Key Takeaways

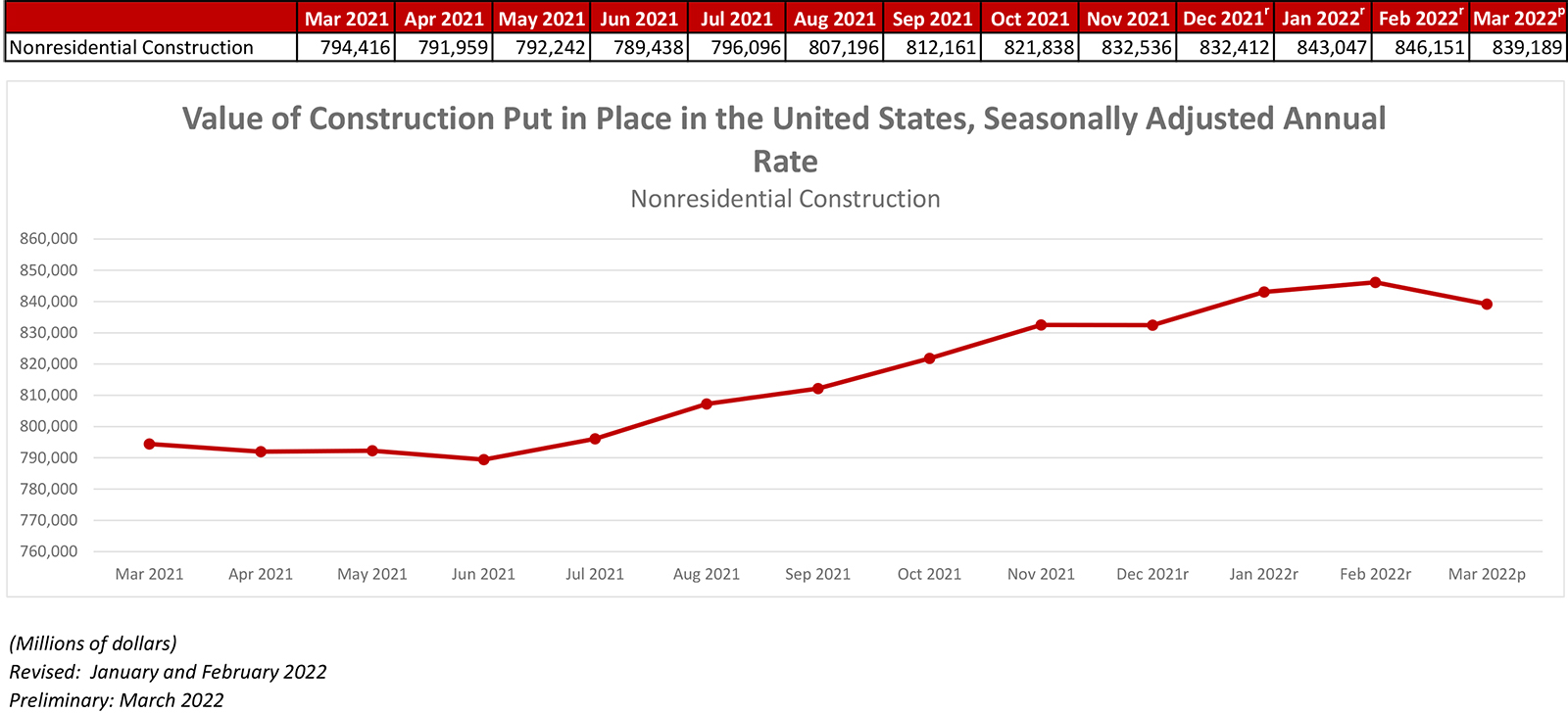

- National nonresidential construction spending down 0.8% in March 2022.

- On a seasonally adjusted annualized basis, nonresidential spending totaled $839.2 billion for the month.

- "Even though nonresidential construction spending levels are significantly short of what they were pre-pandemic, many contractors indicate that they are operating at capacity ... this speaks to how challenging the economic environment is becoming, with contractors wrestling with workforce skills shortages and sky-high materials prices."

Press Release from Associated Builders and Contractors, Inc.: Nonresidential Construction Spending Down 1% in March; Recession Could Be Around the Corner, Says ABC

WASHINGTON, May 2—National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $839.2 billion for the month.

