Key Takeaways

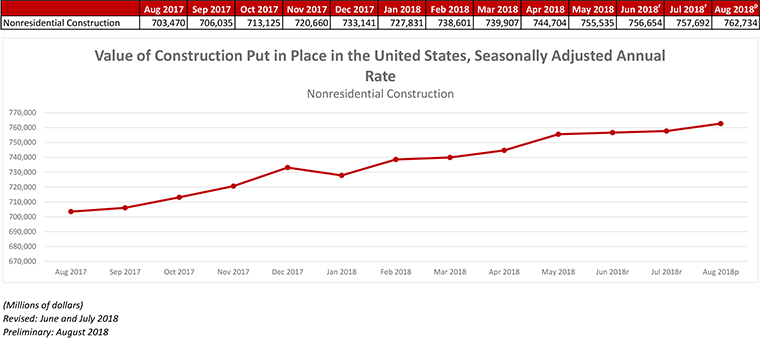

- Nonresidential construction spending, which totaled $762.7 billion on a seasonally adjusted annual rate for August, expanded 0.7% in August to its highest level since the U.S. Census Bureau began the data series in 2002.

- Associated General Contractors of America officials said that these spending figures showed strong demand in construction across the country but that growth in the construction industry still depends on contractors’ ability to find sufficient qualified workers, urging public officials to step up support for career and technical education and to allow employment-based immigration.

- “In a survey of more than 2500 firms that our association released recently, respondents overwhelmingly say they plan to add employees in the next 12 months—a strong indicator of ongoing demand for construction. However, 80 percent of the firms report difficulty filling hourly craft positions. These labor shortages are prompting many firms to increase costs and delay construction schedules.”

Press Release from Associated Builders and Contractors, Inc.

WASHINGTON, Oct. 1— National nonresidential construction spending expanded 0.7 percent in August to its highest level since the U.S. Census Bureau began the data series in 2002, according to an Associated Builders and Contractors analysis released today. Total nonresidential spending stood at $762.7 billion on a seasonally adjusted, annualized rate in August, which represents an increase of 8.4 percent compared to one year ago. Private nonresidential spending fell 0.2 percent in August largely due to a 1.3 percent decline in power-related spending, the largest private construction spending category, and public nonresidential spending increased 2 percent.

“The good news on the nation’s economy and the construction sector just keeps coming,” said ABC Chief Economist Anirban Basu. “The increase in overall nonresidential construction spending was reasonably predictable given the predominance of positive leading indicators such as ABC’s Construction Backlog Indicator, which reported record-setting 9.9 months of backlog in the second quarter of this year, and the Architectural Billings Index. In addition, the recent pattern of stable private construction spending coupled with growing public spending remained in place in August."

“Rising property values, ongoing rapid job creation and a confident consumer translates into rising real estate values, income and retail sales tax collections, which in turn creates additional resources to invest in infrastructure,” said Basu. “That helps explain the chunky year-over-year spending increases in a number of primarily publicly financed categories, including water supply, which increased 37 percent; conservation and development, 34 percent; transportation, 23 percent; and highway/street, 14 percent."

“It is quite possible that construction spending growth will accelerate from current levels,” said Basu. “Aside from the strong economy, ongoing increases in materials prices and worker compensation is translating into rising project delivery costs, which, all things being equal, produces faster construction spending growth."

“For now, rising construction and borrowing costs are not stifling economic activity,” said Basu. “However, purchasers of construction services may be increasingly inclined to postpone projects if costs continue to rise, which is likely. And while contractors remain concerned about the overall construction workforce shortage negatively affecting project deadlines, the near-term outlook remains robust.”

Press Release from Associated General Contractors of America

Construction Spending Extends Year-to-Date Gains in August in Most Public and Private Segments Even as Contractors Struggle to Find Craft Workers

Construction Spending Numbers Show Strong Continued Demand Across Nearly Every Sector; Association Urges Investment in Career and Technical Education, Immigration Policy Changes to Maintain Growth

Construction spending increased 0.1 percent from July to August and 5.3 percent for eight months of 2018 combined, with continued year-to-date gains for major public and private categories, according to an analysis of new government data by the Associated General Contractors of America. Association officials said that these spending figures showed strong demand in construction across the country but that growth in the construction industry still depends on contractors’ ability to find sufficient qualified workers, urging public officials to step up support for career and technical education and to allow employment-based immigration.

“Nearly all categories of construction spending continued to expand through August,” said Ken Simonson, the association’s chief economist. “Furthermore, growth is well-balanced among public, private nonresidential and residential projects. But contractors are increasingly worried about a shortage of skilled workers.”

