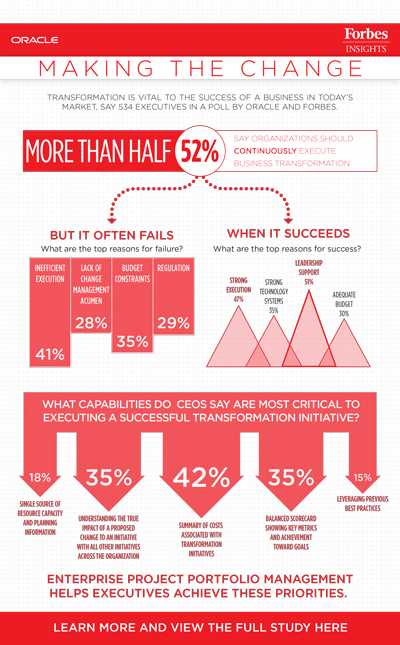

Making the Change: Planning, Executing, and Measuring Successful Business Transformation

For companies that don’t want merely to succeed in their industries but to lead them, continual business transformation is a must. With 93% of U.S. companies in some phase of changing their business model, according to recent research by consulting firm KPMG, businesses that aren’t thinking about transformation are all but irrelevant. Business transformation can mean everything from a major shift in IT systems to a large-scale innovative construction project or changes to business models and product designs. Similarly, the drivers of transformation vary widely, ranging from the increased globalization of markets in all industries to shifting energy prices to consumer expectations of constant innovation.

For companies that don’t want merely to succeed in their industries but to lead them, continual business transformation is a must. With 93% of U.S. companies in some phase of changing their business model, according to recent research by consulting firm KPMG, businesses that aren’t thinking about transformation are all but irrelevant. Business transformation can mean everything from a major shift in IT systems to a large-scale innovative construction project or changes to business models and product designs. Similarly, the drivers of transformation vary widely, ranging from the increased globalization of markets in all industries to shifting energy prices to consumer expectations of constant innovation.

This paper looks at what tends to drive business transformation initiatives both internally and externally for a company, and what determines the success or failure of such initiatives. It also reveals how companies execute business transformation and the value a well-executed initiative can deliver.