Key Takeaways

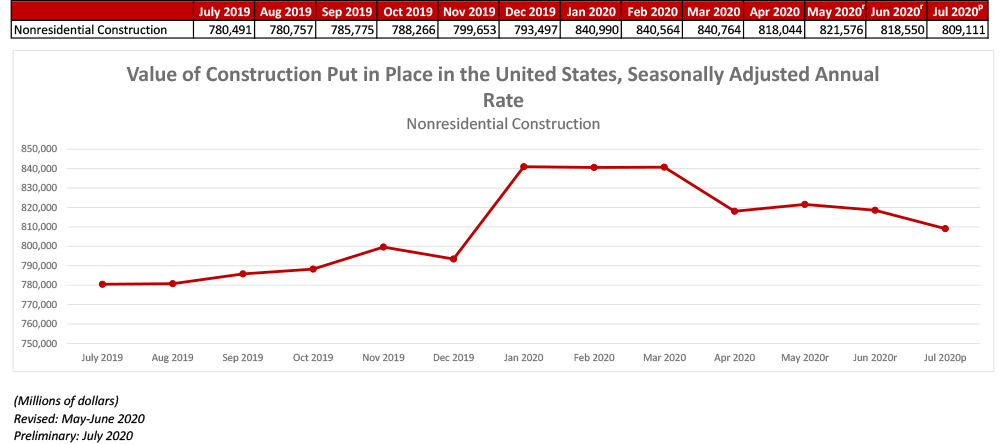

- National nonresidential construction spending decreased 0.1% in August.

- On a seasonally adjusted annualized basis, spending totaled $814.3 billion for the month.

- “The good news is that nonresidential construction spending momentum remains apparent in a number of public segments. On a monthly basis, construction spending was up in the water supply, highway/street and educational categories. Spending in the public safety segment is up nearly 40% compared to the same time last year."

Press Release from Associated Builders and Contractors, Inc.

WASHINGTON, Oct. 1—National nonresidential construction spending fell 0.1% in August, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, spending totaled $814.3 billion for the month.

Of the 16 nonresidential subcategories, nine were down on a monthly basis. Private nonresidential spending decreased 0.3% from July, while public nonresidential construction spending was up 0.2%. Nonresidential construction spending is down 0.7% compared to August 2019.

“While overall construction spending rose significantly in August, much of that was attributed to surging single-family housing starts,” said ABC Chief Economic Anirban Basu. “The picture is very different in a number of nonresidential construction categories, especially in segments that have been disproportionately impacted by the pandemic, such as lodging and office, which are down 12.1% and nearly 9% year over year, respectively.

“The good news is that nonresidential construction spending momentum remains apparent in a number of public segments,” said Basu. “On a monthly basis, construction spending was up in the water supply, highway/street and educational categories. Spending in the public safety segment is up nearly 40% compared to the same time last year.

“Absent an infrastructure-oriented stimulus package, the likely trajectory of nonresidential construction spending does not appear especially bright,” said Basu. “Commercial real estate fundamentals are poor, with elevated vacancy rates and tighter lending conditions, rendering it probable that private nonresidential construction spending will continue to dip. State and local finances have been pummeled by the pandemic, resulting in less support for the next generation of public projects. Many contractors report declining backlog, according to ABC’s Construction Backlog Indicator, and fewer opportunities to bid on new projects. With winter coming and infection rates poised to rise, the quarters to come are shaping up to be challenging ones.”

Press Release from Associated General Contractors of America (AGC)

Press Release from Associated General Contractors of America (AGC)

Construction Spending Rises 1.4 Percent In August As Residential Boom Outweighs Private Nonresidential Decline And Flat Public Categories

Construction Officials Caution that Demand for Non-Residential Construction Will Continue to Stagnate without New Federal Coronavirus Recovery Measures, Including Infrastructure and Liability Reform

Construction spending increased by 1.4 percent in August as strong gains in residential construction outweighed decreases in most private nonresidential segments and many public categories, according to an analysis by the Associated General Contractors of America of government data released today. Association officials cautioned that nonresidential construction demand will likely continue to stagnate without new federal measures to offset the economic impacts from the coronavirus.

“The August spending report shows a stark divide between housing and nonresidential markets that appears likely to widen over the coming months,” said Ken Simonson, the association’s chief economist. “With steadily rising business closures and worker layoffs, and growing budget gaps for state and local governments, project cancellations are likely to mount and new starts will dwindle.”

Construction spending in August totaled $1.41 trillion at a seasonally adjusted annual rate, an increase of 1.4 percent from July’s upwardly revised total. Residential spending jumped by 3.7 percent, while private and public nonresidential spending inched down by a combined 0.1 percent.

Private nonresidential construction spending contracted by 0.3 percent from July to August, with decreases in nine out of 11 categories. The two largest private nonresidential segments, power construction and commercial construction—comprising retail, warehouse and farm structures—each shrank by 1.1 percent. Among other large segments, manufacturing construction rose 2.2 percent and office construction slipped 0.3 percent.

Public construction spending edged up 0.1 percent in August but eight of 13 categories declined. Despite the increase in August, public construction spending has trended down by 2.5 percent from its high point in March.

Private residential construction spending increased by 3.7 percent in August, powered by a 5.5 percent jump in single-family homebuilding and a 3.0 percent gain in residential improvements. In contrast, new multifamily construction spending dipped by 0.1 percent from July.

Association officials noted that demand for nonresidential construction was being impacted by broader economic challenges brought about by the coronavirus. These challenges are impacting demand for many commercial projects while also impacting state and local construction budgets. The construction officials urged Congress and the White House to work together to enact new recovery measures to help boost economic activity and demand for construction.

“One of the biggest challenges facing the construction industry is the lack of demand for many new types of commercial and local infrastructure projects, especially after the current crop of projects is completed,” said Stephen E. Sandherr, the association’s chief executive officer. “Washington officials can give a needed boost to construction demand and employment by boosting infrastructure and putting in place liability protections for firms that are protecting workers from the coronavirus.”