Spending year-to-date through the first eight months of 2018 was 7.0 percent higher than in January through August 2017 for public construction and 4.8 percent for private construction, the economist remarked. Within private construction, spending for residential projects increased 6.5 percent and 2.7 percent for nonresidential projects.

Most major segments had gains, Simonson observed. The largest public categories recorded year-to-date gains of 6.4 percent for highway construction, 1.0 percent for educational construction and 15.9 percent for transportation construction. Of the three private residential spending categories, single-family homebuilding rose 7.9 percent year-to-date, multifamily slipped by 0.7 percent and improvements to existing buildings climbed 6.9 percent. Among private nonresidential spending niches, the largest—power construction (including oil and gas field and pipeline structures)—edged up 1.1 percent, commercial (retail, warehouse and farm) construction rose 4.6 percent, office construction increased 6.5 percent and manufacturing construction declined 5.5 percent.

“In a survey of more than 2500 firms that our association released recently, respondents overwhelmingly say they plan to add employees in the next 12 months—a strong indicator of ongoing demand for construction,” Simonson added. “However, 80 percent of the firms report difficulty filling hourly craft positions. These labor shortages are prompting many firms to increase costs and delay construction schedules.”

Association officials said the growth in construction spending was a sign that recently enacted tax and regulatory reforms are helping stimulate new economic growth. But they cautioned that labor shortages could undermine future demand for construction by inflating the cost of many projects. They urged federal officials to increase funding for career and technical education programs, make it easier to establish apprenticeship and other construction training programs, and allow more people with construction skills to legally enter the country.

“The best way to ensure construction firms can keep pace with growing demand is to find new ways to recruit and prepare a new generation of worker,” Sandherr said. “Exposing more young adults to the opportunities available to them in construction is the best way to get more people into high-paying careers in the sector.”

Reporting from CNBC:

Manufacturing activity slips in September; construction spending rises slightly in August

U.S. manufacturing activity slowed in September as growth in new orders moderated sharply, but factories hired more workers, pointing to sustained strength in the sector.

The Institute for Supply Management (ISM) said its index of national factory activity dropped 1.5 points to a reading of 59.8 last month from 61.3 in August, which was the highest since May 2004. A reading above 50 indicates growth in manufacturing, which accounts for about 12 percent of the U.S. economy.

The ISM continued to describe demand as remaining “robust.” The ISM also noted that “the nation’s employment resource and supply chains continued to struggle, but to a lesser degree.” It said factories continued to be “overwhelmingly concerned about tariff-related activity, including how reciprocal tariffs will impact company revenue and current manufacturing locations.”

President Donald Trump’s “America First” trade policy have left the United States embroiled in a bitter trade war with China and tit-for-tat import tariffs with other trading partners, including the European Union, Canada and Mexico.

Washington last week slapped tariffs on $200 billion worth of Chinese goods, with Beijing retaliating with duties on $60 billion worth of U.S. products. The U.S. and China had already imposed tariffs on $50 billion worth of each other’s goods.

While data have suggested little impact on the economy so far from the tariffs, analysts warn that the import duties could disrupt supply chains, undercut business investment and slow the economy’s momentum. The economy grew at a 4.2 percent annualized rate in the second quarter, almost double the 2.2 percent in the January-March period.

The ISM’s new orders sub-index fell to a reading of 61.8 last month from 65.1 in August. A measure of export orders, however, rose last month. The survey’s employment measure rose to 58.8, the highest reading since February from 58.5 in August. U.S. financial markets were little moved by the data.

Construction spending

A second report from the Commerce Department showed construction spending edged up 0.1 percent in August. Data for July was revised up to show construction outlays rising 0.2 percent instead of the previously reported 0.1 percent gain.

Economists polled by Reuters had forecast construction spending increasing 0.4 percent in August. Construction spending rose 6.5 percent on a year-on-year basis.

Spending on public construction projects jumped 2.0 percent in August to the highest level since July 2009. That followed a 1.7 percent increase in July. Spending on federal government construction projects soared 5.9 percent to a 10-month high after increasing 2.3 percent in July.

State and local government construction outlays accelerated 1.7 percent in August to the highest level since March 2009. That followed a 1.6 percent rise in July.

But spending on private construction projects fell 0.5 percent in August after decreasing 0.2 percent in July. Private construction outlays have now declined for three straight months. Investment in private residential projects fell 0.7 percent in August after gaining 0.2 percent in July.

Homebuilding has been constrained by rising material costs as well as persistent land and labor shortages. Residential investment contracted in the first half of the year and is expected to have declined further in the third quarter.

Spending on private nonresidential structures, which includes manufacturing and power plants, slipped 0.2 percent in August after declining 0.8 percent in July.