Key Takeaways

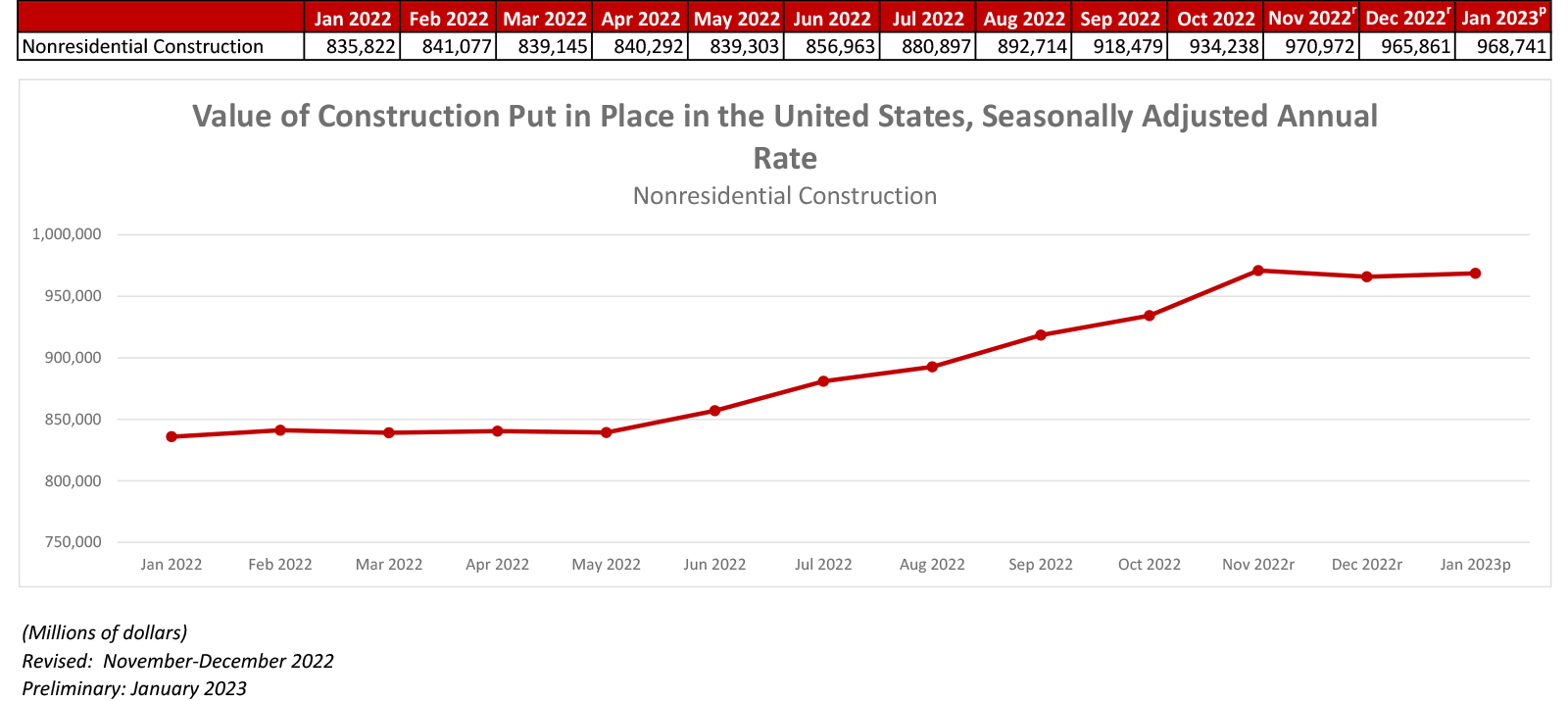

- National nonresidential construction spending increased by 0.3% in January.

- On a seasonally adjusted annualized basis, nonresidential spending totaled $968.7 billion for the month.

- "On a year-over-year basis, spending in the nonresidential sector continues to outpace inflation. That’s largely attributable to strength in the industrial segment; manufacturing-related construction spending surged 5.9% in January and is up by an astonishing 53.6% since January 2022."

