwhile, was expected to have risen 0.1 percent in September.

The strength last month was driven by a 0.6 per cent increase in residential construction and a smaller 0.1 per cent increase in nonresidential activity, which pushed this category to an all-time high. However, these gains were offset by a 0.9 per cent drop in spending on government projects.

The increase in residential construction featured an 8.7 per cent jump in apartment construction, which offset a 0.8 per cent drop in single-family homes.