Key Takeaways

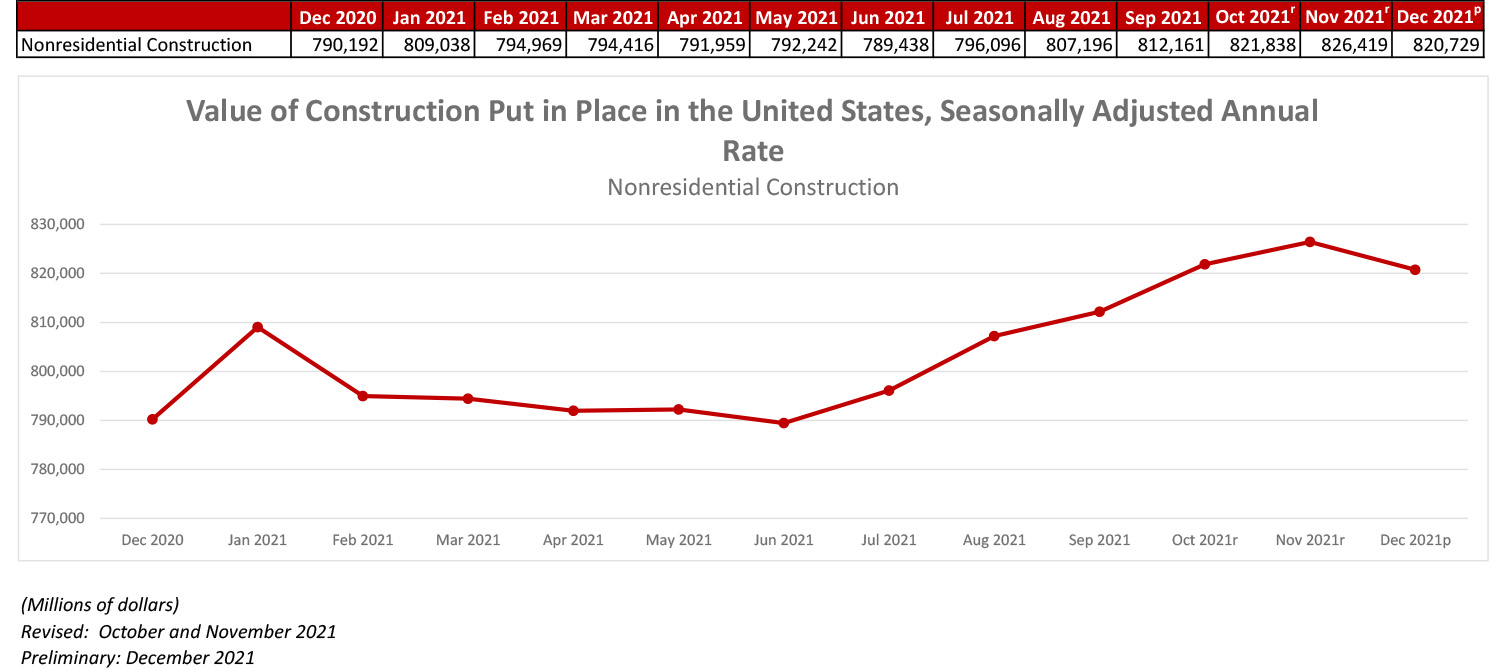

- National nonresidential construction spending fell 0.7% in December 2021.

- On a seasonally adjusted annualized basis, nonresidential spending totaled $820.7 billion for the month.

- "Public construction was responsible for much of the weakness in December. The expectation among many is that, as infrastructure monies begin to flow, the second half of the year will be better than the first"

Press Release from Associated Builders and Contractors, Inc.

WASHINGTON, Feb. 1—National nonresidential construction spending fell 0.7% in December 2021, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $820.7 billion for the month.

Spending was down on a monthly basis in 11 of the 16 nonresidential subcategories. Private nonresidential spending was virtually unchanged, but public nonresidential construction spending declined 1.6% in December. Overall nonresidential construction spending was up 3.9% from a year ago. Residential construction spending rose 14.7% over that timespan.

