Key Takeaways

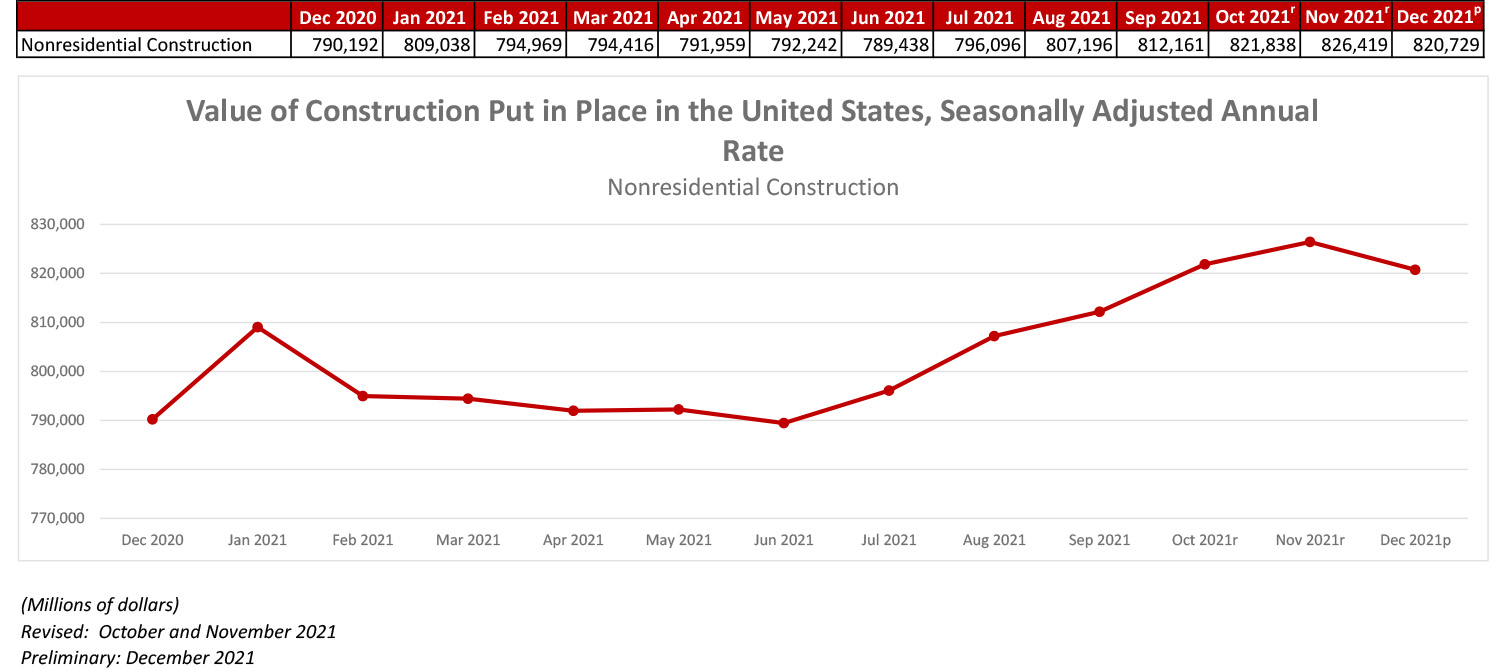

- National nonresidential construction spending up 1.3% in January 2022.

- On a seasonally adjusted annualized basis, nonresidential spending totaled $838.9 billion for the month.

- "Total construction spending is up more than 8% from last year, but materials prices are up approximately 24% over that span. Worker compensation costs have also been rising rapidly. As a result, contractor profit margin expectations have worsened in recent months, according to ABC’s Construction Confidence Index."

Press Release from Associated Builders and Contractors, Inc.

WASHINGTON, March 1— National nonresidential construction spending was up 1.3% in January, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $838.9 billion for the month.

Spending was up on a monthly basis in nine of the 16 nonresidential subcategories. Private nonresidential spending increased by 1.8%, while public nonresidential construction spending rose 0.5% in January.

