Press Release from Associated Builders and Contractors, Inc.

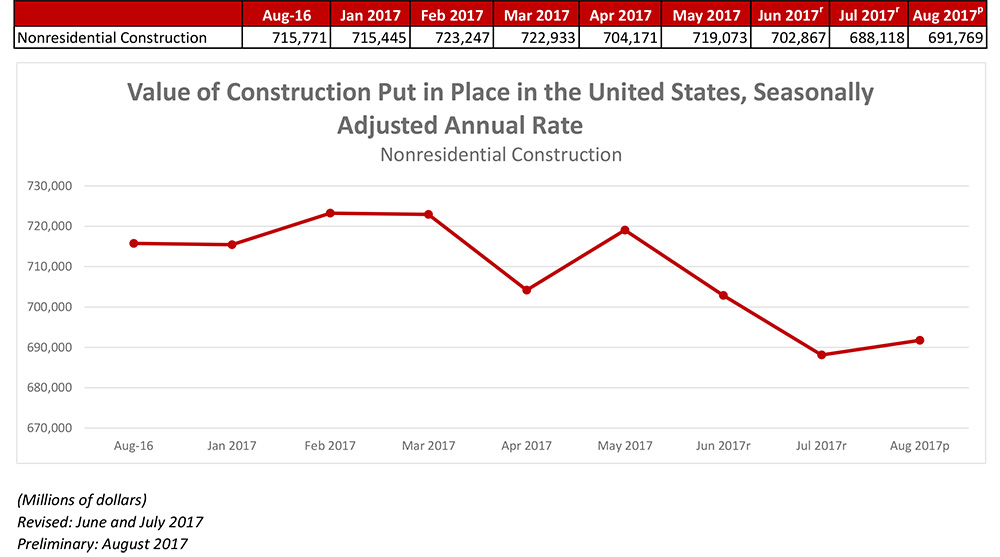

WASHINGTON, Oct. 2—Nonresidential construction spending expanded 0.5 percent in August, totaling $691.8 billion on a seasonally adjusted, annualized basis, according to an analysis of data from the U.S. Census Bureau by Associated Builders and Contractors (ABC). Though this represents an improvement from July’s total ($688.2 billion), nonresidential spending remains 3.4 percent below its year-ago level and is down 3.8 percent from the cyclical peak attained in May 2017.

Spending levels expanded in 10 of the 16 nonresidential construction subsectors in August on a monthly basis. The manufacturing subsector experienced the largest absolute monthly decline (-$2.6 billion) and the greatest year-over-year decline (-$16.1 billion).

“Collectively, nonresidential construction firms continue to hire, and staffing levels are well ahead of year-ago levels. That is consistent with a busier industry. ABC’s Construction Backlog Indicator (CBI) also continues to show that the average nonresidential construction firm can expect to remain busy, with a significant amount of future work already under contract. But the spending data show that the industry has actually become somewhat less busy over the past year.

“There are a number of possible explanations,” said Basu. “One is that employers may be forced in many instances to replace each retiring skilled worker with more than one employee. This is also consistent with declining industry productivity measured in terms of output per hour worked.

“Another possibility is that the construction segments that have been expanding in recent years are more labor intensive than those in which spending has been in decline,” said Basu. “Spending declines have been especially noteworthy in several capital-intensive public spending segments, including conservation and development and sewage and waste disposal. By contrast, spending increases over roughly the past three years have been apparent in segments requiring many workers specializing in high-quality finishes, including in the lodging and office categories.”

Reporting from CNBC:

Construction Spending Rises

In separate report on Monday, the Commerce Department said construction spending rose 0.5 percent to $1.21 trillion. July's construction outlays were revised sharply down to show a 1.2 percent plunge instead of the previously reported 0.6 percent drop. Construction spending increased 2.5 percent on a year-on-year basis.

The government said Harvey and Irma did not appear to have impacted the construction spending data as the responses from the Texas and Florida areas affected by the storms were "not significantly lower than normal."

In August, spending on private residential projects increased 0.4 percent, rising for a fourth straight month. Spending on nonresidential structures increased 0.5 percent, snapping two straight monthly declines.

In the wake of Harvey and Irma, nonresidential construction spending could fall in September. According to the Commerce Department, Texas and Florida accounted for 22 percent of U.S. private nonresidential construction spending in 2016.

Investment in nonresidential structures such as oil and gas wells has been slowing as the boost from recovering oil prices fizzles. Private construction projects spending increased 0.4 percent in August.

Outlays on public construction projects rebounded 0.7 percent in August after slumping 3.3 percent in July. Spending on state and local government construction projects increased 1.1 percent in August. Gains in September are likely to be curbed by the hurricanes.

Texas and Florida accounted for 15 percent of U.S. state-and-locally owned construction spending in 2016, according to the Commerce Department.

Federal government construction spending tumbled 4.7 percent to its lowest level since April 2007.

Reporting from USAToday:

U.S. Construction Spending Rebounded 0.5% in August

U.S. construction spending rebounded 0.5% in August after two months of contraction, helped by strength in home building, and commercial and government construction.

The climb came after declines of 1.2% in July and 0.8% in June, the Commerce Department reported Monday. It was the best showing since a 1.6% rise in May. Still, the August gain was not enough to recoup the losses of the past two months, leaving spending 1.5% below the May level.

Housing construction was up 0.4%. Nonresidential activity increased 0.5%, reflecting strength in hotel and office building. The August rebound was also helped by a gain in spending by state and local governments, which helped offset a further decline at the federal level.

Economists believe that construction spending will get a boost in coming months as rebuilding efforts get underway from the recent devastating hurricanes. Government analysts said that Hurricane Harvey only affected construction activity in Texas for the last week of August, while Hurricane Irma did not have any impact until September.

The overall economy grew at a 3.1% annual rate in the April-June quarter, the best showing in more than two years. Analysts believe activity slowed a bit in the July-September quarter to around 2.5% GDP growth. But they expect the impact of reconstruction efforts to start boosting GDP as soon as the current quarter.

The 0.4% advance in home building reflected a 0.3% increase in single-family construction spending and a 0.9% jump in the smaller and more volatile apartment sector.

Overall public construction was up 0.7% in August, reflect a 1.1% rise in state and local activity which offset a 4.7% plunge in spending at the federal level, the third straight drop in federal government construction activity.