Key Takeaways

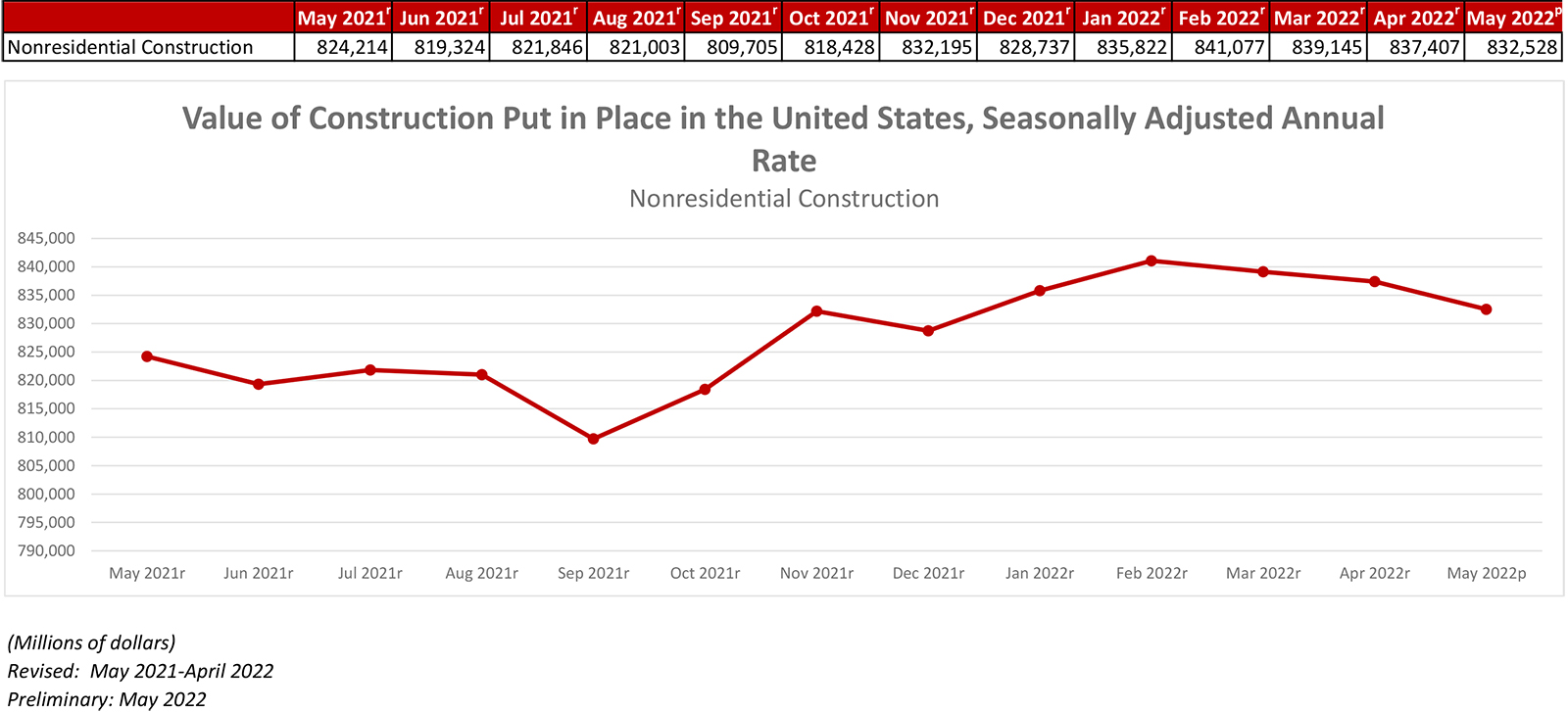

- National nonresidential construction spending down 0.6% in May 2022.

- On a seasonally adjusted annualized basis, nonresidential spending totaled $832.5 billion for the month.

- "Many contractors continue to report that they are operating at capacity despite a lack of strong nonresidential construction spending recovery. That juxtaposition provides solid evidence that the supply side of the U.S. economy remains heavily constrained by worker shortages, domestic and global supply chain disruptions and resulting high prices"

- Notice from U.S. Census Bureau: "With the May 2022 release, unadjusted data will be revised back to January 2020 and seasonally adjusted data will be revised back to January 2015. With each May release, seasonally adjusted data will now be revised for an additional five years beyond the revision period for unadjusted data. Research has shown that this revision span should produce more reliable seasonally adjusted time series."