Press Release from Associated Builders and Contractors: Nonresidential Construction Spending Inches Higher in January, Says ABC

WASHINGTON, March 1—National nonresidential construction spending increased by 0.3% in January, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $968.7 billion for the month.

Spending was down on a monthly basis in seven of the 16 nonresidential subcategories. Private nonresidential spending was up 0.9%, while public nonresidential construction spending was down 0.6% in January.

“Nonresidential construction spending inched higher to start the year and is just below the all-time high established in November,” said ABC Chief Economist Anirban Basu. “On a year-over-year basis, spending in the nonresidential sector continues to outpace inflation. That’s largely attributable to strength in the industrial segment; manufacturing-related construction spending surged 5.9% in January and is up by an astonishing 53.6% since January 2022. With the CHIPS and Science Act directing $280 billion into semiconductor manufacturing and an ongoing desire to reshore manufacturing capacity, the segment should continue to thrive.

“Excluding manufacturing-related construction, nonresidential spending actually declined in January,” said Basu. “A combination of headwinds, including severely elevated borrowing costs, ongoing labor shortages and still-high input costs are likely to blame. Despite these factors and a gloomy economic outlook, a majority of contractors continue to expect their sales to increase over the next six months, according to ABC’s Construction Confidence Index.”

Press Release from Associated General Contractors of America: Construction Spending Dips 0.1 Percent In January As Drop In Homebuilding And Public Construction Outweigh Private Nonresidential Gains

Construction Association Calls on Officials in Washington to Speed Up Issuance of Guidance on ‘Buy America’ Rules for Construction Materials and Energy Projects Eligible for Tax Credits

WASHINGTON, Mar. 1—Total construction spending decreased by 0.1 percent in January, as declines in single-family homebuilding and public construction offset marginal gains from private nonresidential construction, according to an analysis by the Associated General Contractors of America today of new federal data. Association officials said a lack of clear guidance from officials in Washington is delaying expenditures on much-needed infrastructure and energy projects.

“Laws enacted more than six months ago created unprecedented funding and tax credits for a wide range of transportation, environmental, energy and manufacturing projects,” said Ken Simonson, the association’s chief economist. “But few contractors have actually won contracts yet.”

Construction spending, not adjusted for inflation, totaled $1.826 trillion at a seasonally adjusted annual rate in January, 0.1 percent below the December rate, which was revised up from the initial estimate a month ago. Spending on private residential construction decreased for the eighth consecutive month in January, by 0.6 percent. Spending on private nonresidential construction increased 0.9 percent in January, while public construction investment declined 0.6 percent.

Spending varied among large nonresidential segments. The biggest component, manufacturing plants, increased 5.9 percent. Commercial construction—comprising warehouse, retail, and farm construction—decreased 3.1 percent in January. Highway and street construction decreased 1.0 percent. Spending on power construction rose 0.9 percent.

Among other categories that are expected to receive funding or tax credits under federal legislation, investment in transportation facilities rose 1.7 percent. Outlays for sewage and waste disposal construction declined 2.5 percent, while spending on water treatment infrastructure decreased 5.9 percent.

Residential spending shrank due to a 1.7 percent contraction from December in single-family homebuilding. That outweighed increases of 0.4 percent in multifamily construction and 0.3 percent in additions and renovations to owner-occupied houses.

Association officials expressed frustration that a lack of guidance on projects eligible for tax credits and incomplete or contradictory information about “Buy America” requirements have held up billions of dollars in project awards. They urged the Biden administration to finalize rules for awarding projects under the Infrastructure Investment and Jobs Act, which became law in 2021, and the Inflation Reduction Act, which was enacted in August of 2022.

“Contractors, developers, and state agencies have been hamstrung by the lack of clear or realistic guidance implementing under these laws,” said Stephen E. Sandherr, the association’s chief executive officer. “It is high time to put in place the rules that will enable these vitally needed projects to be built.”