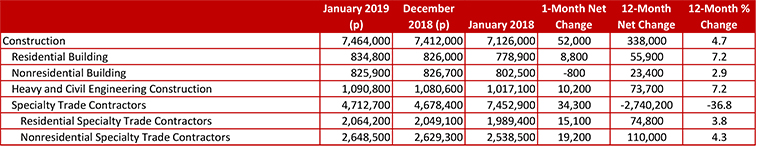

According to data released last week by the US Bureau of Labor Statistics, the national construction industry added 52,000 net new jobs in January. Industry employment is up by 338,000 net jobs year-over-year, a 4.7% increase.

Press Release from Associated Builders and Contractors, Inc (ABC)

Construction Employment Surges to Start Year, Says ABC

WASHINGTON, Feb. 1— Construction employment expanded by 52,000 net new jobs in January, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Labor Statistics. Industry employment is up by 338,000 net jobs on a yearly basis, which represents an increase of 4.7 percent. Nonresidential construction employment grew by 28,600 net new positions on a monthly basis, although the nonresidential building subsector lost 800 net positions.

Construction industry unemployment rose to 6.4 percent, up 1.3 percentage points from December but 0.9 percentage points lower than in January 2018. The nationwide unemployment rate inched up a tenth of a percentage point to 4 percent. BLS also revised its estimate for December 2018 construction employment to 28,000 net new jobs, down from 38,000.

Construction industry unemployment rose to 5.1 percent due to a meaningful increase in labor force participation, yet remains 0.8 percent lower than at the same time one year ago. And while unemployment rose to 3.9 percent nationally, wage growth continues to accelerate.

“Today’s numbers are especially important for construction industry leaders to consider,” said Anirban Basu, ABC’s chief economist. “Because of the federal government shutdown and the market volatility that characterized last year’s final quarter, confidence among consumers and many business operators had been shaken. This is a far cry from a year ago when many economic actors were upbeat after the brilliant financial market performance in 2017 and the passage of tax reform late that year. Today’s jobs report counters concerns that confidence had fallen far enough to jeopardize broader economic momentum and that the federal government shutdown could impact the January employment numbers in a meaningful and negative manner."

“Instead, today’s employment numbers were exceptional,” said Basu. “Not only did the nation manage to add more than 300,000 net new jobs during the initial month of 2019, labor force participation rose further, indicating that more people are being persuaded to participate in the strongest labor market in a generation. What’s more, construction job totals surged higher, with nonresidential construction adding 28,000 on a seasonally adjusted basis in January. This comports neatly with elevated backlog and with the notion that a strong economy continues to create fresh opportunities for contractors."

“Today’s data also suggest that contractors will continue to wrestle with their most profound challenge: the lack of sufficient numbers of suitably skilled workers,” said Basu. “This strongly suggests that wage and cost pressures facing the industry will persist well into 2019 and likely beyond. Today’s numbers also help to dampen any emerging concerns regarding a recession in the near term.”

Press Release from Associated General Contractors of America (AGC)

Construction Employment Climbs by 52,000 In January to 11-Year Peak; Industry Workweek Hits All-Time High as Unemployment Falls to Low

Government Data on Construction Spending, Association Survey Find Demand for All Project Types; Officials Call for More Funds for Training and Education, Immigration Reform to Keep Work on Track

Construction employment increased by 52,000 jobs in January and by 338,000 jobs, or 4.7 percent, over the past year, while the latest reading on construction spending showed moderate increases in all major categories, according to an analysis of new government data by the Associated General Contractors of America. Association officials urged government officials to strengthen career and technical education programs and facilitate immigration for workers with construction skills before a worker shortage stalls completion of needed infrastructure.

“There has been no letup in demand for construction projects—or workers,” said Ken Simonson, the association’s chief economist. “Even though the industry added employees at more than double the pace of the overall economy in the past year, the average workweek in construction reached an all-time high and unemployment in construction hit a series low, indicating that contractors would hire even more workers if they were available.”

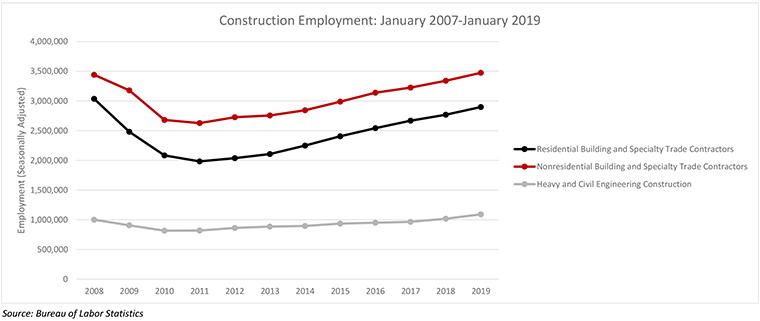

Construction employment totaled 7,464,000 in January, the most since January 2008. A report on construction spending—delayed a month by the partial government shutdown—showed an increase of 0.8 percent from October to November and 4.5 percent year-to-date for the first 11 months of 2018 combined compared to the same period in 2017. Year-to-date spending rose by 3.9 percent for residential construction, 3.5 percent for private nonresidential construction and 7.0 percent for public construction.

Average weekly hours in the industry increased to 39.9 hours in January, the highest since the series began in 2006, the economist noted. Average weekly hours of production and nonsupervisory employees, a series that dates back to 1947 and covers construction trades, set a record of 40.6 hours, Simonson added.

The unemployment rate for jobseekers with construction experience in January was 6.4 percent, down from 7.3 percent in January 2018. The number of such workers fell to 638,000 from 707,000 a year earlier. Both figures were the lowest for January since those series began in 2000, Simonson pointed out.

In a survey the association released in January, more contractors reported they expect the dollar volume of projects available to bid on to expand than to shrink in 2019 in each of 13 project categories. In addition, 79 percent of construction firms reported that they expect to add employees in 2019. However, nearly as many—78 percent—reported they were having trouble filling some positions and 68 percent said they expected that hiring would remain difficult or become harder. Association officials cautioned, however, that contractors’ expansion plans could be thwarted if Washington officials fail to fund more career and technical education to prepare more individuals for construction careers and to allow firms that document a shortage of qualified workers to bring in workers from outside the U.S.

“The pool of unemployed workers with construction experience has virtually evaporated, and everyone in the industry is working longer hours than ever,” said Stephen E. Sandherr, the association’s chief executive officer. “The only way to satisfy the demand is to provide more people with the skills needed to work in construction and to expand the nation’s labor force with qualified workers from outside our borders.”