Spending was down on a monthly basis in 11 of 16 nonresidential subcategories. Private nonresidential spending was down 1.2%, while public nonresidential construction spending was down 0.3% in March. On a year-over-year basis, nonresidential construction spending is up 5.6%, led by 31.9% growth in construction related to manufacturing.

“March’s construction spending numbers aren’t adjusted for inflation and are actually worse than they look,” said ABC Chief Economist Anirban Basu. “While overall construction spending rose 0.1% in March, largely because of the strength in multifamily residential construction, construction spending was down in real terms. Nonresidential construction performance declined because of weakness in segments like commercial (-1.9%) and amusement/recreation (-2.1%).

“Even though nonresidential construction spending levels are significantly short of what they were pre-pandemic, many contractors indicate that they are operating at capacity, according to ABC’s Construction Backlog Indicator,” said Basu. “This speaks to how challenging the economic environment is becoming, with contractors wrestling with workforce skills shortages and sky-high materials prices. The elevated cost of construction service delivery helps explain why more projects are not moving forward as project owners are forced to wait.

“Circumstances could become easier or more challenging for contractors during the months ahead,” said Basu. “The Federal Reserve’s stepped-up efforts to combat inflation will eventually translate into better pricing for key construction inputs. However, those same efforts will soften the economy. Many economists believe that a recession in America over the next 12 to 18 months has become virtually inevitable. Thus, even as delivering construction services becomes more affordable, demand for construction services, particularly private construction, may begin to fade.”

Press Release from Associated General Contractors of America: Nonresidential And Multifamily Construction Spending Slump In March As Supply-Chain Woes, Labor Shortages Stymie Strong Project Demand

Association Officials Call for Immediate End to Tariffs on Lumber, Steel and Aluminum Products, and Urge Congress and the Administration to Boost Career and Technical Education Funding, Apprenticeship Options

WASHINGTON, May 2—Spending on most categories of nonresidential and multifamily construction declined from February to March as contractors struggled to find enough workers and get timely deliveries of materials, according to an analysis the Associated General Contractors of America released today regarding federal spending data. Association leaders urged Washington officials to end tariffs on construction materials and widen the opportunities for gaining the skills for rewarding careers in construction.

“Contractors continue to report strong demand for most types of structures, with few owners canceling or postponing planned projects,” said Ken Simonson, the association’s chief economist. “But worker shortages and supply-chain problems, from lockdowns in China to the war in Ukraine, are slowing project completions.”

Construction spending in March totaled $1.73 trillion at a seasonally adjusted annual rate, 0.1 percent above the upwardly revised February rate and 11.7 percent higher than in March 2021. Private residential construction spending accounted for all of the increase in the latest month, rising 1.0 percent for the month and 18.4 percent from March 2021. In contrast, private nonresidential construction spending slumped 1.2 percent from February, although the March total was 8.5 percent higher than in March 2021. Public construction spending slipped 0.2 percent for the month but increased 1.7 percent from the year-ago level.

Among residential segments, single-family construction added 1.3 percent over the February total and 19.4 percent year-over-year. Multifamily construction fell 0.5 percent in March but rose 3.9 percent from a year earlier. Spending on improvements to existing owner-occupied houses increased 1.1 percent for the month and 22.5 percent year-over-year.

There were notable monthly declines in the largest private nonresidential categories despite generally robust growth from a year earlier. The largest private nonresidential segment, power construction, slipped 1.2 percent for the month to a level 0.3 percent below the March 2021 rate. The next-largest segment, commercial construction, skidded 1.9 percent in March but gained 15.5 percent year-over-year. Manufacturing construction fell 1.6 percent in March but topped the March 2021 rate by 31.8 percent.

The largest public segments also slipped in March. Highway and street construction declined 0.4 percent from February but rose 7.5 percent compared to March 2021. Educational construction tumbled 0.8 percent for the month and 6.2 percent year-over-year. Transportation construction spending slid 0.5 percent in March and 1.2 percent year-over year.

Association officials said solving the materials and labor supply problems will require both short- and long-term action by officials in Washington. They urged President Biden to end tariffs that are restricting supplies and raising prices for lumber, steel, and aluminum products. To improve the labor supply, they called for more funding of career and technical education and recognition of a broader range of apprenticeship programs.

“Now that Congress has funded a substantial increase in infrastructure construction, it is imperative that the supply of materials and workers be increased as well,” said Stephen E. Sandherr, the association’s chief executive officer. “Congress and the administration need to act promptly on several fronts.”