Press Release from Associated Builders and Contractors, Inc.

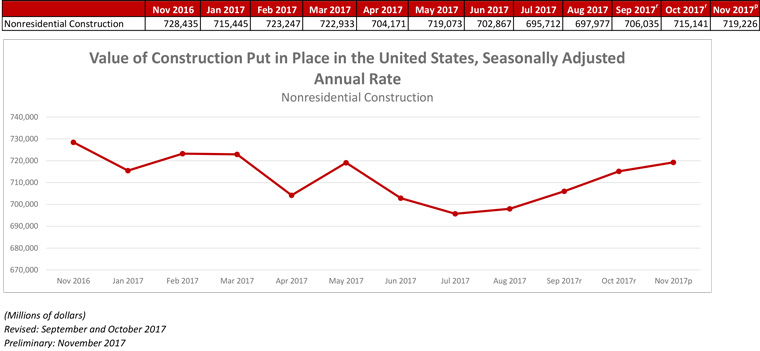

WASHINGTON, Jan. 3—Nonresidential construction spending expanded 0.6 percent in November, totaling $719.2 billion on a seasonally adjusted basis, according to an Associated Builders and Contractors (ABC) analysis of data released today by the U.S. Census Bureau. Despite the month-over-month expansion, nonresidential spending fell 1.3 percent from November 2016.

Private nonresidential construction spending is down 3.1 percent year-over-year, while public sector spending has increased 1.7 percent over the same period. Spending in the manufacturing and power categories, two of the larger nonresidential subsectors, fell by a combined $21.7 billion over the past year.

“The November report represented a stark reversal of preexisting trends,” said ABC Chief Economist Anirban Basu. “For much of the past several years, the pattern in nonresidential construction spending has been one in which a number of private categories expanded briskly, including lodging and office, while a host of public construction categories experienced sluggish spending. That changed in November, with public construction spending rising and private construction spending shrinking on a year-over-year basis.

“There are several possible explanations, including growing concerns about overbuilding in a number of large metropolitan areas in the lodging, office and commercial categories,” said Basu. “Financiers may also be less willing to supply financing to a variety of private projects given such concerns. At the same time, the U.S. housing market is the strongest it has been in at least a decade, raising sales prices and expanding assessable residential tax bases. That in turn has supplied additional resources for infrastructure. Over the past year, this has been particularly apparent in the educational and public safety categories.”

Reporting from CNBC:

ISM manufacturing and construction spending both clock gains

U.S. factory activity increased more than expected in December, boosted by a surge in new orders growth, in a further sign of strong economic momentum at the end of 2017.

The economy's robust fundamentals were also underscored by other data on Wednesday showing construction spending rising to a record high in November amid broad gains in both private and public outlays.

The Institute for Supply Management (ISM) said its index of national factory activity jumped to a reading of 59.7 last month from 58.2 in November. A reading above 50 indicates growth in manufacturing, which accounts for about 12 percent of the U.S. economy.

The survey's production sub-index rose 1.9 points to a reading of 65.8 and a gauge of new orders shot up 5.4 points to 69.4. Manufacturers also reported an increase in export orders. A measure of factory employment, however, fell to 57.0 last month from 59.7 in November.

Manufacturing is likely to get a boost this year from a $1.5 trillion tax cut approved by the Republican-controlled U.S. Congress last month. The overhaul of the tax code, the most sweeping in 30 years, slashed the corporate income tax rate to 21 percent from 35 percent.

Business spending surged in anticipation of the corporate tax cuts. Recent weakness in the dollar and a strengthening global economy are expected to buoy exports of U.S.-made goods, which would underpin manufacturing.

The dollar rose against the euro and yen after Wednesday's data. U.S. stock indexes hit new record highs, while prices of U.S. Treasuries were mixed.

Solid economic outlook

In a separate report on Wednesday, the Commerce Department said construction spending rose 0.8 percent to an all-time high of $1.257 trillion in November. Construction spending advanced 2.4 percent on a year-on-year basis.

The manufacturing and construction reports added to data ranging from the labor market to housing and consumer spending in sketching a robust picture of the U.S. economy.

Gross domestic product estimates for the fourth quarter are converging around a 2.8 percent annualized rate. The economy grew at a 3.2 percent pace in the third quarter.

In November, spending on private residential projects soared 1.0 percent to the highest level since February 2007 after rising 0.3 percent in October. The increase was in line with a recent jump in homebuilding and supports the view that housing would boost economic growth in the fourth quarter after acting as a drag on gross domestic product since the April-June period.

Spending on nonresidential structures rebounded 0.9 percent in November after falling 0.2 percent in the prior month. Overall, spending on private construction projects climbed 1.0 percent in November to a record high. That followed a 0.3 percent increase in October.

Outlays on public construction projects rose 0.2 percent in November after jumping 3.5 percent in October. Spending on state and local government construction projects rose 0.7 percent. Federal government construction spending tumbled 4.8 percent.

Construction spending

U.S. construction spending increased more than expected in November, hitting a record high, driven by a surge in investment in private residential and nonresidential projects.

The Commerce Department said on Wednesday that construction spending rose 0.8 percent to an all-time high of $1.257 trillion. October's construction outlays were revised down to show a 0.9 percent rise instead of the previously reported 1.4 percent gain.

Economists polled by Reuters had forecast construction spending increasing 0.5 percent in November. Construction spending advanced 2.4 percent on a year-on-year basis.

In November, spending on private residential projects soared 1.0 percent to the highest level since February 2007 after rising 0.3 percent in October. The increase was in line with a recent jump in homebuilding and supports the view that housing would boost economic growth in the fourth quarter after being a drag to gross domestic product since the April-June period.

The strong construction spending report suggests fourth-quarter GDP growth estimates, which are currently just below a 3.0 percent annualized rate, could be raised. The economy grew at a 3.2 percent pace in the third quarter.

Spending on nonresidential structures rebounded 0.9 percent in November after falling 0.2 percent in the prior month. Overall, spending on private construction projects climbed 1.0 percent in November to a record high. That followed a 0.3 percent increase in October.

Outlays on public construction projects rose 0.2 percent in November after jumping 3.5 percent in October. Spending on state and local government construction projects rose 0.7 percent. Federal government construction spending tumbled 4.8 percent.

Reporting from USAToday:

US construction spending hit record high in November

WASHINGTON — U.S. builders spent 0.8% more on construction projects in November, the fourth consecutive monthly gain.

November advance follows October's revised 0.9% gain, the Commerce Department said Wednesday. The increase brought total construction spending for the month to a seasonally-adjusted annual rate of $1.26 trillion, an all-time high.

Private construction spending, which was up 1% from last month, also hit an all-time high.

The increase in spending by builders, along with a robust manufacturing report released separately Wednesday, underscores the solid momentum of the U.S. economy heading into the new year.

The November increase was led by a solid advance in homebuilding, which rose 1% from October as strength in single-family construction offset weakness in apartment building. Construction of single-family homes rose 1.9% in November, offsetting a 1.3% drop in apartment building.

Non-residential construction rebounded 0.9% in November after declining four of the last five months, led by office building, which rose 5.5%.

Spending on transportation construction was up 3.7%, putting it 42.2% higher than a year ago, the largest advance by far by any sector.

Government construction posted a modest 0.2% increase after much bigger gains in the previous three months. Federal construction spending plunged 4.8%, the biggest drop in five months. That weakness was offset by a 0.7% rise in state and local construction, which accounts for more than 90% of total government activity.