Key Takeaways

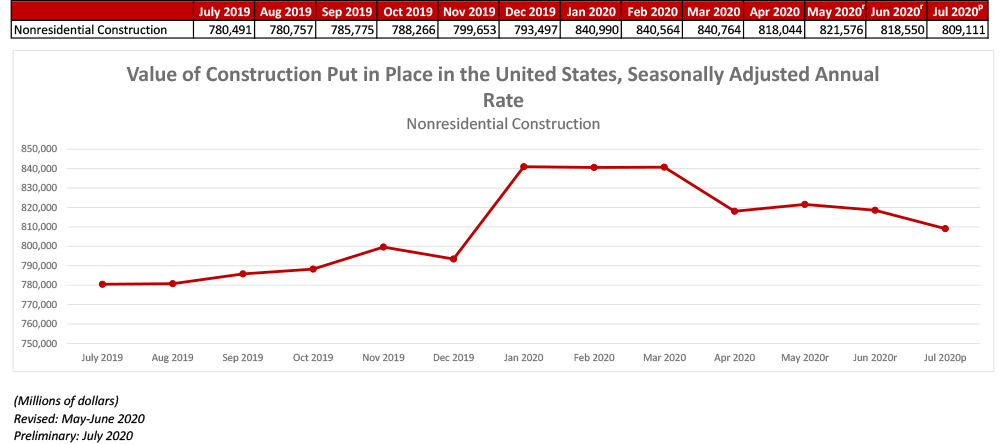

- National nonresidential construction spending decreased 1.2% in July.

- On a seasonally adjusted annualized basis, spending totaled $809.1 billion.

- "The wild card, as is often the case, is Congress. Another stimulus package could go a long way toward improving the trajectory of overall nonresidential construction spending, particularly one with a sizable infrastructure component. The upshot is that declines in nonresidential construction spending are likely even in the context of broader economic recovery."

Press Release from Associated Builders and Contractors, Inc.

WASHINGTON, Sept. 1—National nonresidential construction spending fell 1.2% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, spending totaled $809.1 billion for the month.

Of the 16 nonresidential subcategories, 10 were down on a monthly basis. Private nonresidential spending declined 1.0% while public nonresidential construction spending was down 1.3% in July.

“There are two primary countervailing forces influencing the trajectory of nonresidential construction spending,” said Basu. “The first is a force for good and involves the reopening of the economy and associated rebound in overall economic activity. Despite the lingering pandemic, third quarter GDP growth is likely to be quite strong. All things being equal, this would tend to strengthen business for contractors.

“However, the second force at work is not benign and appears to be the stronger of the two,” said Basu. “The crisis has resulted in tighter project financing conditions, battered state and local government finances, substantial commercial vacancy and uncertainty regarding the future of key segments, such as office and lodging. And while backlog was strong at the start of the year, contractors indicate that it is now declining rapidly, in part due to abundant project cancellations.”

“Next year is shaping up to be an especially harsh one for many contractors, especially as some are already indicating that they are nearing the end of their backlog,” said Basu. “The wild card, as is often the case, is Congress. Another stimulus package could go a long way toward improving the trajectory of overall nonresidential construction spending, particularly one with a sizable infrastructure component. The upshot is that declines in nonresidential construction spending are likely even in the context of broader economic recovery.”

Press Release from Associated General Contractors of America

Public And Private Nonresidential Construction Spending Slump In July As Industry Employment Declines From July 2019 In Two-thirds Of Metros

New York City, Brockton-Bridgewater-Easton, Mass. Have Worst Job Losses, While Walla Walla, Wash. and Baltimore-Columbia-Towson, Md. Post Largest Year-over-Year Construction Employment Increases

Steep monthly declines in public and private nonresidential construction spending offset a surge in homebuilding in July, while industry employment decreased compared to July 2019 levels in two-thirds of the nation’s metro areas, according to an analysis by the Associated General Contractors of America of government data released today. Association officials said many commercial construction firms were likely to continue shedding jobs without needed federal coronavirus relief measures.

“The dichotomy between slumping nonresidential projects—both public and private—and robust homebuilding seems sure to widen as the pandemic continues to devastate state and local finances and much of the private sector,” said Ken Simonson, the association’s chief economist. “Without new federal investments in infrastructure and other measures to boost demand for nonresidential construction, contractors will be forced to let more workers go.”

Construction spending in July totaled $1.36 trillion at a seasonally adjusted annual rate, a gain of 0.1 percent from June. A 1.2 percent drop in nonresidential spending nearly canceled out a 2.1 percent jump in residential spending, which was boosted by growth in both single-family (3.1 percent) and multifamily construction (4.9 percent).

Public construction spending decreased by 1.3 percent, dragged down by a 3.1 percent drop in highway and street construction spending and a 3.0 percent decline in educational construction spending, the two largest public segments. The next-largest segment, transportation facilities, also contracted, by 1.6 percent.

Private nonresidential construction spending slid 1.0 percent from June to July. The largest segment, power construction, dipped 0.1 percent. Among other large private spending categories, commercial construction—comprising retail, warehouse and farm structures—slumped 3.2 percent, while manufacturing construction rose 0.2 percent and office construction fell 0.7 percent.

Construction employment declined from July 2019 to July 2020 in 238, or 66 percent, out of 358 metro areas, increased in 90 areas (25 percent) and held steady in 30. New York City lost the most construction jobs (-26,500, -16 percent), while the steepest percentage loss occurred in Brockton-Bridgewater-Easton, Mass. (-36 percent, -2,100 jobs). Baltimore-Columbia-Towson, Md. added the most construction jobs over the year (4,800, 6 percent), while Walla Walla, Wash. had the largest percentage gain (25 percent, 300 jobs).

Association officials said that in addition to the new spending and metro employment data, the association is releasing the results of its annual workforce survey tomorrow that will underscore the need for new federal recovery measures. The construction officials called on Congress and the Trump administration to enact new infrastructure investments, pass a one-year extension to the current surface transportation law with additional transportation construction funding and enact liability reforms to shied firms that are protecting workers from the coronavirus from needless lawsuits.

“Without new federal relief measures, the industry’s limited recovery will likely be short lived,” said Stephen E. Sandherr, the association’s chief executive officer. “Congress and the President should be taking advantage of current market conditions to rebuild our infrastructure, restore lost jobs and reinvigorate the economy.”