Key Takeaways

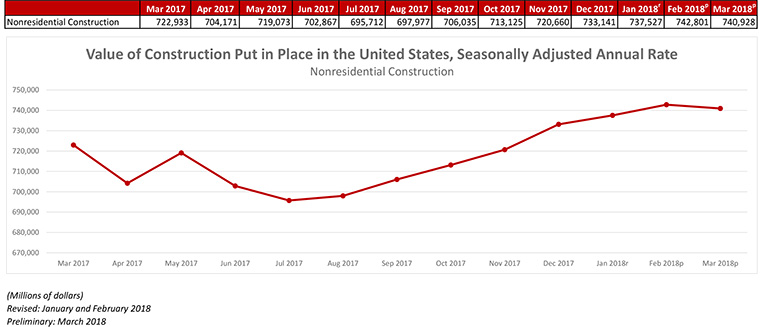

- Nonresidential construction spending decreased 0.3 percent in March, totaling $740.9 billion on a seasonally adjusted basis.

- February’s spending estimate was revised roughly $10 billion higher, from $732.8 billion to $742.8 billion, rendering the March decline less meaningful.

- “The upshot is that CEOs and other construction leaders should remain upbeat regarding near-term prospects despite today’s construction spending report ... At the same time, construction industry leaders must remain wary of a sea of emerging risks to the ongoing economic and construction industry expansions.”

Press Release from Associated Builders and Contractors, Inc.

WASHINGTON, May 1—Nonresidential construction spending declined 0.3 percent in March, according to an Associated Builders and Contractors (ABC) analysis of U.S. Census Bureau data released today. Nonresidential spending, which totaled $740.9 billion on a seasonally adjusted, annualized basis, has expanded 2.5 percent on a year-over-year basis. February’s spending estimate was revised roughly $10 billion higher, from $732.8 billion to $742.8 billion, rendering the March decline less meaningful.

Private sector nonresidential construction spending fell 0.4 percent on a monthly basis, but rose 2.2 percent from a year ago. Public sector nonresidential spending remained unchanged in March, but it is up 2.9 percent year-over-year.

“The nonresidential construction spending data emerging from the Census Bureau continue to be a bit at odds with other data characterizing growth in the level of activity,” said ABC’s Chief Economist Anirban Basu. “For instance, first quarter GDP data indicated brisk expansion in nonresidential investment. Data from ABC’s Construction Backlog Indicator, the Architecture Billings Index and other leading industry indicators have also been suggesting ongoing growth. Despite that, private nonresidential construction spending is up by roughly the inflation rate, indicating that the volume of services delivered over the past year has not expanded in real terms.

“That said, most economists who follow the industry presumed that March data would be somewhat soft,” said Basu. “The Northeast and Midwest were impacted by unusually persistent storm activity in March. The same phenomenon impacted March’s employment estimates, which indicated that construction actually lost 15,000 jobs that month. Other weather-sensitive industries, including retail trade, also experienced slow to negative job growth in March.

“The upshot is that CEOs and other construction leaders should remain upbeat regarding near-term prospects despite today’s construction spending report,” said Basu. “Leading indicators, including a host of confidence measures, collectively suggest that business investment will be on the rise during the months ahead. Improved state and local government finances should also support additional nonresidential construction activity.

“At the same time, construction industry leaders must remain wary of a sea of emerging risks to the ongoing economic and construction industry expansions,” said Basu. “Interest rates are on the rise. Materials prices, including those associated with softwood lumber, steel and aluminum, are expanding briskly. Wage pressures continue to build. There are also issues related to America’s expanding national debt, increasingly volatile financial markets, geopolitical uncertainty that has helped to propel fuel prices higher, and lack of transparency regarding America’s infrastructure investment intentions. The challenge for construction CEOs and others, therefore, is to prepare for growing activity in the near-term, but for something potentially rather different two to three years from now.”

Reporting from MarketWatch:

Construction spending stumbles in March

The numbers: Construction expenditures were 1.7% lower in March compared with February, the Commerce Department said Tuesday. But a hefty increase to earlier spending estimates in prior months signals that outlays remain on a strong footing.

What happened: Spending ticked down to a seasonally adjusted annual $1.285 trillion rate in March from a $1.306 trillion pace in February. March expenditures were 3.6% higher than a year ago.

The Econoday forecast was for a 0.5% increase in March.

The big picture: In March, outlays for public sector construction projects were little changed, but private-sector spending fell 2.1%.

Residential construction spending was 3.5% lower for the month, but 5.3% higher, compared with a year ago.

With expenditures now seen as stronger in January and February than the government originally estimated, total construction spending for the year to date is 5.5% higher than the same period in 2017.

What they’re saying: “Construction spending was quite soft in March, falling by 1.7%, likely reflecting at least in part the difficult weather during the month,” said Stephen Stanley, Amherst Pierpont Securities chief economist. “I continue to look for a sizable bounceback in construction activity in the spring, as weather delays dissipate.”

Market reaction: The 10-year Treasury yield, TMUBMUSD10Y, -0.78% which is hovering just below recent highs, ticked up after the release of the construction spending data and a report that showed manufacturers are facing higher costs.