Key Takeaways

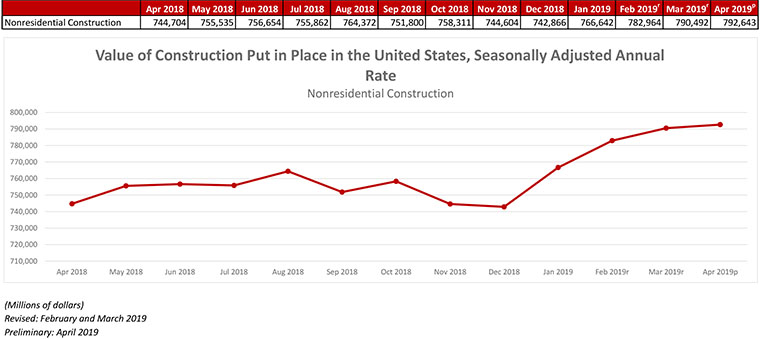

- Nonresidential construction spending, which totaled $792.6 billion on a seasonally adjusted annual basis for April, was a 6.4% increase over the same time last year.

- Among the 16 nonresidential construction spending categories, nine experienced an increase in monthly spending, with the largest increases registered in water supply (9.8%), highway and street (6.8%) and transportation (3.9%).

- While public nonresidential spending expanded 4.8% on a monthly basis and increased 15.4% since April 2018, private nonresidential spending fell 2.9% in April and is up just 0.6 % year-over-year.

Press Release from Associated Builders and Contractors, Inc.

WASHINGTON, June 3—According to an Associated Builders and Contractors analysis of U.S. Census Bureau data released today, national nonresidential construction spending rose 0.3% in April, totaling $792.6 billion on a seasonally adjusted annualized basis, which is a 6.4% increase compared to the same time last year. While public nonresidential spending expanded 4.8% on a monthly basis and increased 15.4% since April 2018, private nonresidential spending fell 2.9% in April and is up just 0.6 % year-over-year.

Among the 16 nonresidential construction spending categories, nine experienced an increase in monthly spending, with the largest increases registered in water supply (9.8%), highway and street (6.8%) and transportation (3.9%). Manufacturing (-7.1%) and commercial (-3.7%) experienced the largest decreases in April, though manufacturing spending is still up 10.9% compared to the same time last year.

“Today’s data release shows that nonresidential construction spending remains vigorous in America,” said ABC Chief Economist Anirban Basu. “While April’s monthly nonresidential construction spending growth of 0.3 percent appears lackluster, this was largely the result of a sizeable upward revision to March construction spending figures.

“Today’s data release also indicates that the baton has now been fully passed,” said Basu. “Earlier in the recovery, nonresidential construction spending growth was primarily driven by private segments. Low interest rates and abundant liquidity helped fuel private investment in hotels, data centers, casinos, fulfillment centers and other forms of private construction. But over the past year, private nonresidential construction spending has barely budged. Meanwhile, public residential spending is up 15.4 percent and April’s spending growth was led by water supply and highway/street.

“Given current levels of backlog, which expanded to 9.5 months in March 2019, nonresidential construction spending should remain elevated,” said Basu. “That said, risks of recession in 2020 are rapidly rising, which has the potential to reduce construction activity in 2021 and/or 2022.”

Press Release from Associated General Contractors of America

Construction Spending Diverges in April as Public Sector Investment Surges, Private Nonresidential Projects Slip and Single-family Homebuilding Stalls

Results for First Four Months of 2019 Combined Show Ongoing Strength Aside from Single-Family Market; Association Officials Urge End to Tariffs That Pose Threat to Construction Costs and Demand

Construction spending was unchanged from March to April, with mixed results by project type for the month and for the year to date, according to an analysis today by the Associated General Contractors of America of new federal spending data. Association officials warned that tariffs and countermeasures by U.S. trading partners are adding costs and uncertainty to construction projects and are potentially reducing demand for numerous types of projects.

“Overall spending was flat in April, but that masks significant differences among the various construction sectors for both the latest month and the first four months of 2019 combined,” said Ken Simonson, the association’s chief economist. “The year-to-date totals, which are a more reliable indicator of underlying trends than are initial monthly estimates, show activity is still increasing for most project types other than single-family homebuilding.”

Construction spending totaled $1.30 trillion at a seasonally adjusted annual rate in both March and April, according to estimates the U.S. Census Bureau released today. For the first four months of 2019 combined, spending edged up by 0.2 percent from the same period in 2018.

Public construction spending soared 4.8 percent for the month and 11.8 percent year-to-date. Among the three largest public categories, highway and street construction spending jumped 17.2 percent, educational construction climbed 8.9 percent and transportation (airports, transit, rail and port) construction increased 6.2 percent.

Private nonresidential spending declined 2.9 by percent from March to April but the four-month total was 2.6 percent higher than in January-April 2018. Major private nonresidential categories mostly experienced spending increases year-to-date. The largest, power construction (comprising electric power generation, transmission and distribution, plus oil and gas fields and pipelines), increased by 2.0 percent year-to-date. Commercial (retail, warehouse and farm) construction decreased by 6.0 percent. Manufacturing construction posted a 10.7 percent gain. Private office construction spending rose 8.0 percent.

Private residential construction spending slipped 0.6 percent for the month and 7.6 percent year-to-date. Single-family homebuilding decreased 7.1 percent in the first four months of the year while spending on multifamily projects increased 7.9 percent. Spending on residential improvements slumped 13.1 percent year-to-date.

Association officials said that ever-changing tariffs have made it difficult for contractors to estimate project costs accurately, while retaliatory actions by U.S. trading partners cut into demand for construction by exporters, their suppliers and their logistics and transportation partners. The officials urged President Trump to end tariffs that are harming U.S. contractors and other businesses, and to avoid using tariffs as a weapon for immigration or other policies. They added that the latest round of threatened tariffs is coming at time when private-sector demand for construction is essentially flat.

“These tariffs are doing much more harm than good,” said Stephen E. Sandherr, the association’s chief executive officer. “They drive up construction costs, cause uncertainty for businesses that need to know their costs before investing in projects, and damage U.S. competitiveness.”