Press Release from Associated Builders and Contractors, Inc.: Nonresidential Construction Spending Slightly Dips in May, Says ABC

WASHINGTON, July 1—National nonresidential construction spending was down by 0.6% in May, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $832.5 billion for the month.

Spending was down on a monthly basis in 10 of the 16 nonresidential subcategories. Private nonresidential spending was down 0.4%, while public nonresidential construction spending was down 0.8% in May. Nonresidential construction spending is up 1.0% over the past year, though spending is down in 10 of 16 categories over that span. The best performer is manufacturing, a segment in which construction spending is up 26.3% on a year-over-year basis.

“Many contractors continue to report that they are operating at capacity despite a lack of strong nonresidential construction spending recovery,” said ABC Chief Economist Anirban Basu. “That juxtaposition provides solid evidence that the supply side of the U.S. economy remains heavily constrained by worker shortages, domestic and global supply chain disruptions and resulting high prices.

“Since the early months of the pandemic, contractors have reported that they are able to pass along their cost increases to project owners, according to ABC’s Construction Confidence Index,” said Basu. “But there are growing concerns among industry leaders that the ability to pass along cost increases will dissipate during the months ahead as financial conditions tighten and confidence in economic performance wanes.

“A primary implication is that contractor margins may be squeezed going forward, and there is growing anecdotal evidence that this is already occurring,” said Basu. “There is also a growing risk of a significant number of project postponements in both private and public construction segments due to high materials prices and labor costs.

“The key to sustaining nonresidential construction’s recovery will be slower inflation,” said Basu. “As long as inflation remains elevated, monetary policy will continue to tighten and project owners will be less willing to move forward with projects in an effort to preserve cash. Unfortunately, ongoing efforts to limit inflation are likely to result in recession or at least further economic slowing, which will create additional issues for many contractors. However, less inflation and more favorable construction materials prices would create a foundation for renewed construction spending vigor.”

Press Release from Associated General Contractors of America: Construction Spending Dips In May As New Residential Activity Stalls, While Nonresidential Projects Decline For Third Consecutive Month

Construction Association Officials Note that Labor Shortages and Supply Chain Problems are Limiting Construction Capacity, Urge Public Leaders to Support Construction-Focused Programs, End Tariffs

WASHINGTON, July 1—Total construction spending edged down 0.1 percent in May as spending on new houses and apartments stalled, while public and private nonresidential construction slumped, according to an analysis the Associated General Contractors of America released today of federal spending data. Association officials said the construction industry’s capacity to build projects was being limited by workforce shortages and supply chain problems.

“Contractors say demand remains strong for nonresidential projects but they are having trouble both getting materials on time and hiring enough workers,” said Ken Simonson, the association’s chief economist. “The industry’s unemployment rate was down to 3.8 percent in May, a sign of how scarce experienced workers are.”

Construction spending, not adjusted for inflation, totaled $1.78 trillion at a seasonally adjusted annual rate in May, 0.1 percent below the upwardly revised April rate and 9.7 percent higher than in May 2021. Private nonresidential construction spending declined for the third month in a row, slipping 0.4 percent from April, although the May rate was 3.7 percent higher than in May 2021. Public construction spending decreased for the second-straight month, falling 0.8 percent from April and 2.7 percent from the year-ago rate.

Residential spending rose 0.2 percent for the month but the gains were limited to improvements to owner-occupied housing. New single- and multifamily spending were each virtually unchanged from April.

The downturn in nonresidential construction spending was widespread. The largest segment, power—comprising electric, oil, and gas projects—slipped 1.0 percent in May. Spending on commercial construction—warehouse, retail, and farm projects—declined 0.9 percent. Educational construction spending decreased 0.5 percent. Among the five largest segments, only manufacturing construction increased, by 1.2 percent, as work began or continued on numerous large factory projects.

Association officials said that contractors are having to slow schedules and even turn down work because of challenges they are having finding workers and procuring materials needed for projects. They urged federal, state and local leaders to boost funding for and to support new education and training programs that expose future workers to construction skills and opportunities. And they urged the Biden administration to remove tariffs and explore other ways to ease supply chain challenges.

“Contractors have the work, but they don’t have enough workers or materials to keep pace with strong demand for construction in many parts of the country,” said Stephen E. Sandherr, the association’s chief executive officer. “Exposing more people to the opportunities and benefits of working in construction and fixing the supply chain will boost construction activity and employment in much of the country.”