Key Takeaways

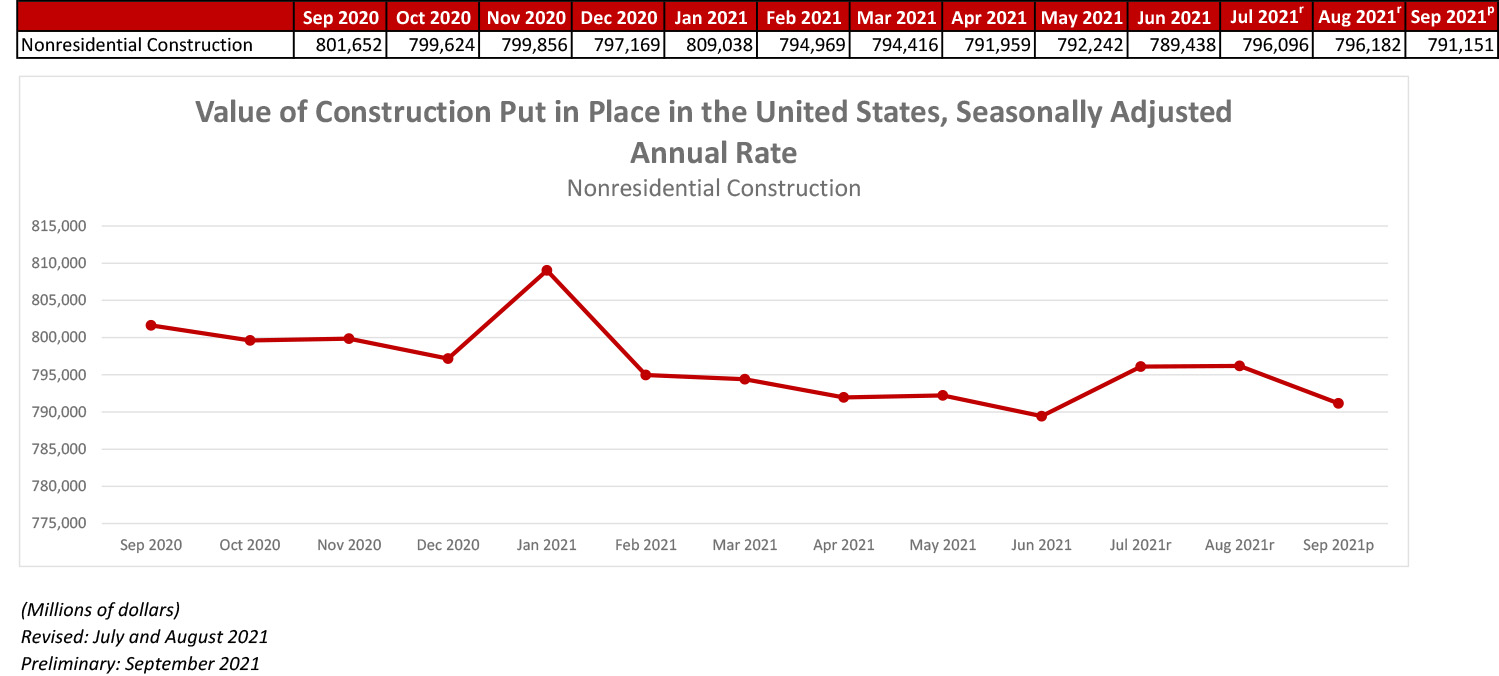

- National nonresidential construction spending declined 0.6% in September 2021.

- On a seasonally adjusted annualized basis, nonresidential spending totaled $791.2 billion for the month.

- “Many observers thought that America would have passed a meaningful infrastructure package by now. That has not yet happened, and many state transportation agencies, along with their local counterparts, note that planning for projects has become extraordinarily challenging in the context of uncertain federal funding."

Press Release from Associated Builders and Contractors, Inc.

WASHINGTON, Nov. 1—National nonresidential construction spending contracted 0.6% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $791.2 billion for the month.

