Key Takeaways

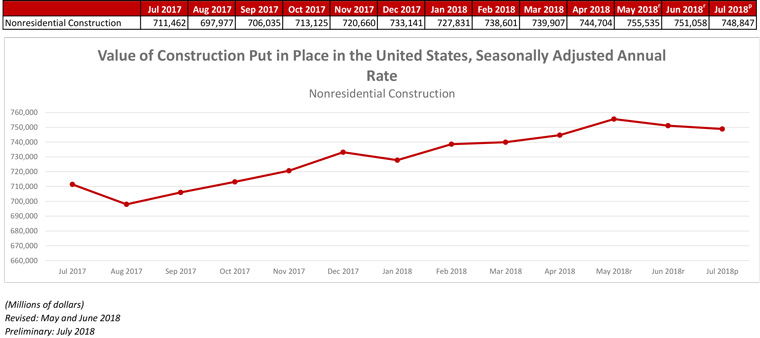

- Nonresidential construction spending, which totaled $748.8 billion on a seasonally adjusted annual rate for July, is down 0.3% from June, but up 5.3% from the same time last year.

- Private nonresidential spending fell again July (1%), while public nonresidential spending expanded 0.7%.

- Associated General Contractors of America officials said sustained growth will depend in part on contractors’ ability to find increasingly scarce craft workers and urged public officials to step up support for career and technical education to prepare more students for construction careers.

- “The implication is that the economy’s strong performance is increasingly translating into infrastructure spending, even in the absence of a federal infrastructure package. Given recent economic and financial market performance, there is every reason to believe that state and local government finances, though still fragile in many instances, will continue to improve. That strongly suggests public construction spending will continue to progress during the months ahead. "

Press Release from Associated Builders and Contractors, Inc (ABC)

WASHINGTON, Sept. 4—National nonresidential construction spending declined 0.3 percent in July, according to an Associated Builders and Contractors analysis of U.S. Census Bureau data released today. Total nonresidential spending stood at $748.8 billion on a seasonally adjusted, annualized rate in July, an increase of 5.3 percent from the same time last year. Private nonresidential spending fell 1 percent in July, while public nonresidential spending expanded 0.7 percent.

“Construction spending dynamics have reversed almost completely during the past 12 to 18 months,” said ABC Chief Economist Anirban Basu. “Earlier in the cycle, private construction expanded briskly, driven in part by abundantly available financing at very low interest rates. While private construction volumes continue to be elevated, they are no longer expanding at quite the same rate. For instance, construction spending on lodging and office space barely budged for the month, while commercial construction, such as fulfillment and shopping centers, fell 3.3 percent.

“By contrast, nonresidential construction segments associated with large public components, including conservation and development, education, highway and street, public safety, and sewage and waste disposal all experienced an uptick in spending in July,” said Basu. “Many states are now running budget surpluses for the first time in years, in part due to surging capital gains tax collections. One result is that more public projects are moving forward. As evidence, construction spending in the water supply category is up 29 percent on a year-over-year basis, conservation and development (e.g. flood control) by 24 percent, transportation by nearly 21 percent, public safety-related spending by 17 percent and sewage and waste disposal by 11 percent."

“The implication is that the economy’s strong performance is increasingly translating into infrastructure spending, even in the absence of a federal infrastructure package,” said Basu. “Given recent economic and financial market performance, there is every reason to believe that state and local government finances, though still fragile in many instances, will continue to improve. That strongly suggests public construction spending will continue to progress during the months ahead. In contrast, private construction spending growth is more likely to remain constrained for a number of reasons, including recent increases in private borrowing costs and concerns that segments in certain communities are now overbuilt or approaching overbuilt status.”