“Normally, one would look at headline numbers indicating that construction investment rose in America as a reason to cheer,” said ABC Chief Economist Anirban Basu. “But the construction spending data are not adjusted for inflation, and in real terms, construction spending was likely down for the month. Total construction spending is up more than 8% from last year, but materials prices are up approximately 24% over that span. Worker compensation costs have also been rising rapidly. As a result, contractor profit margin expectations have worsened in recent months, according to ABC’s Construction Confidence Index.

“Circumstances are worse in the nonresidential construction segment,” said Basu. “While construction spending is up 13% in the industry’s residential component, nonresidential spending is up less than 4% year-over-year. In certain categories, spending is down in both real and nominal terms. The fading of pandemic-related construction spending has produced a decline of 35% in the public safety segment. Financial impacts on the education sector stemming from the pandemic have resulted in a 7% decline in education-related construction spending. Spending in the beleaguered lodging segment is down nearly 25% in nominal terms.

“The Russian invasion of Ukraine will not help,” said Basu. “Oil and other key input prices are rising, placing further upward pressure on the cost of delivering construction services. Those elevated costs have already been leading some project owners to postpone projects in the hope of procuring more favorable bids in the future. Steel, copper, aluminum, neon and nickel prices are all implicated by the outbreak of war, and sanctions on Russia and limits on its exports will be in place long after hostilities end.”

Construction Spending Rose In January From December And January 2021 But Public Construction Is Being Delayed By Inaction In Washington

Association Officials Note Congress Has Yet to Fund Promised Increases in Infrastructure Funding Outlined In the Bipartisan Infrastructure Act, While Administration Adds Restrictions Congress Didn’t Put in the Law

Press release from Associated General Contractors of America

Construction spending increased in January compared to both December and a year ago, with strong gains in private nonresidential and residential construction but mixed results for public spending, according to an analysis of federal spending data the Associated General Contractors of America released today. Association leaders urged Washington officials to speed the award of funds promised by the Bipartisan Infrastructure law.

“Private nonresidential construction, especially for manufacturing plants, has rebounded sharply in recent months, while demand for housing remains strong,” said Ken Simonson, the association’s chief economist. “But public projects have yet to grow consistently.”

Construction spending in January totaled $1.68 trillion at a seasonally adjusted annual rate, 1.3 percent above the upwardly revised December rate and 8.2 percent higher than in January 2021. Private residential construction spending rose 1.3 percent in January from a month prior and 13.4 percent from January 2021, while private nonresidential construction spending increased 1.8 percent from December to January and 7.3 percent from January 2021. In contrast, public construction spending rose 0.6 percent for the month but slipped 1.3 percent from the year-ago level.

Among residential segments, single-family construction added 1.2 percent over the December total and 15.4 percent year-over-year. Multifamily construction inched down less than 0.1 percent in January but rose 4.8 percent from a year earlier. Spending on improvements to existing owner-occupied houses increased 1.8 percent for the month and 13.7 percent year-over-year.

A surge in manufacturing construction, which gained 8.5 percent for the month and 31.2 percent year-over-year, accounted for the bulk of the private nonresidential pickup. In addition, the largest private nonresidential segment, power construction, rose 2.7 percent for the month but trailed the January 2021 rate by 1.4 percent. The next-largest segment, commercial construction, declined 0.5 percent in January but jumped 18.0 percent year-over-year, with year-over-year gains in each component: warehouses (up 22.4 percent), retail categories (up 15.2 percent), and farm (up 4.4 percent).

The largest public segments showed diverse results. Highway and street construction edged down 0.1 percent from December but rose 5.2 percent compared to January 2021. Educational construction was unchanged for the month and skidded 9.9 percent year-over-year. Transportation construction spending climbed 1.6 percent in January but only 0.1 percent year-over year.

Association officials said one reason for the uneven public sector construction spending is that Congress has not appropriated most of the extra funds authorized in the Bipartisan Infrastructure law signed by President Biden last year. In addition, the administration has added restrictions not intended by Congress. They urged Congress to quickly pass the overdue appropriations bill and the administration to stick to the wording and intent of the infrastructure bill.

“The highway, transportation, and other infrastructure promised by that bill is urgently needed to tackle snarled supply chains and rising costs,” said Stephen E. Sandherr, the association’s chief executive officer. “Congress and the administration need to fulfill the promise of the legislation right away.”