Key Takeaways

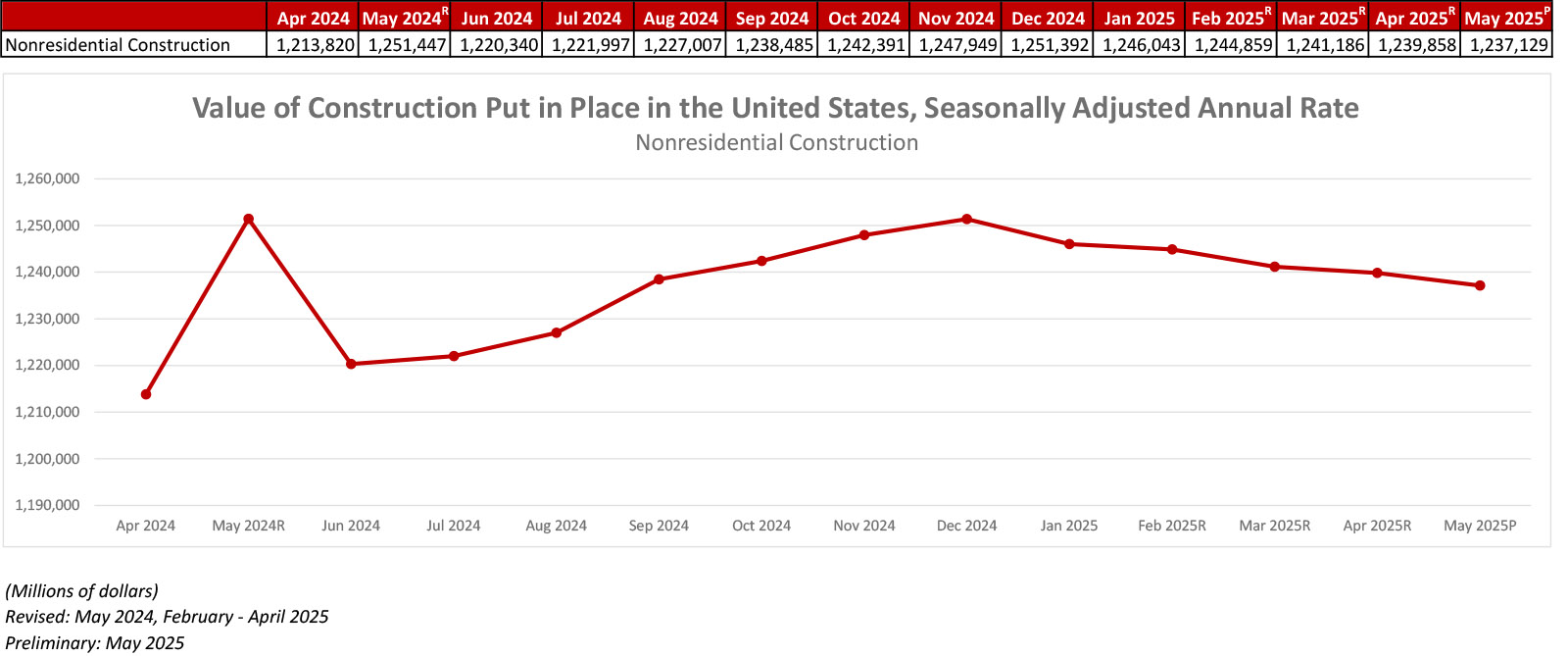

- National nonresidential construction spending decreased 0.2% in May.

- On a seasonally adjusted annualized basis, nonresidential spending totaled $1.237 trillion for the month.

- "Given the many headwinds at play, including high interest rates, tight lending standards, elevated uncertainty and the effects of immigration and trade policy on labor and materials costs, spending may struggle to rebound during the second half of the year."

Press Release from Associated Builders and Contractors: Nonresidential Construction Spending Down 0.2% in May, Says ABC

WASHINGTON, July 1—National nonresidential construction spending decreased 0.2% in May, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.237 trillion.

Spending was down on a monthly basis in half of the nonresidential subcategories. Private nonresidential spending was down 0.4%, while public nonresidential construction spending was practically unchanged in May.

“Nonresidential construction spending declined for the fourth straight month in May,” said ABC Chief Economist Anirban Basu. “Private sector nonresidential activity remains particularly weak and is down nearly 7% from its January 2023 peak. Manufacturing investment, which increased by more than 200% in recent years, has begun to fall and is now down by more than 5% since its August 2024 peak. With the exception of data centers, on which spending increased another 1% in May, there are few categories with momentum.

“This decline in nonresidential activity was reflected in ABC’s Construction Backlog Indicator, which fell sharply in May,” said Basu. “Given the many headwinds at play, including high interest rates, tight lending standards, elevated uncertainty and the effects of immigration and trade policy on labor and materials costs, spending may struggle to rebound during the second half of the year.”

Press Release from Associated General Contractors of America: Construction Spending Decreases By 0.3 Percent From April To May And 3.5 Percent Over 12 Months, Marking Largest Yearly Drop Since 2019

Public Sector Gains Offset by Continued Declines in Private Sector Construction Activity as Uncertainty about Tariffs, Taxes, and Labor Policy Prompt Developers to Reconsider or Delay Projects

Construction spending fell for the fourth month in a row in May, declining 0.3 percent from April and 3.5 percent from a year earlier, the largest year-over-year decrease since February 2019, according to an analysis by the Associated General Contractors of America of a new government report. Association officials noted that growing uncertainty about potential new tariffs, labor policy and tax rates are prompting many private sector developers to delay or cancel planned projects.

“Uncertainty about tariffs, tax rates and labor availability are making it hard for many developers to risk moving forward with planned construction projects,” said, Ken Simonson, chief economist of the Associated General Contractors of America. “While public sector demand remains solid, it just isn’t enough to offset the private sector pullbacks in activity.”

Spending totaled $2.14 trillion at a seasonally adjusted annual rate in May, 0.3 percent below a downwardly revised April rate and 3.5 percent less than in May 2024. The decline followed decreases of 0.2 percent in April and 0.7 percent in March.

Private nonresidential construction declined by 0.4 percent for the month, with a year-over-year decrease of 3.9 percent—marking the ninth consecutive annual decline in the category. Spending on the largest private segment, manufacturing plants slipped 0.1 percent in May. Private power construction spending fell 0.6 percent. Commercial construction—warehouse, retail, and farm projects, declined 0.8 percent.

Private residential construction slid 0.5 percent for the month and 6.7 percent from May 2024. Single-family homebuilding slumped 1.8 percent while spending on improvements to owner-occupied homes grew 0.9 percent. Multifamily construction was flat for the month.

Public construction increases softened the overall decline. Public spending inched up 0.1 percent from April and 3.3 percent from May 2024. Of the three largest public construction categories, highway and street construction fell 0.3 percent in May, spending on educational structures increased 0.1 percent, and spending on transportation facilities rose 0.6 percent.

Association officials urged Congress and the Trump administration to help eliminate the market uncertainties that are prompting the private sector pullback. This includes passing legislation to avoid a large tax increase on construction firms and other sectors of the economy. And it includes resolving the trade disputes that are prompting the proposed tariffs. And they called for new investments in construction education and training and more ways for people to enter the country lawfully to work in construction.

“The more certainty there is in the market, the more likely private sector developers will greenlight planned construction projects,” said Jeffrey D. Shoaf, the association’s chief executive officer. “Washington officials can help provide that certainty by setting clear tax rates, resolving trade disputes and addressing significant construction labor shortages.”