Press Release from Associated General Contractors of America

Construction Spending Extends Year-to-Date Gains in July in Most Public and Private Segments Even as Contractors Struggle to Find Craft Workers

Latest Spending Figures Show Spending Growth Is Widespread yet Not Overheated but Worker Shortages Could Undermine Future Growth According to New Survey; Association Proposes Workforce Solutions

Construction spending increased 0.1 percent from June to July and 5.2 percent for seven months of 2018 combined, with year-to-date growth for most major public and private categories, according to an analysis of new government data by the Associated General Contractors of America. Association officials said sustained growth will depend in part on contractors’ ability to find increasingly scarce craft workers and urged public officials to step up support for career and technical education to prepare more students for construction careers.

“It is striking how balanced the growth in construction spending has been so far this year,” said Ken Simonson, the association’s chief economist. “Spending totals for the first seven months of 2018 combined nearly match those for the same period of 2017. Contractors are optimistic that demand for projects will continue but many report that workforce shortages are leading to longer construction schedules and higher costs.”

Spending year-to-date through the first seven months of 2018 was 5.4 percent higher than in January through July 2017 for public construction and 5.2 percent for private construction, the economist pointed out. Within private construction, there were increases of 7.7 percent for residential projects and 2.2 percent for nonresidential.

Most major segments had gains, Simonson observed. The largest public categories recorded year-to-date gains of 3.6 percent for highway construction, 0.6 percent for educational construction and 14.0 percent for transportation construction. Of the three private residential spending categories, single-family homebuilding rose 8.5 percent, multifamily dipped 0.9 percent and improvements to existing building climbed 9.4 percent. Among private nonresidential spending niches, the largest—power construction (including oil and gas field and pipeline structures)—edged up 0.4 percent, commercial (retail, warehouse and farm) construction rose 4.7 percent, office construction increased 5.8 percent and manufacturing construction declined 7.2 percent.

“In the latest Autodesk-AGC of America Workforce Survey, firms overwhelmingly plan to hire more workers, but 80 percent of firms report difficulty filling hourly craft positions, leading to longer completion times for projects.” Simonson added. “This trend could drag down further gains in spending.”

Association officials said their new Workforce Development Plan lays out ways that federal, state and local officials can work with contractors to provide greater opportunities for students to gain skills needed for construction careers and to enable contractors to partner with schools, colleges and workforce training agencies. Construction offers excellent pay and advancement opportunities, Stephen E. Sandherr, the association’s chief executive officer, noted. He pointed out that Labor Department data for July showed hourly earnings in the construction industry averaged $29.86, or 10 percent more than for the private nonfarm sector as a whole.

“Construction careers offer good wages, tremendous pride in accomplishments and the kind of upward mobility many ambitious workers are seeking,” Sandherr said. “Public officials can and should do more to encourage students to explore high-paying construction career opportunities.”

Reporting from Reuters:

U.S. construction spending rises slightly in July

WASHINGTON, Sept 4 (Reuters) - U.S. construction spending barely rose in July as increases in homebuilding and investment in public projects were overshadowed by a sharp drop in private nonresidential outlays.

The Commerce Department said on Tuesday that construction spending edged up 0.1 percent. Data for June was revised up to show construction outlays declining 0.8 percent instead of the previously reported 1.1 percent drop.

Economists polled by Reuters had forecast construction spending increasing 0.5 percent in July. Construction spending increased 5.8 percent on a year-on-year basis.

Spending on private residential projects rebounded 0.6 percent in July following two straight months of declines.

While homebuilding rose in July, the overall trend has slowed, with builders continuing to complain about rising material costs as well as persistent land and labor shortages. Residential investment contracted in the first half of the year.

Spending on private nonresidential structures, which includes manufacturing and power plants, dropped 1.0 percent in July. That was the biggest decline since August 2017 and followed a 0.1 percent gain in June.

Overall, spending on private construction projects slipped 0.1 percent in July after decreasing 0.5 percent in June.

Investment in public construction projects increased 0.7 percent after tumbling 1.7 percent in June. Spending on federal government construction projects rebounded 2.5 percent. That followed a 3.0 percent drop in June.

State and local government construction outlays advanced 0.6 percent in July after falling 1.6 percent in the prior month.