Spending was down in 11 of the 16 nonresidential subcategories, with spending in amusement and recreation unchanged for the month. Both private and public nonresidential spending declined 0.6% in September.

“It is not surprising that nonresidential construction spending declined in September,” said ABC Chief Economist Anirban Basu. “Nonresidential construction spending has generally been trending lower for several months and the factors behind this are well known. First, the pandemic has continued, resulting in ongoing global supply chain disarray. That has kept commodity and materials prices higher than they otherwise would be, causing some project owners to pull back on construction starts. Indeed, ABC’s Construction Backlog Indicator has signaled a loss of momentum in nonresidential construction spending.

“Second, many observers thought that America would have passed a meaningful infrastructure package by now,” said Basu. “That has not yet happened, and many state transportation agencies, along with their local counterparts, note that planning for projects has become extraordinarily challenging in the context of uncertain federal funding.

“Finally, to the extent that projects are moving forward, construction skills shortages are slowing the pace of construction delivery,” said Basu. “Were an infrastructure package to pass, it is unclear how projects would be sufficiently staffed given a higher rate of retirement among construction workers and a lack of entry into the skilled trades. These factors have continued in recent weeks, suggesting that nonresidential construction spending may remain somewhat soft during the months ahead.”

Construction Spending Slumps In September As Drop In Residential Work Projects Adds To Ongoing Downturn In Private And Public Nonresidential

Year-to-Date Declines Continue for Most Infrastructure Categories Compared to First Nine Months of 2020; Association Officials Urge Congress and the President to Finish Work on Bipartisan Infrastructure Bill

Press release from Associated General Contractors of America

Total construction spending declined in September for the first time since February, as both residential and nonresidential construction slipped, according to a new analysis of federal construction spending data the Associated General Contractors of America released today. Officials urged the House of Representatives to promptly complete work on the bipartisan infrastructure bill that the Senate passed earlier this year, noting that spending on infrastructure in the first nine months of 2021 fell short of year-earlier levels.

“Spending on projects has been slowed by shortages of workers and materials, as well as extended or uncertain delivery times,” said Ken Simonson, the association’s chief economist. “And the extreme rise in materials costs is likely to mean some infrastructure projects will no longer be affordable without additional funding.”

Construction spending in September totaled $1.57 trillion at a seasonally adjusted annual rate, down 0.5 percent from August. Year-to-date spending in the first nine months of 2021 combined increased 7.1 percent from the total for January-September 2020. While both residential and nonresidential construction declined from August to September, the two categories have diverged relative to 2020 levels. Residential construction spending slipped 0.4 percent for the month but was 24.5 percent higher year-to-date. Combined private and public nonresidential construction spending decreased 0.6 percent in September and 5.8 percent year-to-date.

Most infrastructure categories posted significant year-to-date declines, Simonson pointed out. The largest public infrastructure segment, highway and street construction, was 1.3 percent lower than in January-September 2020. Spending on public transportation construction slumped 6.8 percent year-to-date. Investment in sewage and waste disposal structures was the sole exception, rising 4.3 percent, but public water supply projects dipped 0.9 percent and conservation and development construction plummeted 19.5 percent.

Other types of nonresidential spending also decreased year-to-date, Simonson added. Combined private and public spending on electric power and oil and gas projects declined 2.5 percent. Education construction slumped 10.1 percent. Commercial construction--comprising warehouse, retail, and farm structures--dipped 1.7 percent, as a 13.2 percent plunge in retail construction outweighed a 12.0 percent hike in warehouse structures. Office spending fell 9.2 percent and manufacturing construction inched down 0.2 percent.

Association officials said the almost ubiquitous downturn in infrastructure spending shows that enactment of the Bipartisan Infrastructure bill that already passed in the Senate is urgently needed. They said each day’s delay is putting the nation further behind in unclogging supply chains and enhancing competitiveness.

“This legislation advances the policy priorities that members of both parties have long said they want,” said Stephen E. Sandherr, the association’s chief executive officer. “It is disgraceful that both sides are still holding these projects hostage while sorting out other priorities. Construction workers, businesses, and the public deserve better.”