Key Takeaways

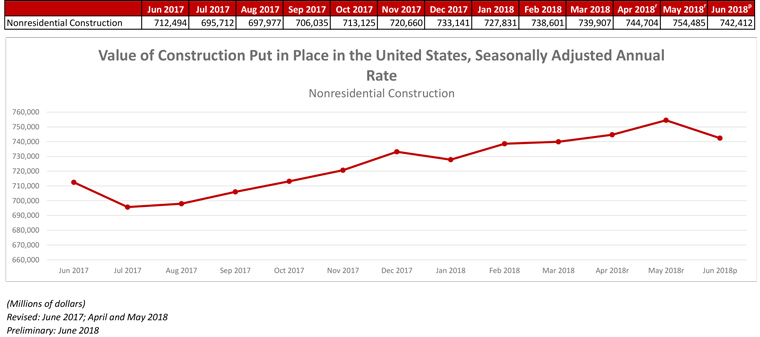

- Nonresidential construction spending, which totaled $742 billion on a seasonally adjusted annual rate for June, is down 1.6% from May.

- Private nonresidential spending fell 0.3% in June, while public nonresidential spending contracted by 3.5%.

- “Tax and regulatory reform are helping stimulate new demand for construction projects. But if contractors are forced to raise prices significantly to cope with rising labor and materials costs, many public and private sector clients may scale back investments in new construction projects.”

- "Since monthly construction spending declines were apparent in both private and public segments, it is also possible that certain projects have been put on hold, with the hope that input prices will eventually decline to lower levels.”

Press Release from Associated Builders and Contractors, Inc.

WASHINGTON, Aug. 1—Nonresidential construction spending contracted 1.6 percent on a monthly basis in June, according to an Associated Builders and Contractors analysis of U.S. Census Bureau data released today. Spending totaled $742.4 billion on a seasonally adjusted annual rate for the month, a 4.2 percent increase from the same time one year ago. Private nonresidential spending fell 0.3 percent in June, while public nonresidential spending contracted by 3.5 percent.

“The hope is that June’s construction spending setback is merely a statistical aberration,” said ABC Chief Economist Anirban Basu. “That is certainly a possibility given the recent second quarter gross domestic product report, which among other things indicated extraordinarily rapid growth in the construction of structures. Other data, including ABC’s Construction Backlog Indicator, indicate ongoing elevated levels of demand for construction services. Construction employment statistics are also consistent with industry expansion.

“But as tempting as it is to simply relegate June spending data to the back burner, there are other less benign explanations,” said Basu. “One relates to worker productivity. With construction firms suffering grave difficulty finding skilled workers, it may simply be a case of slowed construction service delivery. However, this is not an especially compelling explanation for one month of data. The shortage of human capital is long-lived, and the recent pace of construction hiring has been rapid.

“A more likely explanation is that the recent surge in construction materials prices is resulting in material acquisition delays,” said Basu. “This has the effect of lengthening projects as contractors painstakingly search for the most affordable sources of steel, lumber or other inputs. Since monthly construction spending declines were apparent in both private and public segments, it is also possible that certain projects have been put on hold, with the hope that input prices will eventually decline to lower levels.”

Press Release from Associated General Contractors of America

Construction Spending Retreats in June from Record High in May but Shows Continued Strength Across Most Public and Private Investment Categories

Latest Spending Figures Show Benefits of Recent Tax and Regulatory Reform Measures, But Construction Officials Caution that Labor Shortages and Trade Tariffs Could Weigh on Future Growth in Demand

Construction spending declined 1.1 percent in June from an upwardly revised record level in May, but there were widespread gains in both public and private investment for the first half of the year, according to an analysis of new government data by the Associated General Contractors of America. Association officials said the relatively strong construction spending figures show how recent tax and regulatory reforms are helping boost demand for construction.

“There appears to be plenty of demand for construction despite the drop in spending reported for June,” said Ken Simonson, the association’s chief economist. “The estimate for May, which was already a record high, was revised sharply upward, as were numbers for April. These revisions show that the June total may be higher than initially reported and that it is wiser to focus on longer-term trends, such as the year-to-date totals for the first half of 2018 compared with the same period in 2017. Those numbers show a healthy increase in spending.”

Despite the decline from May, construction spending in the first six months of 2018 combined was 5.1 percent higher than in January through June 2017, the economist pointed out. For the month, public construction spending slumped 3.5 percent, private residential spending decreased 0.5 percent, and private nonresidential construction spending slipped 0.3 percent. On a year-to-date basis, in contrast, public construction spending climbed 4.7 percent, private residential spending grew 8.3 percent, and private nonresidential construction spending edged up 1.8 percent.

Among public infrastructure spending categories, the largest segment—highway and street construction--increased 4.2 percent year-to-date. Educational construction inched up 0.1 percent in the first half of the year, while transportation construction (airports, transit, public rail and ports) jumped 11.7 percent.

The largest private category, single-family homebuilding, increased 9.0 percent year-to-date, while multifamily construction spending dipped 0.7 percent, Simonson noted. The largest private nonresidential category—power construction spending (including oil and gas field and pipeline structures)—declined 0.8 percent year-to-date, but the next largest segment—commercial construction (comprising retail, warehouse and farm buildings) had a gain of 4.8 percent. Private office construction spending grew by 5.6 percent year-to-date, while manufacturing construction spending jumped shrank 8.5 percent.

Association officials said recent steps to reform the federal tax code and reduce regulatory barriers to economic growth appear to be helping boost demand for construction. But they cautioned that growing construction labor shortages and new trade tariffs affecting the price of key construction materials could hamper future sector growth.

“Tax and regulatory reform are helping stimulate new demand for construction projects.” Sandherr said. “But if contractors are forced to raise prices significantly to cope with rising labor and materials costs, many public and private sector clients may scale back investments in new construction projects.”

Reporting from CNBC:

Construction spending posts biggest drop in over a year; factory activity slows

U.S. construction spending recorded its biggest drop in more than a year in June as investment in both private and public projects fell, but spending for the prior months was revised sharply higher.

U.S. construction spending recorded its biggest drop in more than a year in June as investment in both private and public projects fell, but spending for the prior months was revised sharply higher.

The Commerce Department said on Wednesday that construction spending fell 1.1 percent, the largest decline since April 2017. Data for May was revised up to show construction outlays rising 1.3 percent instead of the previously reported 0.4 percent gain. April's outlays increased 1.7 percent instead of the previously estimated 0.9 percent.

Economists polled by Reuters had forecast that construction spending would advance 0.3 percent in June. Construction spending accelerated 6.1 percent on a year-on-year basis.

Economists are forecasting that construction spending will contribute to overall growth this year even though interest rates are rising. A lack of inventory has stymied homebuyers and pushed home prices higher as demand for existing and new homes has surged.

Spending on private residential projects fell 0.5 percent in June following a 1.3 percent increase in May. Homebuilding has been slowing, with builders citing rising material costs as well as persistent land and labor shortages. Residential investment contracted in the first half of the year.

Spending on private nonresidential structures slipped 0.3 percent in June after gaining 0.2 percent in the prior month. Overall, outlays on private construction projects fell 0.4 percent in June after increasing 0.9 percent in May.

Investment in public construction projects tumbled 3.5 percent, the biggest drop since March 2013, after surging 3.0 percent in May. Spending on federal government construction projects declined 3.1 percent. That followed a 0.9 percent increase in May.

State and local government construction outlays plunged 3.5 percent in June, also the largest drop since March 2013, after jumping 3.1 percent in the prior month.