Key Takeaways

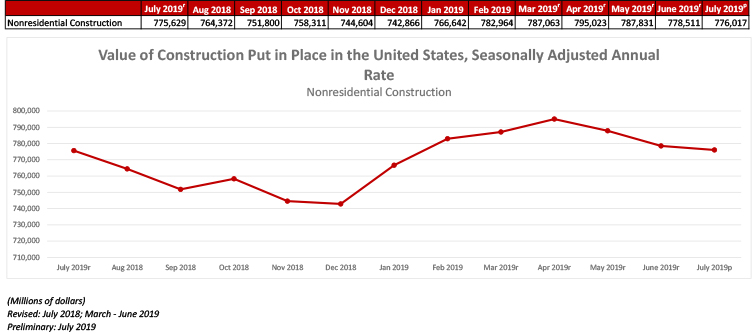

- Nonresidential construction spending, which totaled $776 billion on a seasonally adjusted annual basis for July, declined 0.3% from June and the June estimates were revised upward to $778.5 billion.

- Private nonresidential spending fell 0.8% in July and 2.7% on a yearly basis. Public nonresidential spending increased 0.4% on a monthly basis and 4.3% for the year.

- “Trends in nonresidential construction tend to lag the broader economy by a year to 18 months, which means that today's construction spending numbers reflect in large measure broader economic dynamics characterizing 2018. Last year was a good one for the economy, persuading many to move ahead with projects.”

Press Release from Associated Builders and Contractors, Inc.

WASHINGTON, Sept. 3— According to an Associated Builders and Contractors analysis of U.S. Census Bureau data published today, national nonresidential construction spending declined 0.3% in July, totaling $776 billion on a seasonally adjusted annualized basis, and increased 0.1% compared to July 2018. The June 2019 estimates were revised upward from $773.8 billion to $778.5 billion.

In July, private nonresidential spending decreased 0.8% on a monthly basis and 2.7% on a yearly basis. Public nonresidential spending, however, increased 0.4% for the month and 4.3% for the year.

"While there is much discussion regarding the extent to which the U.S. economy has slowed and will slow going forward, these considerations have relatively little to do with today's nonresidential construction spending data," said ABC Chief Economist Anirban Basu. "Trends in nonresidential construction tend to lag the broader economy by a year to 18 months, which means that today's construction spending numbers reflect in large measure broader economic dynamics characterizing 2018. Last year was a good one for the economy, persuading many to move ahead with projects.

"Recent construction spending data, therefore, have been impacted by factors more closely related to the industry," said Basu. "For instance, the recent weakening in certain private construction segments, including office and lodging, are likely due to growing concerns regarding overbuilding and the somewhat higher cost of capital. Public spending growth, despite solid numbers in July, has been more erratic of late. This may have something to do with the looming insolvency of the Highway Trust Fund, which is expected in 2021 without congressional action. There is already evidence that some states have begun to postpone planning for new projects until there is more clarity regarding federal infrastructure spending, evident in the 2.7% spending decline observed in the highway and street category.

"Despite recent slow growth in construction spending, the U.S. construction industry has continued to expand employment levels during the past year," said Basu. "ABC’s Construction Backlog Indicator continues to show that the average contractor or subcontractor will remain busy over the near term. One of the reasons for relatively slow growth in nonresidential construction spending may simply be that the U.S. contracting community cannot deliver significantly more service in the context of worsening labor/skills shortages. In other words, nonresidential construction volume is already near its peak potential supply. Given that, one wouldn't expect substantial growth in construction spending even in the context of significantly stronger economic growth."

Press Release from Associated General Contractors of America

Construction Spending Edges Higher in July but Decreases Year-to-Date as Decline in Single-Family Homebuilding Offsets Multifamily and Nonresidential Increases

Association Survey Finds Contractors Remain Eager to Hire but Report Continuing Difficulty in Filling Hourly Craft Positions; Officials Urge Increase in Career and Technical Education, Greater Immigration for Qualified Workers

Construction spending inched up less than 0.1 percent in July from June but slipped from year-ago levels, as a weak single-family homebuilding market and declines in some private nonresidential segments masked gains in public and multifamily construction, according to an analysis today by the Associated General Contractors of America of new federal spending data. Association officials said a new survey they released showed contractors remain eager to hire employees but are having difficulty finding qualified craft workers.

“Overall spending totals have been fluctuating for more than two years, with divergent patterns for residential, private nonresidential and public construction,” said Ken Simonson, the association’s chief economist. “Although year-to-date construction spending in the first seven months of 2019 combined was less than in the same period last year, most nonresidential and multifamily contractors remain busy and optimistic about future work.”

Construction spending totaled $1.289 trillion at a seasonally adjusted annual rate in July, a gain of less than 0.1 percent from the June rate and a decrease of 2.7 percent from the July 2018 rate, according to estimates the U.S. Census Bureau released today. Year-to-date, spending declined by 2.1 percent from the January-July 2018 total.

Public construction spending increased 0.4 percent for the month and 5.6 percent year-to-date. Among the four largest public categories, spending in the first seven months of 2019 jumped 12.0 percent compared to the same period in 2018 for highway and street construction spending, was unchanged for educational construction and climbed 9.8 percent for transportation (airports, transit, rail and port) projects.

Private nonresidential spending declined 0.8 percent from June to July but the seven-month total was 0.6 percent higher than in January-July 2018. Major private nonresidential categories experienced mixed year-to-date results. The largest, power construction (comprising electric power generation, transmission and distribution, plus oil and gas fields and pipelines), climbed 8.3 percent year-to-date. Commercial (retail, warehouse and farm) construction tumbled 15.2 percent. Manufacturing construction posted a 4.7 percent gain. Private office construction spending rose 7.9 percent.

Private residential construction spending increased 0.6 percent for the month but slumped 8.5 percent year-to-date. Single-family homebuilding decreased 8.7 percent in the first seven months of the year, while spending on multifamily projects increased 6.6 percent. Spending on residential improvements plunged 12.7 percent year-to-date.

Association officials said that one reason construction spending declined between June and July is because contractors cannot find enough qualified workers to keep pace with demand. They noted that 91 percent of construction firms in a survey the association released last week reported they expect to hire hourly craft workers for expansion or replacement in the next 12 months, but 80 percent of the firms say they are having a hard time filling hourly craft positions. As a result, the drop in construction spending in some nonresidential categories so far in 2019 may indicate some firms are turning down or delaying projects because they cannot find enough qualified workers.

“Construction firms are taking a broad range of steps to boost pay, increase training and become more efficient as they cope with labor shortages,” said Stephen E. Sandherr, the association’s chief executive officer. “Public officials can help by boosting investments in career and technical education and allowing for more immigrants with construction skills to legally enter the country.”