Key Takeaways

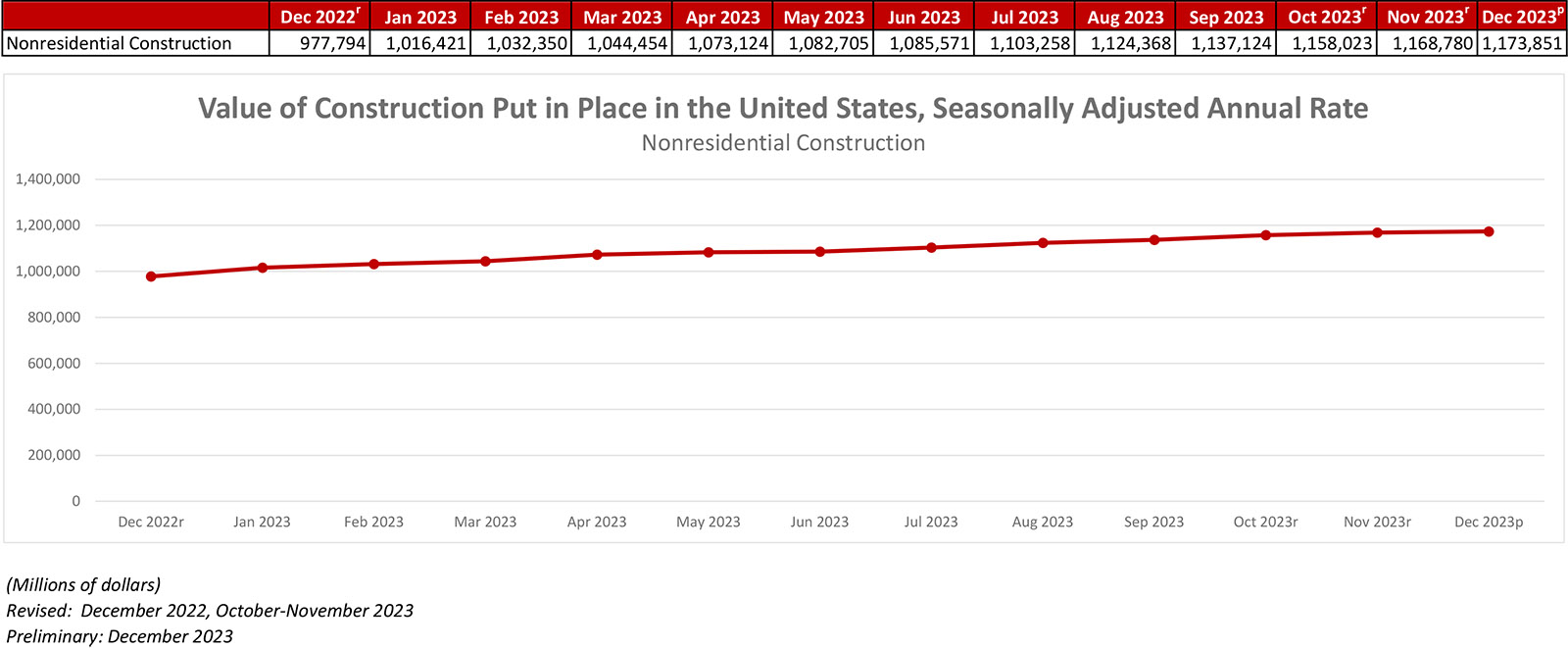

- National nonresidential construction spending increased 0.4% in December.

- On a seasonally adjusted annualized basis, nonresidential spending totaled $1.174 trillion for the month and is up year-over-year.

- "Nonresidential construction spending finished 2023 up more than 20%—the 19th consecutive monthly increase—and will carry ample momentum in 2024."

Press Release from Associated Builders and Contractors: ABC: Nonresidential Construction Spending Increases 0.4% in December

WASHINGTON, Feb. 1—National nonresidential construction spending increased 0.4% in December, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.174 trillion.

Spending was down on a monthly basis in 8 of the 16 nonresidential subcategories. Private nonresidential spending was down 0.2% in December, while public nonresidential construction spending was up 1.4%.

"Nonresidential construction spending finished 2023 up more than 20%—the 19th consecutive monthly increase—and will carry ample momentum in 2024," said ABC Chief Economist Anirban Basu. "While much of that strength is due to surging investment in new manufacturing structures, roughly half of the 16 nonresidential subsegments saw spending increases by 20% or more in 2023."

"That said, privately financed nonresidential activity actually declined in December, albeit by just 0.2%," said Basu. "That decrease in private activity was offset by surging activity in the highway and street category, which along with other publicly financed segments will retain momentum in the coming months as infrastructure investments are finally put in place."

Press Release from Associated General Contractors of America: Construction Spending Rises 0.9 Percent In December With Year-over-Year Increases Among All Project Types But Mixed Results For The Month

Demand Appears Strong on Balance Heading into 2024 but Persistent Shortage of Skilled Workers, Lagging Federal Investments in Infrastructure, and Tighter Financing Conditions May Limit Growth in Outlays

Total construction spending increased by 0.9 percent in December and 13.9 percent year-over-year, as gains in residential and public segments offset mixed results among private nonresidential markets, according to an analysis of federal spending data the Associated General Contractors of America released today. Association officials cautioned that higher interest rates, labor shortages and regulatory delays could impact future construction spending levels despite overall strength in the market.

"Construction spending rose across the board in 2023 despite higher interest costs, shortages of workers, and delays in awarding federal money for infrastructure," said Ken Simonson, the association’s chief economist. "These challenges remain in early 2024 but the industry is poised for further growth overall."

Construction spending, not adjusted for inflation, totaled $2.096 trillion at a seasonally adjusted annual rate in December. That figure is 0.9 percent above the upwardly revised November rate and 13.9 percent above the December 2022 level.

Spending on private residential construction rose by 1.4 percent and 6.8 percent year-over-year. Single-family construction climbed for the eighth-straight month, by 1.6 percent. Spending on multifamily projects rose 0.3 percent.

Public construction spending increased 1.3 percent in December and 21.3 percent from a year earlier. Spending on the largest public category, highways and streets, jumped 4.1 percent for the month, while outlays for educational structures slipped 0.1 percent. Spending on transportation facilities rose 1.1 percent. Other infrastructure segments were mixed: sewage and waste disposal declined 0.8 percent and water supply spending slumped 2.5 percent but conservation and development outlays rose 1.4 percent.

Spending on private nonresidential construction dipped 0.2 percent in December but increased by 19.1 percent from December 2022. The largest segments mostly declined for the month. Manufacturing construction edged down 0.1 percent. Commercial construction—comprising warehouse, retail, and farm projects—declined 0.5 percent. Investment in power, oil, and gas projects rose 0.3 percent. Spending on offices and data centers decreased by 0.2 percent and health care construction fell 0.8 percent.

Association officials noted that contractors remain worried that higher interest rates could stifle private-sector demand for construction. Construction firms also continue to struggle to find qualified workers to hire and report that regulatory delays appear to be impacting the start of construction on some infrastructure projects.

"Despite overall strong market conditions, there are a number of reasons to be cautious about how 2024 will play out for the construction industry," said Stephen E. Sandherr, the association’s chief executive officer. "Federal officials can help by boosting investments in construction education and training and accelerating infrastructure permitting reviews."