“Much of the increase in nonresidential construction spending is attributable to inflationary pressures, not actual increases in physical output,” said ABC Chief Economist Anirban Basu. “The fact that nonresidential spending was down in December despite rising labor costs and elevated materials prices does not bode well for near-term profitability.

“A few segments continue to create a disproportionate share of contractor opportunities,” said Basu. “Among those are the commercial segment, which includes construction of fulfillment centers and manufacturing, a segment in which construction spending has expanded more than 30% during the past year. Residential construction also continues to be a hot spot in an environment characterized by scant inventory of unsold homes and rapidly rising rents, and the strength of multifamily construction is arguably one of the most surprising aspects of the economic recovery. Overall, contractors remain confident about the next six months, according to ABC’s Construction Confidence Index.

“Public construction was responsible for much of the weakness in December,” said Basu. “The expectation among many is that, as infrastructure monies begin to flow, the second half of the year will be better than the first. It is possible that infrastructure dollars will not begin to forcefully affect the marketplace until 2023. Time will tell.”

Construction Spending Increased In December For The Month And Year, But Nonresidential And Public Construction Lagged Residential Sector

Association Officials Note Congress Has Yet to Appropriate the Increases in Infrastructure Funding Outlined in the Bipartisan Infrastructure Bill, Urge Swift Action to Rebuild Aging Infrastructure

Press release from Associated General Contractors of America

Construction spending increased in December compared to both November and a year ago thanks to growing demand for residential construction, according to an analysis of federal spending data the Associated General Contractors of America released today. Association officials noted, however, that spending on private nonresidential construction was flat for the month and down compared to a year ago while public sector construction spending fell for both the month and the year.

“Demand for new housing remains strong, while demand for nonresidential projects has been variable and most types of public sector investments in construction are declining,” said Ken Simonson, the association’s chief economist. “Contractors coping with rising materials prices and labor shortages are also dealing with the consequences of a nonresidential market that is, at best, uneven.”

Construction spending in December totaled $1.64 trillion at a seasonally adjusted annual rate, 0.2 percent above the November rate and 9.0 percent higher than in December 2020. Full-year spending for 2021 increased 8.2 percent compared to 2020.

Private residential construction spending rose 0.7 percent in December from a month prior and 12.7 percent from December 2020. For 2021 as a whole, residential construction spending jumped 23.2 percent from 2020, with gains of 32.8 percent for single-family spending and 15.6 percent for multifamily spending.

Private nonresidential construction spending was nearly unchanged from November to December but increased 9.1 percent from December 2020. For all of 2021, private nonresidential spending slipped 2.3 percent from 2020. The largest private nonresidential segment, power construction, rose 0.1 percent for the month and 4.9 percent year-over-year. Among other large segments, commercial construction--comprising warehouse, retail, and farm structures--inched up 0.1 percent in December and jumped 18.4 percent year-over-year, driven by surging demand for distribution facilities. Manufacturing construction spending fell by 1.9 percent in December, after 11 consecutive months of growth, but posted a 30.4 percent gain above its year-earlier level.

Public construction declined 1.6 percent in December, with decreases in 11 of the 12 categories, and 2.9 percent year-over-year. For 2021 as a whole, public construction fell 4.2 percent from 2020. Highway and street construction increased 0.1 percent from November and rose 0.9 percent compared to December 2020. Educational construction slipped 1.4 percent for the month and skidded 8.5 percent year-over-year. Transportation construction spending fell 3.0 percent in December and 6.3 percent year-over year.

Association officials said one reason for the declines in public sector construction spending is that Congress has yet to appropriate most of the additional funds authorized in the Bipartisan Infrastructure Bill signed by President Biden last year. They urged Congress to quickly make those new funds available so state and local officials can make the investments needed to improve the nation’s aging infrastructure.

“The Bipartisan Infrastructure Package’s immediate promise is not being met because Congress has yet to appropriate much of the increased funding,” said Stephen E. Sandherr, the association’s chief executive officer. “It is time to improve our infrastructure and protect those who rely on it.”