Key Takeaways

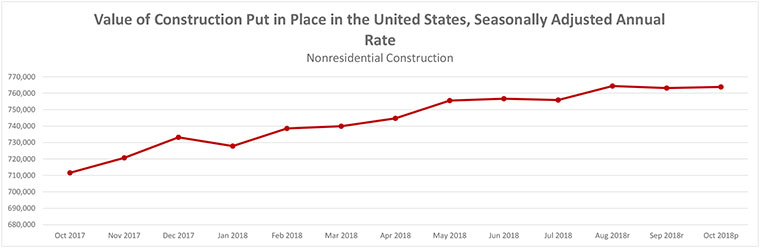

- Nonresidential construction spending, which totaled $763.8 billion on a seasonally adjusted annual rate for October, increased 0.1% and is a 7.3% increase over the same time last year

- Water supply (+23 percent), lodging (+18.9 percent) and amusement and recreation (+16.2 percent) have generated the largest increases among nonresidential construction segments over the past 12 months.

- “While demand for construction services remained strong throughout the year, many contractors indicate that profit margins are under pressure. Given the ongoing dearth of available, skilled construction workers, that is likely to continue into 2019. However, materials price dynamics could be far different given a slowing global economy and expectations for a strong U.S. dollar next year.”

Press Release from Associated Builders and Contractors, Inc.

WASHINGTON, Dec. 3— National nonresidential spending increased 0.1 percent in October, according to an Associated Builders and Contractors analysis of U.S. Census Bureau data released today. Total nonresidential spending for the month stood at $763.8 billion on a seasonally adjusted annualized rate, which represents a 7.3 percent increase over the same time last year.

Thirteen out of 16 sub-sectors are associated with year-over-year increases, with the exceptions being religious (-9.1 percent), communication (-4.7 percent), and health care (-1 percent). Water supply (+23 percent), lodging (+18.9 percent) and amusement and recreation (+16.2 percent) have generated the largest increases among nonresidential construction segments over the past 12 months.

“It is remarkable that the construction spending cycle remains firmly in place despite worker shortages, tariffs, rising materials prices, financial market volatility, more restrictive monetary policy, evidence of a slowing global economy and an abundance of political controversies,” said ABC Chief Economic Anirban Basu. “With backlog still elevated, nonresidential construction spending will enter 2019 with plentiful momentum.

“It is true that not all construction spending segments have participated in the industry’s recovery. However, the number of segments experiencing negative spending growth is small and the expectation is that a turnaround in spending is likely in at least one of these categories,” said Basu. “The religious category (-9.1 percent year-over-year) represents less than 1 percent of total nonresidential construction spending. Demographic forces and a strong economy should translate into growing demand for health care services, which will eventually trigger more construction in the health care category (-1 percent), including in the form of outpatient medical centers.

“While there will always be reasons to fret about the economic outlook, 2018 will go down as a fine year for the U.S. economy and for the nation’s nonresidential construction sector,” said Basu. “That said, while demand for construction services remained strong throughout the year, many contractors indicate that profit margins are under pressure. Given the ongoing dearth of available, skilled construction workers, that is likely to continue into 2019. However, materials price dynamics could be far different given a slowing global economy and expectations for a strong U.S. dollar next year.”

Press Release from Associated General Contractors of America

Construction spending dips in October but maintains year-over-year gains; Association urges action on infrastructure investment as spending stalls

Outlays Decline from Recent Peaks for Highways and Other Transportation, Water, Sewage and Conservation; Association Officials Note Bipartisan Support for Infrastructure but Say Legislation is Needed Promptly

Construction spending inched lower in October from September levels but increased from the October 2017 total, according to an analysis of new Census data by the Associated General Contractors of America. However, investment in public infrastructure posted declines from recent peaks, and association officials urged the White House and Congress to act promptly on comprehensive infrastructure legislation.

“Although most segments of construction continue to post year-over-year spending gains, investment in vitally needed infrastructure has stalled or shrunk in the past four months,” said Ken Simonson, the association’s chief economist. “If infrastructure contractors start losing employees to more-active construction segments, it may be hard to get infrastructure projects done on time once funding resumes.”

Construction spending totaled $1.309 trillion at a seasonally adjusted annual rate in October, a dip of 0.1 percent from the September rate but 4.9 percent higher than in October 2017. Private residential construction fell 0.5 percent for the month but increased 1.8 percent year-over-year. Private nonresidential spending slipped 0.3 percent from September to October but increased 6.4 percent over 12 months. Public construction spending, comprising public buildings and infrastructure, increased 0.8 percent for the month and 8.5 percent for the year.

The economist noted that public spending was boosted by large increases in educational spending and other public building segments, while all public infrastructure categories had declined from recent highs. Seasonally adjusted spending on highway and street construction peaked in August and has dropped 2.1 percent in the past two months, he said. Public investment in air, rail and water transportation facilities fell 1.2 percent between August and October. Outlays for sewage and waste disposal and water supply systems topped out in June and have decreased 2.2 percent and 8.6 percent, respectively, since then. Public spending on conservation and development, such as levees and dams, slumped 14.6 percent from August to October.

Association officials said that now is the ideal time to invest in repairing, modernizing and expanding infrastructure. Stephen E. Sandherr, the association’s chief executive officer, called on federal officials to act quickly to enact legislation that would increase funding and speed the approval process to improve highways and other modes of transportation, enhance water safety and supply, and strengthen critical levees and dams.

“Infrastructure is vital to all Americans and is a subject both parties should be able to agree on funding and improving,” Sandherr said. “The incoming Congress has an opportunity to create a bipartisan infrastructure bill that will benefit all regions and all parts of the economy.”