Key Takeaways

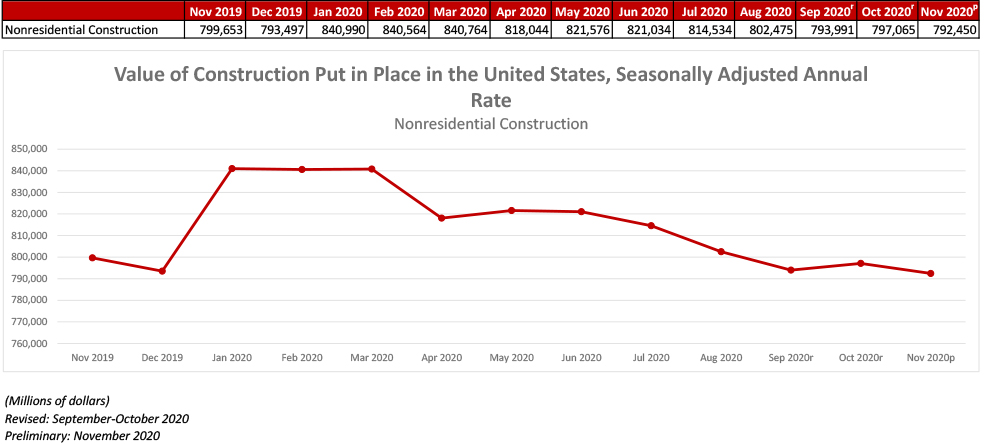

- National nonresidential construction spending fell 0.6% in November 2020.

- On a seasonally adjusted annualized basis, spending totaled $792.5 billion for the month.

- AGC urges the incoming Congress to act quickly to boost investments in infrastructure and pass liability reforms to protect firms that employ necessary safety protocols to protect their workers and the public from meritless coronavirus lawsuits. “Without additional measures to boost demand for nonresidential construction, this year is likely to be a challenging one for the industry,” said Stephen E. Sandherr, the association’s chief executive officer. “The impacts of the pandemic are clearly accumulating for many construction employers.”

Press Release from Associated Builders and Contractors, Inc.

WASHINGTON, Jan. 4—National nonresidential construction spending fell 0.6% in November 2020, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, spending totaled $792.5 billion for the month.

Ten of the sixteen nonresidential subcategories saw decreased spending on a monthly basis. Private nonresidential spending fell 0.8%, while public nonresidential spending fell 0.2% in November.

“Typically, spending patterns in nonresidential construction lag behind those of the overall economy by 12 to 18 months,” said ABC Chief Economist Anirban Basu. “But the pandemic-induced downturn of 2020 was so abrupt and created such massive issues for developers, state and local governments, and others who purchase construction services that the impact on nonresidential construction was virtually immediate. As a result, private nonresidential construction spending is down 9.5% since November 2019.

“The single hardest hit segment of the industry is lodging, a category in which construction spending declined more than 8% in a single month and 27% since the same time last year,” said Basu. “While leisure travel is likely to rebound as more Americans are vaccinated, business travel may take years to recover. This bodes poorly for the construction of hotels with elaborate meeting spaces located in central business districts or close to airports.

“The near-term nonresidential construction spending outlook is generally not positive,” said Basu. “While there will be certain construction segments that remain active, including data centers, fulfillment centers and certain healthcare facilities, commercial construction is positioned to be weak for the next several quarters. This is reflected in ABC’s Construction Backlog Indicator, which in November reached its lowest level since the beginning of 2011."

“Many public segments have also experienced declines in spending in recent months,” said Basu. “The good news is that public construction may receive a substantial boost from post-inauguration stimulus. Infrastructure investment often produces additional opportunities for profitable private development. Suburban commercial developers may also take heart in America’s ongoing residential construction boom, with residential construction spending up more than 16% on a year-over-year basis, as interest in homeownership surges.”

Press Release from Associated General Contractors of America (AGC)

Nonresidential Construction Spending Shrinks Further In November As Many Commercial Projects Languish, Even While Homebuilding Soars

Association Urges Quick Action on Infrastructure Funding and Protection from Meritless Lawsuits; Industry Survey Finds Widespread Pessimism about Volume of Projects Available to Bid on in 2021

Construction spending was a tale of two industries again in November, as soaring single-family construction masked ongoing downturns in private and public nonresidential construction, according to an analysis of new federal construction spending data by the Associated General Contractors of America. Association officials said the new figures underscore the need for new infrastructure investments and other measures to boost demand for nonresidential construction amid the pandemic.

“Private nonresidential construction declined for the fifth-straight month in November, while public nonresidential spending slipped for the fifth time in the past six months,” said Ken Simonson, the association’s chief economist. “Unfortunately, our latest survey finds contractors expect the volume of projects available to bid on in 2021 will be even more meager.”

Construction spending in November totaled $1.46 trillion at a seasonally adjusted annual rate, an increase of 0.9 percent from the pace in October and 3.8 percent higher than in November 2019. But the gains were limited to residential construction, which soared 2.6 percent for the month and 16.2 percent year-over-year. Meanwhile, private and public nonresidential spending slumped 0.6 percent from October and 4.7 percent from a year earlier.

Private nonresidential construction spending decreased for the fifth month in a row, sliding 0.8 percent from October to November and 9.5 percent from November 2019. The largest private nonresidential segment, power construction, declined 0.9 percent for the month. Among the other large private nonresidential project types, commercial construction—comprising retail, warehouse and farm structures—dipped 0.3 percent for the month, manufacturing construction inched up 0.1 percent, office construction gained 0.3 percent, and healthcare construction fell 1.4 percent.

Public construction spending declined 0.2 percent for the month but increased 3.1 percent year-over-year. There were decreases from October to November for most nonresidential categories, although the two largest segments rose: highway and street construction gained 1.8 percent for the month, while educational construction increased 0.3 percent.

Private residential construction spending increased for the sixth consecutive month, rising 2.7 percent in November. Single-family homebuilding jumped 5.1 percent for the month, while residential improvements spending ticked up 0.2 percent. Multifamily construction spending was flat.

Association officials said demand for most types of nonresidential construction was likely to remain down for much of the year. They added that they would have more insights on the state of the industry when the association and Sage release their annual Construction Hiring & Business Outlook on Thursday, January 7. In the meantime, they urged the incoming Congress to act quickly to boost investments in infrastructure and pass liability reforms to protect firms that employ necessary safety protocols to protect their workers and the public from meritless coronavirus lawsuits.

“Without additional measures to boost demand for nonresidential construction, this year is likely to be a challenging one for the industry,” said Stephen E. Sandherr, the association’s chief executive officer. “The impacts of the pandemic are clearly accumulating for many construction employers.”