Key Takeaways

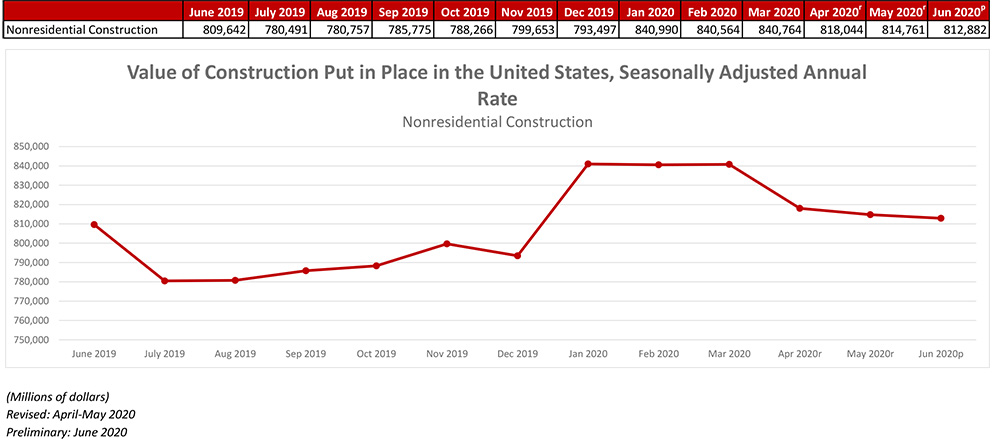

- National nonresidential construction spending decreased 0.2% in June.

- On a seasonally adjusted annualized basis, spending totaled $812.9 billion.

- "The implication is that construction stakeholders should be heavily invested in current negotiations regarding the next round of economic stimulus. In particular, contractors would benefit from additional financial support for state and local governments and businesses. Contractors will also benefit from efforts to induce workers to return to the job market expeditiously as the nascent economic expansion persists."

Press Release from Associated Builders and Contractors, Inc.

WASHINGTON, Aug. 3—National nonresidential construction spending declined 0.2% in June, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted, annualized basis, spending totaled $812.9 billion for the month.

Among the 16 subcategories, six were down compared to May 2020 data. Private nonresidential construction spending increased by 0.2% in June while public nonresidential spending fell 0.8%. Nonresidential construction spending is up 0.4% since June 2019, led by the public safety, water supply and power categories.

“The stability of nonresidential construction is remarkable,” said ABC Chief Economist Anirban Basu. “While gross domestic product crumbled during the second quarter, nonresidential construction spending held its own, partially due to its status as an essential industry in most cities and states. And while many contractors reported that they sustained project interruptions during the second quarter—the worst economic quarter on record—the nation’s nonresidential construction sector was still able to put roughly as much construction in place as in June 2019.

“The industry’s future remains perilous, however,” said Basu. “Economic fundamentals in many private construction segments have been damaged by the ongoing pandemic, including emerging office and retail vacancies. Construction spending in the lodging category is down nearly 15% year over year. Backlog remains healthy, according to ABC’s Construction Backlog Indicator, but many project owners are reporting greater difficulty lining up financing, which will contribute to fewer private construction starts going forward. Public finances have also been damaged. Despite the prevalence of ultra-low borrowing costs, many state and local governments may choose not to add leverage to their capital budgets going forward.

“The implication is that construction stakeholders should be heavily invested in current negotiations regarding the next round of economic stimulus,” said Basu. “In particular, contractors would benefit from additional financial support for state and local governments and businesses. Contractors will also benefit from efforts to induce workers to return to the job market expeditiously as the nascent economic expansion persists.”

Press Release from Associated General Contractors of America

Construction Spending Decreases For Fourth Consecutive Month In June As Declines In Leading Public Categories, Homebuilding Dominate Results

Association Officials Warn Further Contraction is Likely unless Federal Government Enacts Prompt, Major Investment in Infrastructure as State and Local Governments Face Deficits

Construction spending declined for the fourth consecutive month in June as decreases in single-family, highway and educational projects outweighed increases in several private nonresidential categories, according to an analysis by the Associated General Contractors of America of government data released today. As state and local government face budget deficits, association officials cautioned that investments in infrastructure and other construction projects are likely to continue falling unless Congress and the Trump administration provide additional, targeted and dedicated infrastructure funding.

“Regrettably, the overall downward trend in spending is likely to continue and to spread to more project types as work that began before the pandemic hit finishes up,” said Ken Simonson, the association’s chief economist. “Unless the federal government invests heavily—and promptly—in infrastructure projects, both public and private nonresidential investment are likely to shrink further.”

Construction spending in June totaled $1.36 trillion at a seasonally adjusted annual rate, a decline of 0.7 percent from May and the lowest total in a year. After reaching a record high in February of $1.44 trillion, total spending has slumped by 6.0 percent, the steepest four-month contraction in a decade, the economist noted.

Public construction spending decreased by 0.7 percent in June, dragged down by a 1.7 percent drop in highway and street construction spending and a 2.7 percent decline in educational construction spending, the two largest public segments. The next-largest segment, transportation facilities, also contracted, by 0.6 percent.

Private nonresidential construction spending inched up 0.2 percent from May to June, led by a gain of 0.7 percent in the largest segment, power construction. Among other large private spending categories, commercial construction—comprising retail, warehouse and farm structures—slumped 1.3 percent, while manufacturing construction rose 1.7 percent and office construction edged up 0.3 percent.

Private residential construction spending shrank by 1.5 percent in June as spending on single-family homebuilding plunged 3.6 percent to its lowest level since late 2016. In contrast, new multifamily construction spending climbed for the third month in a row, posting a 3.0 percent increase from May.

Association officials said that state and local budgets are getting hammered by declining economic activity related to the ongoing pandemic. They urged Congress and the administration to quickly pass new infrastructure and recovery measures to help reverse the declines in public spending. They added that those new investments would help put many people back to work in good-paying construction careers.

“It will be hard to rebuild the economy if state and local governments lack the resources needed to improve roads, retrofit schools and keep drinking water safe,” said Stephen E. Sandherr, the association’s chief executive officer. “Instead of letting people languish in unemployment, Washington can put people back to work simply by boosting investments in needed infrastructure and other construction projects.”