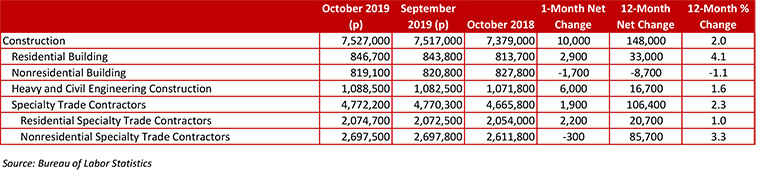

According to data released Friday by the US Bureau of Labor Statistics, the national construction industry added 10,000 net new jobs in October.

Key Takeaways

- The construction industry added 10,000 net new jobs in October and, on a year-over-year basis, has expanded by 148,000 jobs, an increase of 2%.

- The construction unemployment rate rose to 4% in October, up from 3.2% in September.

- Nonresidential construction employment increased by 4,000 jobs on net in October and is up 2.1% over the past year.

- “The expected depletion of the Highway Trust Fund in 2021, however, represents a looming threat to public construction momentum. The implication is that the overall nonresidential construction spending cycle may experience greater turbulence over the next 12 to 18 months, but for now, the data indicate overall positive momentum.”

Press Release from Associated Builders and Contractors, Inc (ABC)

Nonresidential Construction Continues to Add Jobs, Says ABC

WASHINGTON, Nov. 1—The construction industry added 10,000 net new jobs in October, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Labor Statistics. On a year-over-year basis, industry employment has expanded by 148,000 jobs, or 2%.

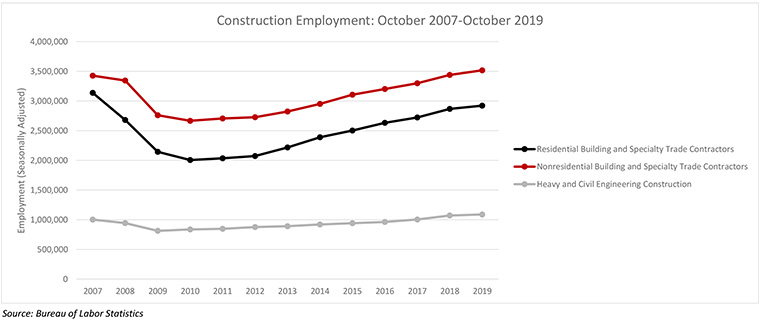

Nonresidential construction employment increased by 4,000 jobs on net in October and is up 2.1% over the past year. On a monthly basis, however, both the nonresidential building and nonresidential specialty trade contractors segments lost jobs, which comports with the recent decline in investment in structures, according to the third quarter gross domestic product release.

The construction unemployment rate rose to 4% in October, up 0.4 percentage points from the same time last year. Unemployment across all workforce participants increased to 3.6% in October as the labor force participation rate for the broader economy inched up to 63.3%.

“Increasingly, the nonresidential construction sector is a tale of two industries,” said ABC Chief Economic Anirban Basu. “While the overall industry has added jobs for the past three consecutive months, the segments most closely tied to commercial construction, including retail and lodging, have slowed substantially. There are many reasons for this, including emerging concerns regarding saturation of available commercial product in a number of areas. Accordingly, the GDP report released earlier this week showed investment in structures contracted 15.3% on a seasonally adjusted annualized basis during the third quarter of 2019, a rather substantial dip. Today’s employment report indicates that the nonresidential building subsegment has now lost jobs on a year-over-year basis over the last four months.

“This represents a stark departure from earlier in the cycle when private construction segments led the construction spending expansion,” said Basu. “For years, public construction lagged private construction in terms of recovery as state and local governments wrestled with the aftermath of the Great Recession. But today’s economy is different. Jobs are plentiful, translating into higher income tax collections. Consumers are spending, helping to generate retail sales tax collections. Property values have also risen and there are more properties to assess and tax, translating into higher property tax collections.

“As a result, there is more money for infrastructure investment in a number of public categories, including water and public safety,” said Basu. “The expected depletion of the Highway Trust Fund in 2021, however, represents a looming threat to public construction momentum. The implication is that the overall nonresidential construction spending cycle may experience greater turbulence over the next 12 to 18 months, but for now, the data indicate overall positive momentum.”

Press Release from Associated General Contractors of America(AGC)

Trade Fights Appear to be Undermining Demand for Many Types of Private-Sector Projects; Association Officials Urge the Trump Administration to Quickly Resolve Disputes with China, the European Union and Other Countries

Construction employment increased by 10,000 jobs in October and by 148,000, or 2.0 percent, over the past 12 months, while construction spending decreased by 2.0 percent from September 2018 to September 2019, according to an analysis of new government data by the Associated General Contractors of America. Association officials said demand for construction is being undermined by uncertainty and tariffs that are part of a series of trade disputes with China, the European Union and other countries.

“The construction industry is still adding workers at a faster clip than the overall economy but growth has slowed as private nonresidential and multifamily construction spending shrinks,” said Ken Simonson, the association’s chief economist. “At the same time, public investment and a recent pickup in single-family homebuilding have helped employment to grow.”

Simonson observed that the 2.0 percent growth in construction employment between October 2018 and October 2019 was the slowest in almost seven years but that the rate remained well above the 1.4 percent increase in total nonfarm payroll employment. Average hourly earnings in construction—a measure of all wages and salaries—increased 2.4 percent over the year to $30.95. That figure was 9.8 percent higher than the private-sector average of $28.18, Simonson noted.

Construction spending totaled $1.294 trillion at a seasonally adjusted annual rate in September, a gain of 0.5 percent from the August rate but 2.0 percent less than the September 2018 rate, according to estimates the U.S. Census Bureau released today. Year-to-date spending for January-September combined fell 2.2 percent from the year-ago total.

Public construction spending increased 1.5 percent for the month and 5.6 percent year-to-date. Among the three largest public categories, spending in the first nine months of 2019 climbed 9.3 percent compared to the same period in 2018 for highway and street construction spending, 1.0 percent for educational construction and 9.1 percent for transportation (airports, transit, rail and port) projects.

Private residential construction spending increased 0.6 percent for the month but slid 7.9 percent year-to-date. Single-family homebuilding rose 1.3 percent from August to September, the third consecutive monthly gain, but fell 8.0 percent year-to-date. Spending on multifamily projects declined 0.7 percent for the month but was 5.9 percent higher year-to-date.

Private nonresidential spending decreased 0.3 percent from August to September and 0.6 percent year-to-date. Major private nonresidential segments experienced mixed year-to-date results. The largest—power construction (comprising electric power generation, transmission and distribution, plus oil and gas fields and pipelines)—climbed 5.5 percent year-to-date. Commercial (retail, warehouse and farm) construction plummeted 15.2 percent. Manufacturing construction posted a 3.2 percent gain. Private office construction spending rose 6.8 percent.

Association officials said that the uncertainty and increased prices that come from recent trade fights and a series of threatened and imposed tariffs appear to be undermining demand for many types of construction projects. They urged the Trump administration to quickly resolve outstanding trade disputes with China, the European Union and other countries.

“Resolving trade disputes and providing businesses with greater certainty about trade and tariff levels will help accelerate demand for new construction projects,” said Stephen E. Sandherr, the association’s chief executive officer. “The best way to make sure our economy continues to expand is to quickly resolve a series of trade disputes that have contributed to business uncertainty and likely held back many new development and construction projects.”