Key Takeaways

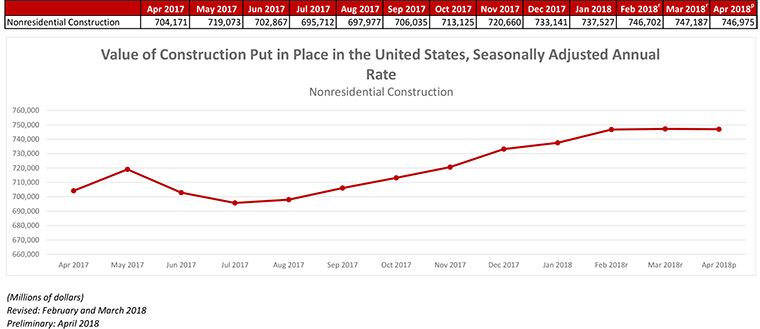

- Nonresidential construction spending remained unchanged in April on a monthly basis, although year-over-year spending is up 6.1%

- Public sector spending fell 1.4% in April, but is up 7.3% year over year.

- Spending in the public safety category, which includes spending on police and fire stations, is up by nearly 17%.

Press Release from Associated Builders and Contractors, Inc.

WASHINGTON, June 1—Nonresidential construction spending remained unchanged in April on a monthly basis, according to an Associated Builders and Contractors (ABC) analysis of U.S. Census Bureau data released today. However, year-over-year spending was up a sturdy 6.1 percent.

Private sector spending increased 0.8 percent on a monthly basis and is up 5.3 percent from a year ago. Public sector spending fell 1.4 percent in April, but is up 7.3 percent year over year.

“Between today’s employment and construction spending reports, it is clear that the economy continues to exhibit strong momentum and abundant confidence,” said ABC Chief Economist Anirban Basu. “It’s important to remember that the construction spending data generally have failed to display as much economic strength as many other indicators. Even the most recent monthly readings on construction spending were unspectacular, but the year-over-year numbers are consistent with ongoing economic and industry progress.

“Perhaps most encouraging is the growing strength of the public categories,” said Basu. “For many years, public construction spending languished even as private categories demonstrated growing vigor. With the dramatic improvement in state and local government finances in many communities in recent years, there is greater capacity to invest in infrastructure. Not coincidentally, construction spending in the transportation category rose 22 percent during the past year. Spending in the public safety category, which includes spending on police and fire stations, is up by nearly 17 percent.

“As always, there is a need to pay attention to any clouds forming on the horizon,” said Basu. “Inflationary pressures continue to build, with tariffs on steel and aluminum likely to accelerate construction materials price appreciation during the next several months. Interest rates are expected to head higher, though perhaps only in fits and starts. Wage pressures also continue to build. The implication is that the cost of financing construction projects is on the rise. Should those costs rise too quickly, the momentum presently observable in nonresidential construction spending and employment data could quickly dissipate.”

Reporting from MarketWatch:

Construction spending throttles higher in April on home-building boost

Year-to-date spending is 6.6% higher than the same period last year

The numbers: Construction expenditures were 1.8% higher in April compared to March, the Commerce Department said Friday.

What happened: Spending jumped more than expected in the month: economists surveyed by Econoday had forecast an 0.8% increase for the month. The April spending pace of $1.31 trillion, seasonally adjusted, was 7.6% higher than a year ago. While the monthly spending rates are often revised, expenditures for the first four months of the year are 6.6% higher than the same period in 2017. And in the April report, revisions to prior months were all upward.

Private-sector expenditures rose 2.8% compared to March, while public sector spending fell. Residential construction spending was up 4.4% during the month, and stood 9.7% higher than a year ago.

Market reaction: The Dow Jones Industrial Average US:DJIA continued to power higher after the release of the data, following solid jobs numbers and the release of the ISM manufacturing index.

What they’re saying: “The April jump reversed the March drop, but the bigger picture here is that this is the fifth 1%-plus increase in the past six months,” said Ian Shepherdson, Chief Economist for Pantheon Macroeconomics. “The strength is across the board, public and private, residential and commercial, with the only softer spot being the state and local government sector, where huge volatility is normal.”