Key Takeaways

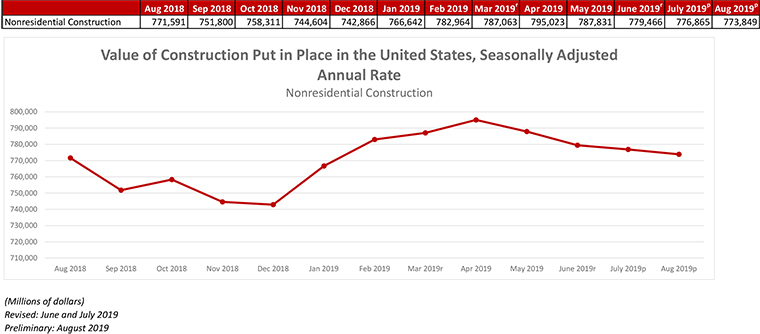

- Nonresidential construction spending, which totaled $773.8 billion on a seasonally adjusted annual basis for August, declined 0.4% from July but is 0.3% higher than August 2018.

- Private nonresidential spending fell 1% in August and 2.8% on a yearly basis, following declines in July as well. Public nonresidential spending increased 0.4% on a monthly basis and 4.8% for the year.

- “All of this is consistent with a slowing economy, especially as measures such as industrial production and capacity utilization remain stagnant.”

Press Release from Associated Builders and Contractors, Inc.

WASHINGTON, Oct. 1—National nonresidential construction spending declined 0.4% in August, according to an Associated Builders and Contractors analysis of U.S. Census Bureau data published today. On a seasonally adjusted annualized basis, spending totaled $773.8 billion, 0.3% higher than in August 2018.

Private nonresidential spending fell 1% on a monthly basis and is down 2.8% compared to the same time last year. Public nonresidential construction expanded 0.4% for the month and 4.8% for the year.

"Nonresidential construction spending is down nearly 3% from its peak in April 2019 due to declines in private construction,” said ABC Chief Economist Anirban Basu. "Construction spending in the commercial category, which encompasses retail space among other segments, is down nearly 12% on a year-over-year basis. Spending related to lodging, including new hotel construction, was down 0.7% for the month and is up less than 4% year over year. Spending in the power segment also decreased in August and is down 3.5% compared to the same time last year.

“All of this is consistent with a slowing economy, especially as measures such as industrial production and capacity utilization remain stagnant,” said Basu. “While this could be attributed to trade wars and a slowing global economy, construction dynamics are rarely so simple. Another likely explanation is that America’s growing shortage of skilled construction workers has driven up the cost of delivering construction services, even in the context of flat materials prices, resulting in more project owners delaying projects.

“On the other hand, public construction spending continues to rise,” said Basu. “Construction spending on public safety is up 13.5% on a year-over-year basis and spending in the sewage/waste disposal category is up nearly 19%. State and local governments continue to benefit from an economy that has pushed property tax, sales tax and income tax collections higher. Low borrowing costs also serve as an inducement to leverage revenues with debt, resulting in more infrastructure spending. Given the recent path of interest rates, this dynamic should continue into 2020.”

Press Release from Associated General Contractors of America

Construction Spending Inches Higher in August but Declines Year-to-Date as Increase in Public Construction Contrasts with Mixed Private Results

Association Survey Finds Projects Take Longer than Anticipated as Contractors Cope with Staffing Challenges; Officials Urge Increased Investment in Career and Technical Education, Greater Immigration for Qualified Workers

Construction spending edged up 0.1 percent in August from July but declined from year-ago levels, with divergent trends in residential and nonresidential categories, according to an analysis today by the Associated General Contractors of America of new federal spending data. Association officials said that many contractors in its recent survey report that staffing challenges are causing projects to take longer than expected, which may be holding down spending. They urged government officials to boost funding for career and technical education and pass comprehensive immigration reform to ease the shortage of construction workers that is slowing projects.

“Eighty percent of the nearly 2,000 contractors responding to our workforce survey this summer reported difficulty filling hourly craft positions,” said Ken Simonson, the association’s chief economist. “Of the firms experiencing staffing challenges, almost half—44 percent—said that projects had taken longer than anticipated. Those delays may be one reason that spending put in place is lagging, even though contractors almost universally report they are busy and would be doing even more projects if they could find enough workers.”

Construction spending totaled $1.287 trillion at a seasonally adjusted annual rate in August, a gain of 0.1 percent from the July rate but 1.9 percent less than the August 2018 rate, according to estimates the U.S. Census Bureau released today. Year-to-date spending for January-August combined fell 2.3 percent from the year-ago total.

Public construction spending increased 0.4 percent for the month and 4.6 percent year-to-date. Among the three largest public categories, spending in the first eight months of 2019 climbed 10.8 percent compared to the same period in 2018 for highway and street construction spending, 0.9 percent for educational construction and 9.3 percent for transportation (airports, transit, rail and port) projects.

Private nonresidential spending decreased 1.0 percent from July to August and 0.1 percent year-to-date. Major private nonresidential segments experienced mixed year-to-date results. The largest—power construction (comprising electric power generation, transmission and distribution, plus oil and gas fields and pipelines)—climbed 6.2 percent year-to-date. Commercial (retail, warehouse and farm) construction plummeted 14.9 percent. Manufacturing construction posted a 3.7 percent gain. Private office construction spending rose 7.7 percent.

Private residential construction spending increased 0.9 percent for the month but slid 5.0 percent year-to-date. Single-family homebuilding rose 1.4 percent from July to August but decreased 8.4 percent year-to-date, while spending on multifamily projects was down 0.9 percent for the month but up 6.5 percent year-to-date. Spending on residential improvements increased 0.8 percent for the month but declined 6.4 percent year-to-date.

Association officials warned that project delays may worsen, noting that nearly three-fourths of the respondents to its survey expect it will be as hard or harder to hire hourly craft workers in the next 12 months, while 29 percent of firms are putting longer completion times into their bids or contracts to offset worker shortages. They urged government officials to act promptly to increase the supply of workers

“Construction firms are using a variety of strategies—raising pay, increasing training and becoming more efficient—to cope with labor shortages,” said Stephen E. Sandherr, the association’s chief executive officer. “Public officials can help by doubling investments in career and technical education and permitting more immigrants with construction skills to legally enter the country.”